Citibank 2009 Annual Report Download - page 236

Download and view the complete annual report

Please find page 236 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.226

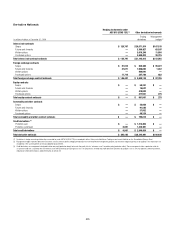

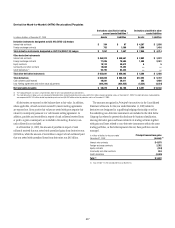

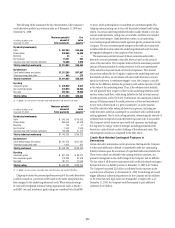

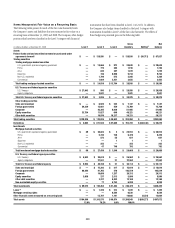

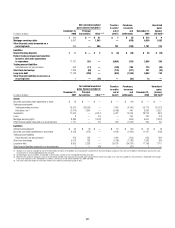

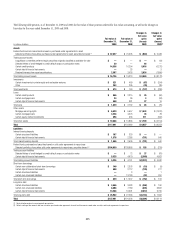

Short-term borrowings and long-term debt

Where fair value accounting has been elected, the fair value of non-

structured liabilities is determined by discounting expected cash flows using

the appropriate discount rate for the applicable maturity. Such instruments

are generally classified as Level 2 of the fair value hierarchy as all inputs are

readily observable.

The Company determines the fair value of structured liabilities (where

performance is linked to structured interest rates, inflation or currency risks)

and hybrid financial instruments (performance linked to risks other than

interest rates, inflation or currency risks) using the appropriate derivative

valuation methodology (described above) given the nature of the embedded

risk profile. Such instruments are classified as Level 2 or Level 3 depending

on the observability of significant inputs to the model.

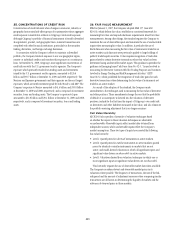

Market valuation adjustments

Liquidity adjustments are applied to items in Level 2 and Level 3 of the fair

value hierarchy to ensure that the fair value reflects the price at which the

entire position could be liquidated. The liquidity reserve is based on the

bid-offer spread for an instrument, adjusted to take into account the size of

the position.

Counterparty credit-risk adjustments are applied to derivatives, such

as over-the-counter derivatives, where the base valuation uses market

parameters based on the LIBOR interest rate curves. Not all counterparties

have the same credit risk as that implied by the relevant LIBOR curve, so it is

necessary to consider the market view of the credit risk of a counterparty in

order to estimate the fair value of such an item.

Bilateral or “own” credit-risk adjustments are applied to reflect the

Company’s own credit risk when valuing derivatives and liabilities measured

at fair value. Counterparty and own credit adjustments consider the expected

future cash flows between Citi and its counterparties under the terms of

the instrument and the effect of credit risk on the valuation of those cash

flows, rather than a point-in-time assessment of the current recognized net

asset or liability. Furthermore, the credit-risk adjustments take into account

the effect of credit-risk mitigants, such as pledged collateral and any legal

right of offset (to the extent such offset exists) with a counterparty through

arrangements such as netting agreements.

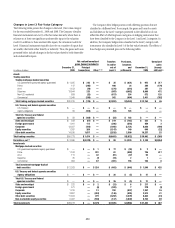

Auction rate securities

Auction rate securities (ARS) are long-term municipal bonds, corporate

bonds, securitizations and preferred stocks with interest rates or dividend

yields that are reset through periodic auctions. The coupon paid in the

current period is based on the rate determined by the prior auction. In the

event of an auction failure, ARS holders receive a “fail rate” coupon, which is

specified by the original issue documentation of each ARS.

Where insufficient orders to purchase all of the ARS issue to be sold

in an auction were received, the primary dealer or auction agent would

traditionally have purchased any residual unsold inventory (without a

contractual obligation to do so). This residual inventory would then be

repaid through subsequent auctions, typically in a short timeframe. Due to

this auction mechanism and generally liquid market, ARS have historically

traded and were valued as short-term instruments.

Citigroup acted in the capacity of primary dealer for approximately

$72 billion of ARS and continued to purchase residual unsold inventory in

support of the auction mechanism until mid-February 2008. After this date,

liquidity in the ARS market deteriorated significantly, auctions failed due to

a lack of bids from third-party investors, and Citigroup ceased to purchase

unsold inventory. Following a number of ARS refinancings, at December 31,

2009, Citigroup continued to act in the capacity of primary dealer for

approximately $28.2 billion of outstanding ARS.

The Company classifies its ARS as held-to-maturity, available-for-sale and

trading securities.

Prior to the Company’s first auction’s failing in the first quarter of 2008,

Citigroup valued ARS based on observation of auction market prices, because

the auctions had a short maturity period (7, 28 and 35 days). This generally

resulted in valuations at par. Once the auctions failed, ARS could no longer

be valued using observation of auction market prices. Accordingly, the fair

value of ARS is currently estimated using internally developed discounted

cash flow valuation techniques specific to the nature of the assets underlying

each ARS.

For ARS with U.S. municipal securities as underlying assets, future cash flows

are estimated based on the terms of the securities underlying each individual

ARS and discounted at an estimated discount rate in order to estimate the current

fair value. The key assumptions that impact the ARS valuations are estimated

prepayments and refinancings, estimated fail rate coupons (i.e., the rate paid

in the event of auction failure, which varies according to the current credit

rating of the issuer) and the discount rate used to calculate the present value

of projected cash flows. The discount rate used for each ARS is based on rates

observed for straight issuances of other municipal securities. In order to arrive at

the appropriate discount rate, these observed rates were adjusted upward to factor

in the specifics of the ARS structure being valued, such as callability, and the

illiquidity in the ARS market.