Citibank 2009 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

213

has a reimbursement agreement with the Residual holder under which the

Residual holder reimburses the Company for any payment made under

the liquidity arrangement. Through this reimbursement agreement, the

Residual holder remains economically exposed to fluctuations in value of

the municipal bond. These reimbursement agreements are actively margined

based on changes in value of the underlying municipal bond to mitigate the

Company’s counterparty credit risk. In cases where a third party provides

liquidity to a proprietary or QSPE TOB trust, a similar reimbursement

arrangement is made whereby the Company (or a consolidated subsidiary of

the Company) as Residual holder absorbs any losses incurred by the liquidity

provider. As of December 31, 2009, liquidity agreements provided with

respect to customer TOB trusts totaled $6.2 billion, offset by reimbursement

agreements in place with a notional amount of $4.6 billion. The remaining

exposure relates to TOB transactions where the Residual owned by the

customer is at least 25% of the bond value at the inception of the transaction.

In addition, the Company has provided liquidity arrangements with

a notional amount of $0.2 billion to QSPE TOB trusts and other non-

consolidated proprietary TOB trusts described above.

The Company considers the customer and proprietary TOB trusts

(excluding QSPE TOB trusts) to be VIEs. Because third-party investors hold

the Residual and Floater interests in the customer TOB trusts, the Company’s

involvement and variable interests include only its role as remarketing

agent and liquidity provider. On the basis of the variability absorbed by the

customer through the reimbursement arrangement or significant residual

investment, the Company does not consolidate the Customer TOB trusts.

The Company’s variable interests in the Proprietary TOB trusts include the

Residual as well as the remarketing and liquidity agreements with the trusts.

On the basis of the variability absorbed through these contracts (primarily

the Residual), the Company generally consolidates the Proprietary TOB

trusts. Finally, certain proprietary TOB trusts and QSPE TOB trusts are

not consolidated by application of specific accounting literature. For the

nonconsolidated proprietary TOB trusts and QSPE TOB trusts, the Company

recognizes only its residual investment on its balance sheet at fair value and

the third-party financing raised by the trusts is off balance sheet.

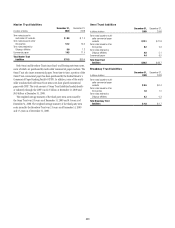

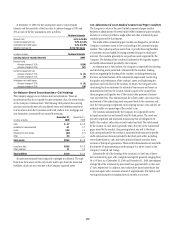

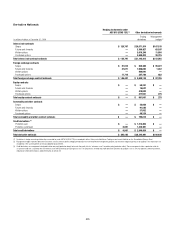

The following table summarizes selected cash flow information

related to Citicorp’s municipal bond securitizations for the years ended

December 31, 2009, 2008 and 2007:

In billions of dollars 2009 2008 2007

Proceeds from new securitizations $0.3 $1.2 $10.5

Cash flows received on retained

interests and other net cash flows 0.7 0.5 —

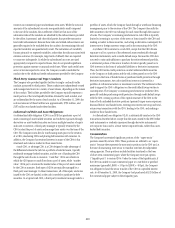

The following table summarizes selected cash flow information related to

Citi Holdings’ municipal bond securitizations for the years ended December

31, 2009, 2008 and 2007:

In billions of dollars 2009 2008 2007

Proceeds from new securitizations $— $0.1 $—

Cash flows received on retained

interests and other net cash flows — — —

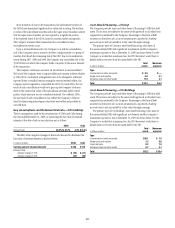

Municipal Investments

Municipal investment transactions represent partnerships that finance the

construction and rehabilitation of low-income affordable rental housing.

The Company generally invests in these partnerships as a limited partner and

earns a return primarily through the receipt of tax credits earned from the

affordable housing investments made by the partnership.

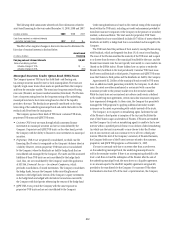

Client Intermediation

Client intermediation transactions represent a range of transactions

designed to provide investors with specified returns based on the returns of

an underlying security, referenced asset or index. These transactions include

credit-linked notes and equity-linked notes. In these transactions, the SPE

typically obtains exposure to the underlying security, referenced asset or

index through a derivative instrument, such as a total-return swap or a

credit-default swap. In turn the SPE issues notes to investors that pay a return

based on the specified underlying security, referenced asset or index. The SPE

invests the proceeds in a financial asset or a guaranteed insurance contract

(GIC) that serves as collateral for the derivative contract over the term of

the transaction. The Company’s involvement in these transactions includes

being the counterparty to the SPE’s derivative instruments and investing in a

portion of the notes issued by the SPE. In certain transactions, the investor’s

maximum risk of loss is limited and the Company absorbs risk of loss above

a specified level.

The Company’s maximum risk of loss in these transactions is defined as

the amount invested in notes issued by the SPE and the notional amount

of any risk of loss absorbed by the Company through a separate instrument

issued by the SPE. The derivative instrument held by the Company may

generate a receivable from the SPE (for example, where the Company

purchases credit protection from the SPE in connection with the SPE’s

issuance of a credit-linked note), which is collateralized by the assets

owned by the SPE. These derivative instruments are not considered variable

interests and any associated receivables are not included in the calculation of

maximum exposure to the SPE.