Citibank 2009 Annual Report Download - page 237

Download and view the complete annual report

Please find page 237 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.227

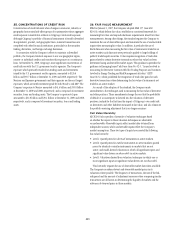

For ARS with student loans as underlying assets, future cash flows are

estimated based on the terms of the loans underlying each individual ARS,

discounted at an appropriate rate in order to estimate the current fair value.

The key assumptions that impact the ARS valuations are the expected

weighted average life of the structure, estimated fail rate coupons, the

amount of leverage in each structure and the discount rate used to calculate

the present value of projected cash flows. The discount rate used for each ARS

is based on rates observed for basic securitizations with similar maturities

to the loans underlying each ARS being valued. In order to arrive at the

appropriate discount rate, these observed rates were adjusted upward to factor

in the specifics of the ARS structure being valued, such as callability, and the

illiquidity in the ARS market.

During the first quarter of 2008, ARS for which the auctions failed and

where no secondary market has developed were moved to Level 3, as the

assets were subject to valuation using significant unobservable inputs. The

majority of ARS continue to be classified as Level 3.

Alt-A mortgage securities

The Company classifies its Alt-A mortgage securities as held-to-maturity,

available-for-sale, and trading investments. The securities classified as

trading and available-for-sale are recorded at fair value with changes in fair

value reported in current earnings and AOCI, respectively. For these purposes,

Alt-A mortgage securities are non-agency residential mortgage-backed

securities (RMBS) where (1) the underlying collateral has weighted average

FICO scores between 680 and 720 or (2) for instances where FICO scores

are greater than 720, RMBS have 30% or less of the underlying collateral

composed of full documentation loans.

Similar to the valuation methodologies used for other trading securities

and trading loans, the Company generally determines the fair value of Alt-A

mortgage securities utilizing internal valuation techniques. Fair-value

estimates from internal valuation techniques are verified, where possible,

to prices obtained from independent vendors. Vendors compile prices from

various sources. Where available, the Company may also make use of

quoted prices for recent trading activity in securities with the same or similar

characteristics to that being valued.

The internal valuation techniques used for Alt-A mortgage securities, as

with other mortgage exposures, consider estimated housing price changes,

unemployment rates, interest rates and borrower attributes. They also

consider prepayment rates as well as other market indicators.

Alt-A mortgage securities that are valued using these methods are

generally classified as Level 2. However, Alt-A mortgage securities backed by

Alt-A mortgages of lower quality or more recent vintages are mostly classified

as Level 3 due to the reduced liquidity that exists for such positions, which

reduces the reliability of prices available from independent sources.

Commercial real estate exposure

Citigroup reports a number of different exposures linked to commercial real

estate at fair value with changes in fair value reported in earnings, including

securities, loans and investments in entities that hold commercial real estate

loans or commercial real estate directly. The Company also reports securities

backed by commercial real estate as Available-for-sale investments, which are

carried at fair value with changes in fair-value reported in AOCI.

Similar to the valuation methodologies used for other trading securities

and trading loans, the Company generally determines the fair value of

securities and loans linked to commercial real estate utilizing internal

valuation techniques. Fair-value estimates from internal valuation

techniques are verified, where possible, to prices obtained from independent

vendors. Vendors compile prices from various sources. Where available, the

Company may also make use of quoted prices for recent trading activity

in securities or loans with the same or similar characteristics to that being

valued. Securities and loans linked to commercial real estate valued using

these methodologies are generally classified as Level 3 as a result of the

reduced liquidity currently in the market for such exposures.

The fair value of investments in entities that hold commercial real

estate loans or commercial real estate directly is determined using a similar

methodology to that used for other non-public investments in real estate

held by the S&B business. The Company uses an established process for

determining the fair value of such securities, using commonly accepted

valuation techniques, including the use of earnings multiples based on

comparable public securities, industry-specific non-earnings-based multiples

and discounted cash flow models. In determining the fair value of such

investments, the Company also considers events, such as a proposed sale

of the investee company, initial public offerings, equity issuances, or other

observable transactions. Such investments are generally classified as Level 3

of the fair-value hierarchy.

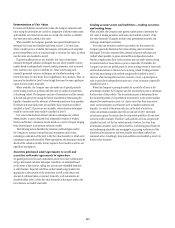

Highly leveraged financing commitments

The Company reports highly leveraged loans with a carrying value of

$36 million and face amount of $468 million at December 31, 2009 as

held-for-sale, which are measured on a LOCOM basis. The fair value of

such exposures is determined, where possible, using quoted secondary-

market prices and classified as Level 2 of the fair value hierarchy if there

is a sufficient level of activity in the market and quotes or traded prices are

available with suitable frequency.

However, due to the dislocation of the credit markets and the reduced

market interest in higher risk/higher yield instruments since the latter half

of 2007, liquidity in the market for highly leveraged financings has been

limited. Therefore, a majority of such exposures are classified as Level 3 as

quoted secondary market prices do not generally exist. The fair value for

such exposures is determined using quoted prices for a similar asset or assets,

adjusted for the specific attributes of the loan being valued.