Citibank 2009 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

174

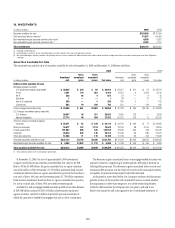

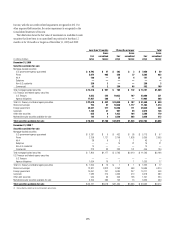

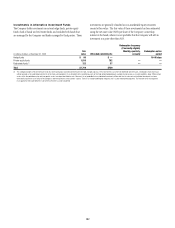

16. INVESTMENTS

In millions of dollars 2009 2008

Securities available-for-sale $239,599 $175,189

Debt securities held-to-maturity (1) 51,527 64,459

Non-marketable equity securities carried at fair value (2) 6,830 9,262

Non-marketable equity securities carried at cost (3) 8,163 7,110

Total investments $306,119 $256,020

(1) Recorded at amortized cost.

(2) Unrealized gains and losses for non-marketable equity securities carried at fair value are recognized in earnings.

(3) Non-marketable equity securities carried at cost primarily consist of shares issued by the Federal Reserve Bank, Federal Home Loan Bank, foreign central banks and various clearing houses of which Citigroup is

a member.

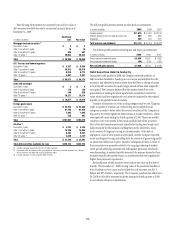

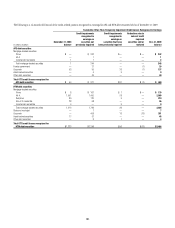

Securities Available-for-Sale

The amortized cost and fair value of securities available-for-sale at December 31, 2009 and December 31, 2008 were as follows:

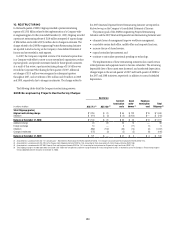

2009 2008 (1)

In millions of dollars

Amortized

cost

Gross

unrealized

gains

Gross

unrealized

losses Fair value

Amortized

cost

Gross

unrealized

gains

Gross

unrealized

losses Fair value

Debt securities available-for-sale

Mortgage-backed securities

U.S. government-agency guaranteed $ 20,625 $ 339 $ 50 $ 20,914 $ 23,527 $ 261 $ 67 $ 23,721

Prime 7,291 119 932 6,478 8,475 3 2,965 5,513

Alt-A 538 93 4 627 54 — 9 45

Subprime 1 — — 1 38 — 21 17

Non-U.S. residential 258 — 3 255 185 2 — 187

Commercial 883 10 100 793 519 — 134 385

Total mortgage-backed securities $ 29,596 $ 561 $1,089 $ 29,068 $ 32,798 $ 266 $ 3,196 $ 29,868

U.S. Treasury and federal agency securities

U.S. Treasury 26,857 36 331 26,562 3,465 125 — 3,590

Agency obligations 27,714 46 208 27,552 20,237 215 77 20,375

Total U.S. Treasury and federal agency

securities $ 54,571 $ 82 $ 539 $ 54,114 $ 23,702 $ 340 $ 77 $ 23,965

State and municipal 16,677 147 1,214 15,610 18,156 38 4,370 13,824

Foreign government 101,987 860 328 102,519 79,505 945 408 80,042

Corporate 20,024 435 146 20,313 10,646 65 680 10,031

Other debt securities 12,268 71 170 12,169 11,784 36 224 11,596

Total debt securities available-for-sale $235,123 $2,156 $3,486 $233,793 $176,591 $1,690 $ 8,955 $169,326

Marketable equity securities available-for-sale $ 4,089 $1,929 $ 212 $ 5,806 $ 5,768 $ 554 $ 459 $ 5,863

Total securities available-for-sale $239,212 $4,085 $3,698 $239,599 $182,359 $2,244 $ 9,414 $175,189

(1) Reclassified to conform to the current period’s presentation.

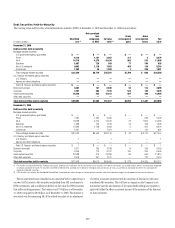

At December 31, 2009, the cost of approximately 5,000 investments

in equity and fixed-income securities exceeded their fair value by $3.698

billion. Of the $3.698 billion, the gross unrealized loss on equity securities

was $212 million. Of the remainder, $1.756 billion represents fixed-income

investments that have been in a gross-unrealized-loss position for less than a

year and, of these, 44% are rated investment grade; $1.730 billion represents

fixed-income investments that have been in a gross-unrealized-loss position

for a year or more and, of these, 96% are rated investment grade.

Available-for-sale mortgage-backed securities-portfolio fair value balance

of $29.068 billion consists of $20.914 billion of government-sponsored

agency securities, and $8.154 billion of privately sponsored securities of

which the majority is backed by mortgages that are not Alt-A or subprime.

The decrease in gross unrealized losses on mortgage-backed securities was

primarily related to a tightening of market spreads, reflecting a decrease in

risk/liquidity premiums. The decrease in gross unrealized losses on state and

municipal debt securities was the result of recovery in the municipal markets,

as liquidity increased and municipal bond yields decreased.

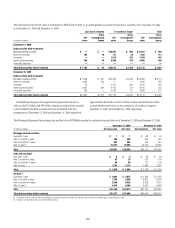

As discussed in more detail below, the Company conducts and documents

periodic reviews of all securities with unrealized losses to evaluate whether

the impairment is other than temporary. Any credit-related impairment

related to debt securities the Company does not plan to sell and is not

likely to be required to sell is recognized in the Consolidated Statement of