Citibank 2009 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.153

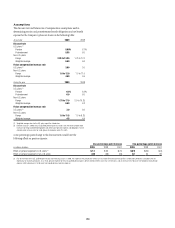

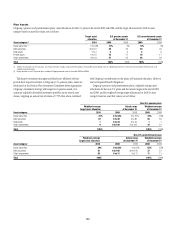

Stock Option Programs

The Company has a number of stock option programs for its non-employee

directors, officers and employees. Generally, in January 2008, 2007 and

2006, stock options were granted only to CAP and FA CAP participants who

elected to receive stock options in lieu of restricted or deferred stock awards,

and to non-employee directors who elected to receive their compensation in

the form of a stock option grant. Beginning in 2009, CAP participants, and

directors may no longer elect to receive stock options. Occasionally, stock

options also may be granted as sign-on awards. All stock options are granted

on Citigroup common stock with exercise prices that are no less than the fair

market value at the time of grant (which is defined under the plan to be the

NYSE closing price on the trading day immediately preceding the grant date,

or on the grant date for grants to certain officers). Generally, options granted

from 2003 through 2009 have six-year terms, and vest ratably over three- or

four-year periods; however, directors’ options cliff vest after two years, and

vesting schedules for sign-on grants may vary. The sale of shares acquired

through the exercise of employee stock options granted from 2003 through

2008 (and FA CAP options granted in 2009) is restricted for a two-year period

(and may be subject to the stock ownership commitment of senior executives

thereafter).

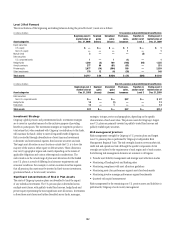

Prior to 2003, Citigroup options, including options granted since the date

of the merger of Citicorp and Travelers Group, Inc., generally vested at a rate

of 20% per year over five years (with the first vesting date occurring 12 to 18

months following the grant date) and had 10-year terms. Certain options,

mostly granted prior to January 1, 2003, and with 10-year terms, permit an

employee exercising an option under certain conditions to be granted new

options (reload options) in an amount equal to the number of common

shares used to satisfy the exercise price and the withholding taxes due upon

exercise. The reload options are granted for the remaining term of the related

original option and vest after six months. Reload options may in turn be

exercised using the reload method, given certain conditions. An option may

not be exercised using the reload method unless the market price on the date

of exercise is at least 20% greater than the option exercise price.

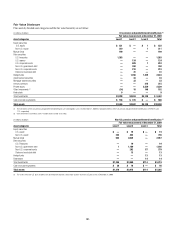

On October 29, 2009, Citigroup made a one-time broad-based option

grant to employees worldwide. The options have a six-year term, and

generally vest in three equal installments over three years, beginning on

the first anniversary of the grant date. The options were awarded with a

strike price equal to the NYSE closing price on the trading day immediately

preceding the date of grant ($4.08). The CEO and other employees whose

2009 compensation was subject to structures approved by the Special Master

did not participate in this grant.

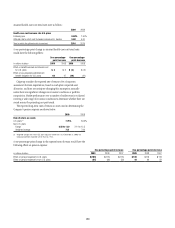

In January 2009, members of the Management Executive Committee

received 10% of their awards as performance-priced stock options, with an

exercise price that placed the awards significantly “out of the money” on

the date of grant. Half of each executive’s options have an exercise price of

$17.85 and half have an exercise price of $10.61. The options were granted

on a day on which Citi’s closing price was $4.53. The options have a 10-year

term and vest ratably over a four-year period.

On January 22, 2008, Vikram Pandit, CEO, was awarded stock options to

purchase three million shares of common stock. The options vest 25% per

year beginning on the first anniversary of the grant date and expire on the

tenth anniversary of the grant date. One-third of the options have an exercise

price equal to the NYSE closing price of Citigroup stock on the grant date

($24.40), one-third have an exercise price equal to a 25% premium over

the grant-date closing price ($30.50), and one-third have an exercise price

equal to a 50% premium over the grant date closing price ($36.60). The first

installment of these options vested on January 22, 2009. These options do not

have a reload feature.

From 1997-2002, a broad base of employees participated in annual option

grant programs. The options vested over five-year periods, or cliff vested after

five years, and had 10-year terms but no reload features. No grants have been

made under these programs since 2002.