Citibank 2009 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

Key Controls over Fair Value Measurement

Citi’s processes include a number of key controls that are designed to ensure

that fair value is measured appropriately, particularly where a fair-value

model is internally developed and used to price a significant product. Such

controls include a model validation policy requiring that valuation models

be validated by qualified personnel, independent from those who created

the models and escalation procedures, to ensure that valuations using

unverifiable inputs are identified and monitored on a regular basis by senior

management.

CVA Methodology

ASC 820-10 requires that Citi’s own credit risk be considered in determining

the market value of any Citi liability carried at fair value. These liabilities

include derivative instruments as well as debt and other liabilities for which

the fair value option was elected. The credit valuation adjustment (CVA) is

recognized on the balance sheet as a reduction in the associated liability to

arrive at the fair value (carrying value) of the liability.

Prior to the fourth quarter of 2008, Citi had historically used its credit

spreads observed in the credit default swap (CDS) market to estimate the

market value of these liabilities. Beginning in September 2008, Citi’s CDS

spread and credit spreads observed in the bond market (cash spreads)

diverged from each other and from their historical relationship. For

example, the three-year CDS spread narrowed from 315 basis points (bps) on

September 30, 2008, to 202 bps on December 31, 2008, while the three-year

cash spread widened from 430 bps to 490 bps over the same time period.

Due to the persistence and significance of this divergence during the fourth

quarter of 2008, management determined that such a pattern may not

be temporary and that using cash spreads would be more relevant to the

valuation of debt instruments (whether issued as liabilities or purchased as

assets). Therefore, Citi changed its method of estimating the market value of

liabilities for which the fair value option was elected to incorporate Citi’s cash

spreads. (CDS spreads continue to be used to calculate the CVA for derivative

positions.) This change in estimation methodology resulted in a $2.5 billion

pretax gain recognized in earnings in the fourth quarter of 2008. Citigroup

recognized a pretax gain of $4,558 million due to changes in the CVA balance

in 2008.

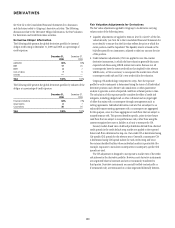

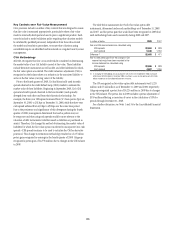

The table below summarizes the CVA for fair value option debt

instruments, determined under each methodology as of December 31, 2008

and 2007, and the pretax gain that would have been recognized in 2008 had

each methodology been used consistently during 2008 and 2007.

In millions of dollars 2008 2007

Year-end CVA reserve balance as calculated using

CDS spreads $2,953 $ 888

Cash spreads 5,446 1,359

Difference (1) $2,493 $ 471

Year-to-date pretax gain from the change in CVA

reserve that would have been recorded in the

income statement as calculated using

CDS spreads $2,065 $ 888

Cash spreads 4,087 1,359

(1) In changing the methodology for calculating the CVA reserve, Citi recorded the 2008 cumulative

difference of $2.493 billion in December 2008, resulting in a year-to-date pretax gain of $4.558

billion recorded in the Consolidated Statement of Income.

The CVA recognized on fair value option debt instruments was $1,220

million and $5,446 million as of December 31, 2009 and 2008, respectively.

Citigroup recognized a pretax loss of $4,226 million in 2009 due to changes

in the CVA balance. The pretax loss in 2009 includes a pretax adjustment of

$330 million reflecting a correction of errors in the calculation of CVA for

periods through December 31, 2008.

For a further discussion, see Notes 1 and 34 to the Consolidated Financial

Statements.