Citibank 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

FUNDING AND LIQUIDITY

General

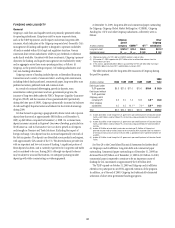

Citigroup’s cash flows and liquidity needs are primarily generated within

its operating subsidiaries. Exceptions exist for major corporate items,

such as the TARP repayment, and for equity and certain long-term debt

issuances, which take place at the Citigroup corporate level. Generally, Citi’s

management of funding and liquidity is designed to optimize availability

of funds as needed within Citi’s legal and regulatory structure. Various

constraints limit certain subsidiaries’ ability to pay dividends or otherwise

make funds available. Consistent with these constraints, Citigroup’s primary

objectives for funding and liquidity management are established by entity

and in aggregate across three main operating entities, as follows: (i)

Citigroup, as the parent holding company; (ii) banking subsidiaries; and

(iii) non-banking subsidiaries.

Citigroup sources of funding include deposits, collateralized financing

transactions and a variety of unsecured short- and long-term instruments,

including federal funds purchased, commercial paper, long-term debt, trust

preferred securities, preferred stock and common stock.

As a result of continued deleveraging, growth in deposits, term

securitization under government and non-government programs, the

issuance of long-term debt under the FDIC’s Temporary Liquidity Guarantee

Program (TLGP) and the issuance of non-guaranteed debt (particularly

during the latter part of 2009), Citigroup substantially increased its balances

of cash and highly liquid securities and reduced its short-term borrowings

during 2009.

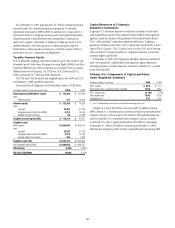

Citi has focused on growing a geographically diverse retail and corporate

deposit base that stood at approximately $836 billion as of December 31,

2009, up $62 billion compared to December 31, 2008. On a volume basis,

deposit increases occurred in Regional Consumer Banking, particularly in

North America, and in Transaction Services due to growth in all regions

and strength in Treasury and Trade Solutions. Excluding the impact of

foreign exchange, Citi’s deposit base has increased sequentially over each of

the last six quarters. The deposits are diversified across products and regions,

with approximately 64% outside of the U.S. This diversification provides Citi

with an important and low-cost source of funding. A significant portion of

these deposits has been, and is currently expected to be, long-term and stable

and is considered to be core. During 2010, although our deposit balances

may be subject to seasonal fluctuations, we anticipate pursuing modest

deposit growth while concentrating on widening spreads.

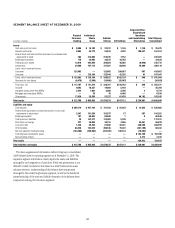

At December 31, 2009, long-term debt and commercial paper outstanding

for Citigroup, Citigroup Global Market Holdings Inc. (CGMHI), Citigroup

Funding Inc. (CFI) and other Citigroup subsidiaries, collectively, were as

follows:

In billions of dollars

Citigroup

parent

company CGMHI (1) CFI (1)

Other

Citigroup

subsidiaries

Long-term debt $197.8 (3) $13.4 $55.5 $97.3 (2)

Commercial paper $ — $ — $ 9.8 $ 0.4

(1) Citigroup guarantees all of CFI’s debt and CGMHI’s publicly issued securities.

(2) At December 31, 2009, approximately $24.1 billion relates to collateralized advances from the

Federal Home Loan Bank.

(3) Of this amount, approximately $64.6 billion is guaranteed by the FDIC with $6.3 billion maturing in

2010, $20.3 billion maturing in 2011 and $38 billion maturing in 2012.

The table below details the long-term debt issuances of Citigroup during

the past five quarters.

In billions of dollars 4Q08 1Q09 2Q09 3Q09 4Q09

2009

Total

Debt issued under

TLGP guarantee $5.8 $ 21.9 $17.0 $10.0 $10.0 $ 58.9

Debt issued without

TLGP guarantee:

Citigroup parent

company/CFI 0.3 2.0 7.4 12.6 4.0 (3)

26.0

Other Citigroup

subsidiaries 0.5 0.5 10.1 (1) 7.9 (2) 5.8 (4) 24.3

Total $6.6 $24.4 $34.5 $30.5 $19.8 $ 109.2

(1) Includes $8.5 billion issued through the U.S. government-sponsored Department of Education Conduit

Facility, and $1 billion issued by Citibank Pty. Ltd. Australia and guaranteed by the Commonwealth of

Australia.

(2) Includes $3.3 billion issued through the U.S. government-sponsored Department of Education Conduit

Facility, and $1 billion issued by Citibank Pty. Ltd. Australia and guaranteed by the Commonwealth of

Australia.

(3) Includes $1.9 billion of senior debt issued under remarketing of $1.9 billion of Citigroup trust

preferred securities held by the Abu Dhabi Investment Authority (ADIA) to provide funds for settlement

of the forward stock purchase contract in March 2010, as provided for by the agreement between Citi

and ADIA.

(4) Includes $1.4 billion issued through the U.S. government-sponsored Department of Education Conduit

Facility.

See Note 20 to the Consolidated Financial Statements for further detail

on Citigroup’s and its affiliates’ long-term debt and commercial paper

outstanding. Commercial paper outstanding as of December 31, 2009 has

decreased from $29 billion as of December 31, 2008 to $10 billion. In 2010,

commercial paper is expected to continue to be an important source of

funding for Citi, maintained at approximately the $10 billion level.

The TLGP expired on October 31, 2009 and Citigroup and its affiliates

elected not to participate in any FDIC-approved extension of the program.

In addition, as of the end of 2009, Citigroup had substantially eliminated

utilization of short-term government funding programs.