Citibank 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.8

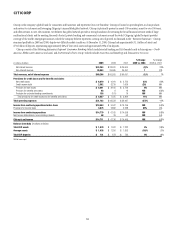

preferred stock issued to the U.S. Treasury and FDIC as consideration for the

loss-sharing agreement were exchanged for trust preferred securities. Prior to

the exchange of the preferred stock held by the U.S. government pursuant to the

exchange offers, Citigroup paid the U.S. government approximately $2.2 billion

in preferred dividends on its investment in Citi, and has subsequently paid

approximately $800 million in interest on the trust preferred securities issued

pursuant to the exchange offers.

Repayment of TARP and Exit from loss-sharing agreement

On December 23, 2009, Citigroup repaid the $20 billion of TARP trust

preferred securities held by the U.S. Treasury and exited the loss-sharing

agreement. In connection with the exit of the loss-sharing agreement,

$1.8 billion of the trust preferred securities held by the U.S. Treasury

out of the approximately $7.1 billion of trust preferred securities issued

in consideration for such agreement to the U.S. Treasury and FDIC

was cancelled.

In connection with the repayment of TARP in December 2009, Citigroup

raised an aggregate of approximately $20.3 billion in common equity. On

December 22, 2009 Citigroup issued $17.0 billion of common stock, or

approximately 5.4 billion shares, and $3.5 billion of tangible equity units

(T-DECs) of which approximately $2.8 billion was recorded as common

equity and $0.7 billion was recorded as long-term debt. On December 29,

2009, Citigroup raised an additional approximate $0.6 billion of common

stock, or approximately 185 million shares, pursuant to exercise of the

underwriters’ overallotment option. In addition, in January 2010, Citigroup

issued $1.7 billion of common stock equivalents to its employees in lieu

of cash compensation they would have otherwise received. Subject to

shareholder approval at Citi’s annual shareholder meeting scheduled to be

held on April 20, 2010, the common stock equivalents will be converted into

common stock.

Following the repayment of TARP and exit from the loss-sharing

agreement, as of December 31, 2009, the U.S. Treasury continues to hold

approximately 7.7 billion shares, or approximately 27.0%, of Citi’s common

stock, not including the exercise of the warrants issued to the U.S. Treasury

that remain outstanding, as described below. The U.S. Treasury has indicated

that it intends to sell its holding in Citi common stock in 2010, subject

to a 90-day lock-up period expiring on March 16, 2010. In addition, the

U.S. Treasury and FDIC continue to hold an aggregate of approximately

$5.3 billion of the trust preferred securities originally issued by Citi as

consideration for the loss-sharing agreement.

As a result of Citi’s repayment of the $20 billion of TARP trust preferred

securities and the exit of the loss-sharing agreement, effective in 2010, Citi

is no longer deemed to be a beneficiary of “exceptional financial assistance”

under TARP.

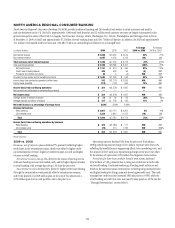

Common stock warrants issued to the U.S. Treasury

The three warrants issued to the U.S. Treasury as part of TARP and the loss-

sharing agreement remain outstanding as of December 31, 2009 following

Citi’s repayment of TARP and exit from the loss-sharing agreement.

Each of the warrants has a term of 10 years from the date of issuance. The

warrant issued to the U.S. Treasury in October 2008 has an exercise price of

$17.85 per share and is exercisable for approximately 210.1 million shares

of common stock. The warrant issued to the U.S. Treasury in December 2008

has an exercise price of $10.61 per share and is exercisable for approximately

188.5 million shares of common stock. The warrant issued to the U.S.

Treasury as part of the loss-sharing agreement in January 2009 also has an

exercise price of $10.61 and is exercisable for approximately 66.5 million

shares of common stock.