Citibank 2009 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

154

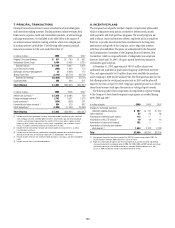

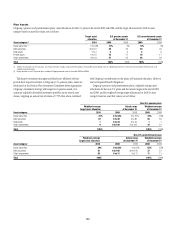

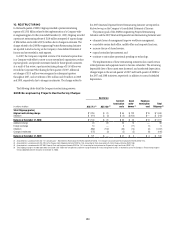

Information with respect to stock option activity under Citigroup stock option programs for the years ended December 31, 2009, 2008 and 2007 is as follows:

2009 2008 2007

Options

Weighted-

average

exercise

price

Intrinsic

value

per share Options

Weighted-

average

exercise

price

Intrinsic

value

per share Options

Weighted-

average

exercise

price

Intrinsic

value

per share

Outstanding, beginning of period 143,860,657 $41.84 $— 172,767,122 $43.08 $— 212,067,917 $41.87 $13.83

Granted—original 321,244,728 4.27 — 18,140,448 24.70 — 2,178,136 54.21 —

Granted—reload — — — 15,984 28.05 — 3,093,370 52.66 —

Forfeited or exchanged (39,285,305) 36.98 — (24,080,659) 42.19 — (8,796,402) 46.26 1.52

Expired (21,775,274) 36.21 — (20,441,584) 38.88 — (843,256) 43.40 4.38

Exercised — — — (2,540,654) 22.36 — (34,932,643) 36.62 11.16

Outstanding, end of period 404,044,806 $12.75 $— 143,860,657 $41.84 $— 172,767,122 $43.08 $ —

Exercisable at end of period 78,939,093 123,654,795 165,024,814

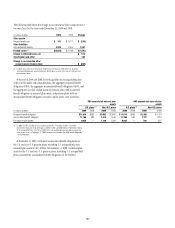

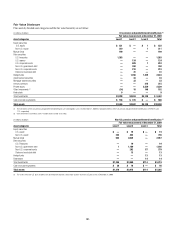

The following table summarizes the information about stock options outstanding under Citigroup stock option programs at December 31, 2009:

Options outstanding Options exercisable

Range of exercise prices

Number

outstanding

Weighted-average

contractual life

remaining

Weighted-average

exercise price

Number

exercisable

Weighted-average

exercise price

$2.97–$9.99 310,267,922 5.8 years $ 4.08 232,964 $ 5.89

$10.00–$19.99 5,718,033 8.6 years 14.75 257,547 15.74

$20.00–$29.99 10,765,908 4.5 years 24.52 3,518,919 24.81

$30.00–$39.99 6,340,854 3.8 years 34.66 4,836,471 35.01

$40.00–$49.99 63,222,120 1.0 years 46.17 62,878,916 46.16

$50.00–$56.41 7,729,969 2.0 years 52.12 7,214,276 51.96

404,044,806 5.0 years $12.76 78,939,093 $44.83

As of December 31, 2009, there was $445.6 million of total unrecognized

compensation cost related to stock options; this cost is expected to be

recognized over a weighted-average period of 1.9 years.

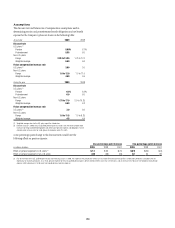

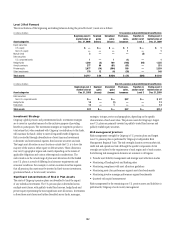

Fair Value Assumptions

Reload options are treated as separate grants from the related original grants.

Pursuant to the terms of currently outstanding reloadable options, upon

exercise of an option, if employees use previously owned shares to pay the

exercise price and surrender shares otherwise to be received for related tax

withholding, they will receive a reload option covering the same number

of shares used for such purposes, but only if the market price on the date of

exercise is at least 20% greater than the option exercise price. Reload options

vest after six months and carry the same expiration date as the option that

gave rise to the reload grant. The exercise price of a reload grant is the fair-

market value of Citigroup common stock on the date the underlying option

is exercised. Reload options are intended to encourage employees to exercise

options at an earlier date and to retain the shares acquired. The result of this

program is that employees generally will exercise options as soon as they

are able and, therefore, these options have shorter expected lives. Shorter

option lives result in lower valuations. However, such values are expensed

more quickly due to the shorter vesting period of reload options. In addition,

since reload options are treated as separate grants, the existence of the reload

feature results in a greater number of options being valued. Shares received

through option exercises under the reload program, as well as certain other

options, are subject to restrictions on sale.

Additional valuation and related assumption information for Citigroup

option programs is presented below. Citigroup uses a lattice-type model to

value stock options.

For options granted during 2009 2008 2007

Weighted-average per-share fair value,

at December 31 $ 1.38 $ 3.62 $ 6.52

Weighted-average expected life

Original grants 5.87 yrs. 5.00 yrs. 4.66 yrs.

Reload grants N/A 1.04 yrs. 1.86 yrs.

Valuation assumptions

Expected volatility 35.89% 25.11% 19.21%

Risk-free interest rate 2.79% 2.76% 4.79%

Expected dividend yield 0.02% 4.53% 4.03%

Expected annual forfeitures

Original and reload grants 7.6% 7% 7%

N/A Not applicable