Citibank 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

102

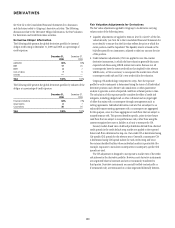

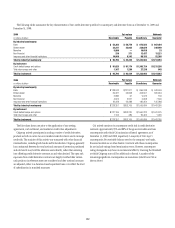

The following tables summarize the key characteristics of Citi’s credit derivative portfolio by counterparty and derivative form as of December 31, 2009 and

December 31, 2008:

2009 Fair values Notionals

In millions of dollars Receivable Payable Beneficiary Guarantor

By industry/counterparty

Bank $ 52,383 $ 50,778 $ 872,523 $ 807,484

Broker-dealer 23,241 22,932 338,829 340,949

Monoline 5,860 — 10,018 33

Non-financial 339 371 13,437 13,221

Insurance and other financial institutions 10,969 8,343 98,155 52,366

Total by industry/counterparty $ 92,792 $ 82,424 $1,332,962 $1,214,053

By instrument

Credit default swaps and options $ 91,625 $ 81,174 $1,305,724 $1,213,208

Total return swaps and other 1,167 1,250 27,238 845

Total by instrument $ 92,792 $ 82,424 $1,332,962 $1,214,053

2008 Fair values Notionals

In millions of dollars Receivable Payable Beneficiary Guarantor

By industry/counterparty

Bank $ 128,042 $121,811 $ 996,248 $ 943,949

Broker-dealer 59,321 56,858 403,501 365,664

Monoline 6,886 91 9,973 139

Non-financial 4,874 2,561 5,608 7,540

Insurance and other financial institutions 29,228 22,388 180,354 125,988

Total by industry/counterparty $ 228,351 $203,709 $1,595,684 $1,443,280

By instrument

Credit default swaps and options $ 221,159 $203,220 $1,560,222 $1,441,375

Total return swaps and other 7,192 489 35,462 1,905

Total by instrument $ 228,351 $203,709 $1,595,684 $1,443,280

The fair values shown are prior to the application of any netting

agreements, cash collateral, and market or credit value adjustments.

Citigroup actively participates in trading a variety of credit derivatives

products as both an active two-way market-maker for clients and to manage

credit risk. The majority of this activity was transacted with other financial

intermediaries, including both banks and broker-dealers. Citigroup generally

has a mismatch between the total notional amounts of protection purchased

and sold and it may hold the reference assets directly, rather than entering

into offsetting credit derivative contracts as and when desired. The open risk

exposures from credit derivative contracts are largely matched after certain

cash positions in reference assets are considered and after notional amounts

are adjusted, either to a duration-based equivalent basis or to reflect the level

of subordination in tranched structures.

Citi actively monitors its counterparty credit risk in credit derivative

contracts. Approximately 85% and 88% of the gross receivables are from

counterparties with which Citi maintains collateral agreements as of

December 31, 2009 and 2008, respectively. A majority of Citi’s top 15

counterparties (by receivable balance owed to the company) are banks,

financial institutions or other dealers. Contracts with these counterparties

do not include ratings-based termination events. However, counterparty

rating downgrades may have an incremental effect by lowering the threshold

at which Citigroup may call for additional collateral. A number of the

remaining significant counterparties are monolines (which have CVA as

shown above).