Citibank 2009 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

131

Citigroup’s repurchases are primarily from Government Sponsored

Entities. The specific representations and warranties made by the Company

depend on the nature of the transaction and the requirements of the buyer.

Market conditions and credit-ratings agency requirements may also affect

representations and warranties and the other provisions the Company may

agree to in loan sales.

In the event of a breach of the representations and warranties, the Company

may be required to either repurchase the mortgage loans (generally at

unpaid principal balance plus accrued interest) with the identified defects or

indemnify (“make-whole”) the investor or insurer. The Company has recorded

a repurchase reserve that is included in Other liabilities in the Consolidated

Balance Sheet. In the case of a repurchase, the Company will bear any

subsequent credit loss on the mortgage loans. The Company’s representations

and warranties are generally not subject to stated limits in amount or time of

coverage. However, contractual liability arises only when the representations

and warranties are breached and generally only when a loss results from the

breach. In the case of a repurchase, the loan is typically considered a credit-

impaired loan and accounted for under SOP 03-3, “Accounting for Certain

Loans and Debt Securities, Acquired in a Transfer” (now incorporated into ASC

310-30, Receivables—Loans and Debt Securities Acquired with Deteriorated

Credit Quality). These repurchases have not had a material impact on

nonperforming loan statistics, because credit-impaired purchased SOP 03-3

loans are not included in nonaccrual loans.

The Company estimates its exposure to losses from its obligation to

repurchase previously sold loans based on the probability of repurchase or

make-whole and an estimated loss given repurchase or make-whole. This

estimate is calculated separately by sales vintage (i.e., the year the loans were

sold) based on a combination of historical trends and forecasted repurchases

and losses considering the: (1) trends in requests by investors for loan

documentation packages to be reviewed; (2) trends in recent repurchases and

make-wholes; (3) historical percentage of claims made as a percentage of

loan documentation package requests; (4) success rate in appealing claims;

(5) inventory of unresolved claims; and (6) estimated loss given repurchase

or make-whole, including the loss of principal, accrued interest, and

foreclosure costs. The Company does not change its estimation methodology

by counterparty, but the historical experience and trends are considered when

evaluating the overall reserve.

The request for loan documentation packages is an early indicator of a

potential claim. During 2009, loan documentation package requests and the

level of outstanding claims increased. In addition, our loss severity estimates

increased during 2009 due to the impact of macroeconomic factors and

recent experience. These factors contributed to a $493 million change in

estimate for this reserve in 2009.

As indicated above, the repurchase reserve is calculated by sales vintage.

The majority of the repurchases in 2009 were from the 2006 and 2007

sales vintages, which also represent the vintages with the largest loss-

given-repurchase. An insignificant percentage of 2009 repurchases were

from vintages prior to 2006, and this is expected to decrease, because those

vintages are later in the credit cycle. Although early in the credit cycle, the

Company has experienced improved repurchase and loss-given-repurchase

statistics from the 2008 and 2009 vintages.

In the case of a repurchase of a credit-impaired SOP 03-3 loan (now

incorporated into ASC 310-30), the difference between the loan’s fair value

and unpaid principal balance at the time of the repurchase is recorded as a

utilization of the repurchase reserve. Payments to make the investor whole

are also treated as utilizations and charged directly against the reserve. The

provision for estimated probable losses arising from loan sales is recorded as

an adjustment to the gain on sale, which is included in Other revenue in the

Consolidated Statement of Income. A liability for representations and warranties

is estimated when the Company sells loans and is updated quarterly. Any

subsequent adjustment to the provision is recorded in Other revenue in the

Consolidated Statement of Income.

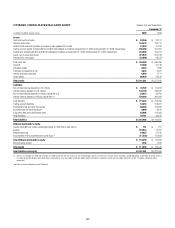

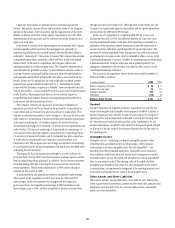

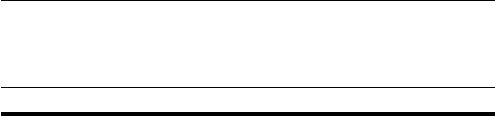

The activity in the repurchase reserve for the years ended December 31,

2009 and 2008 is as follows:

In millions of dollars 2009 2008

Balance, beginning of the year $ 75 $ 2

Additions for new sales 33 23

Change in estimate 493 59

Utilizations (119) (9)

Balance, end of the year $ 482 $ 75

Goodwill

Goodwill represents an acquired company’s acquisition cost over the fair

value of net tangible and intangible assets acquired. Goodwill is subject to

annual impairment tests, whereby Goodwill is allocated to the Company’s

reporting units and an impairment is deemed to exist if the carrying value

of a reporting unit exceeds its estimated fair value. Furthermore, on any

business dispositions, Goodwill is allocated to the business disposed of based

on the ratio of the fair value of the business disposed of to the fair value of

the reporting unit.

Intangible Assets

Intangible assets—including core deposit intangibles, present value

of future profits, purchased credit card relationships, other customer

relationships, and other intangible assets, but excluding MSRs—are

amortized over their estimated useful lives. Intangible assets deemed to

have indefinite useful lives, primarily certain asset management contracts

and trade names, are not amortized and are subject to annual impairment

tests. An impairment exists if the carrying value of the indefinite-lived

intangible asset exceeds its fair value. For other Intangible assets subject

to amortization, an impairment is recognized if the carrying amount is not

recoverable and exceeds the fair value of the Intangible asset.

Other Assets and Other Liabilities

Other assets include, among other items, loans held-for-sale, deferred tax

assets, equity-method investments, interest and fees receivable, premises and

equipment, end-user derivatives in a net receivable position, repossessed

assets, and other receivables.