Citibank 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.63

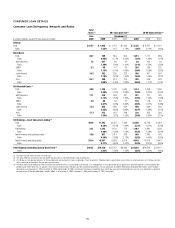

CREDIT RISK

Credit risk is the potential for financial loss resulting from the failure of a

borrower or counterparty to honor its financial or contractual obligations.

Credit risk arises in many of Citigroup’s business activities, including:

lending; •

sales and trading; •

derivatives; •

securities transactions; •

settlement; and •

when Citigroup acts as an intermediary.•

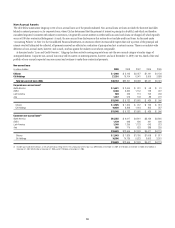

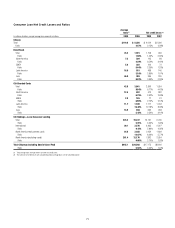

Loan and Credit Overview

During 2009, Citigroup reduced its aggregate loan portfolio by $102.7 billion

to $591.5 billion. In addition, Citi’s total allowance for loan losses totaled

$36.0 billion at December 31, 2009, a coverage ratio of 6.09% of total loans,

up from 4.27% at December 31, 2008.

During 2009, Citigroup recorded a net build of $8.0 billion to its credit

reserves, which was $6.6 billion lower than the build in 2008. The net build

consisted of a net build of $7.6 billion for consumer loans ($1.7 billion in

RCB and $5.9 billion in LCL) and a net build of $0.4 billion for corporate

loans (a build of $0.9 billion in ICG and a release of $0.5 billion in SAP).

Net credit losses of $30.7 billion during 2009 increased $11.7 billion from

year-ago levels. The increase consisted of $7.6 billion for consumer loans

($1.3 billion in RCB, $6.1 billion in LCL and $0.2 billion in SAP) and a net

increase of $4.1 billion for corporate loans ($0.2 billion decrease in ICG offset

by a $4.3 billion increase in SAP).

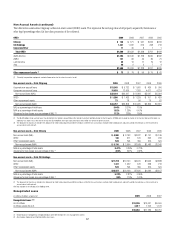

Consumer non-accrual loans totaled $18.6 billion at December 31, 2009,

compared to $12.6 billion at December 31, 2008. The consumer loan 90 days

past due delinquency rate was 4.82% at December 31, 2009, compared to

2.96% at December 31, 2008. The 90 days past due delinquencies continue

to rise for the first mortgage portfolio in the U.S., primarily due to the

lengthening of the foreclosure process by many states and the increasing

impact of the Home Affordable Modification Program (HAMP). Loans in the

HAMP trial modification period are reported as delinquent if the original

contractual payments are not received on time (even if the reduced payments

agreed to under the program are made by the borrower) until the loan

has completed the trial period under the program (see “Consumer Loan

Modification Programs” and “U.S. Consumer Mortgage Lending” below).

The 30 to 89 days past due delinquency rate was 3.56% at December 31, 2009,

compared to 3.51% at December 31, 2008.

Corporate non-accrual loans were $13.5 billion at December 31, 2009,

compared to $9.7 billion at December 31, 2008. The increase from the

prior year is mainly due to Citi’s continued policy of actively moving loans

into non-accrual at earlier stages of anticipated distress. Over two-thirds of

the non-accrual corporate loans are current and continue to make their

contractual payments.

For Citi’s loan accounting policies, see Note 1 to the Consolidated

Financial Statements.

2010 Credit Outlook

Credit costs will remain a significant driver of Citi’s financial performance

in 2010. Certain regions, including Asia and Latin America, are showing

improvement in consumer credit trends. This trend is expected to continue

into 2010 as long as economic recovery in these regions is sustained. In

North America, however, credit trends will largely depend on the broader

macroeconomic environment, as well as the impact of industry factors

such as CARD Act implementation and the outcome of the HAMP, each as

discussed in more detail. Across North America, a modest increase in net

credit losses is expected in the first quarter of 2010, after which there may

be some slight improvement. However, the outcome for the second half of

2010 will largely depend on the economy, and the success of Citi’s ongoing

loss mitigation efforts. Changes to the Company’s consumer loan loss reserve

balances will continue to reflect the losses embedded in the portfolio due to

underlying credit trends, as well as the impact of forbearance programs.

Corporate credit is inherently difficult to predict, and accordingly, the

recognition of credit losses and changes in reserves will be somewhat episodic.