Citibank 2009 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

207

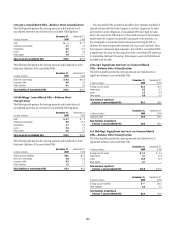

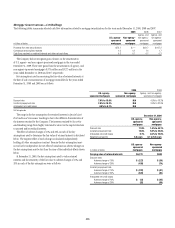

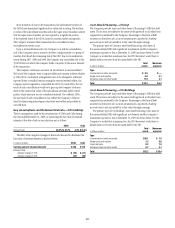

Mortgage Servicing Rights

The fair value of capitalized mortgage servicing rights (MSRs) was

$6.5 billion and $5.7 billion at December 31, 2009 and 2008, respectively.

The MSRs correspond to principal loan balances of $555 billion and

$662 billion as of December 31, 2009 and 2008, respectively. The following

table summarizes the changes in capitalized MSRs for the years ended

December 31, 2009 and 2008:

In millions of dollars 2009 2008

Balance, beginning of year $ 5,657 $ 8,380

Originations 1,035 1,311

Purchases —1

Changes in fair value of MSRs due to changes

in inputs and assumptions 1,546 (2,682)

Transfer to Trading account assets —(163)

Other changes (1) (1,708) (1,190)

Balance, end of year $ 6,530 $ 5,657

(1) Represents changes due to customer payments and passage of time.

The market for MSRs is not sufficiently liquid to provide participants

with quoted market prices. Therefore, the Company uses an option-adjusted

spread valuation approach to determine the fair value of MSRs. This

approach consists of projecting servicing cash flows under multiple interest

rate scenarios and discounting these cash flows using risk-adjusted discount

rates. The key assumptions used in the valuation of MSRs include mortgage

prepayment speeds and discount rates. The model assumptions and the

MSRs’ fair value estimates are compared to observable trades of similar MSR

portfolios and interest-only security portfolios, as available, as well as to MSR

broker valuations and industry surveys. The cash flow model and underlying

prepayment and interest rate models used to value these MSRs are subject to

validation in accordance with the Company’s model validation policies.

The fair value of the MSRs is primarily affected by changes in

prepayments that result from shifts in mortgage interest rates. In managing

this risk, the Company economically hedges a significant portion of the

value of its MSRs through the use of interest rate derivative contracts, forward

purchase commitments of mortgage-backed securities and purchased

securities classified as trading.

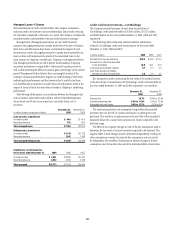

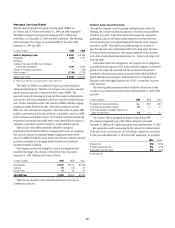

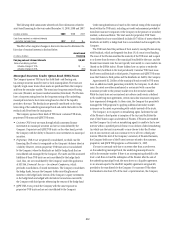

The Company receives fees during the course of servicing previously

securitized mortgages. The amounts of these fees for the years ended

December 31, 2009, 2008 and 2007 were as follows:

In millions of dollars 2009 2008 2007

Servicing fees $1,635 $2,121 $1,683

Late fees 93 123 90

Ancillary fees 77 81 61

Total MSR fees $1,805 $2,325 $1,834

These fees are classified in the Consolidated Statement of Income as

Commissions and fees.

Student Loan Securitizations

Through the Company’s Local Consumer Lending business within Citi

Holdings, the Company maintains programs to securitize certain portfolios

of student loan assets. Under these securitization programs, transactions

qualifying as sales are off-balance-sheet transactions in which the loans

are removed from the Consolidated Financial Statements of the Company

and sold to a QSPE. These QSPEs are funded through the issuance of

pass-through term notes collateralized solely by the trust assets. For these

off-balance-sheet securitizations, the Company generally retains interests

in the form of subordinated residual interests (i.e., interest-only strips) and

servicing rights.

Under terms of the trust arrangements, the Company has no obligations

to provide financial support and has not provided such support. A substantial

portion of the credit risk associated with the securitized loans has been

transferred to third-party guarantors or insurers either under the Federal

Family Education Loan Program, authorized by the U.S. Department of

Education under the Higher Education Act of 1965, as amended, or private

credit insurance.

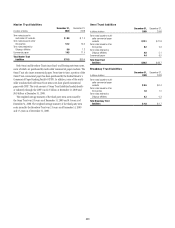

The following tables summarize selected cash flow information related

to student loan securitizations for the years ended December 31, 2009, 2008

and 2007:

In billions of dollars 2009 2008 2007

Proceeds from new securitizations $— $2.0 $2.9

Contractual servicing fees received 0.1 0.1 0.1

Cash flows received on retained interests and

other net cash flows 0.2 0.1 0.1

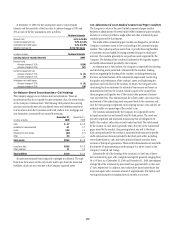

The Company did not recognize any gains or losses during 2009.

The Company recognized a gain of $1 million during the year ended

December 31, 2008 and $71 million during the year ended December 31, 2007.

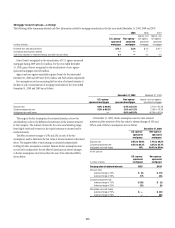

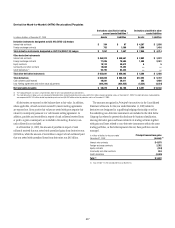

Key assumptions used in measuring the fair value of the residual interest

at the date of sale or securitization of Citi Holdings’ student loan receivables

for the years ended December 31, 2009 and 2008, respectively, are as follows:

2009 2008

Discount rate N/A 10.6%

Constant prepayment rate N/A 9.0%

Anticipated net credit losses N/A 0.5%

N/A Not applicable