Citibank 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284

|

|

iii

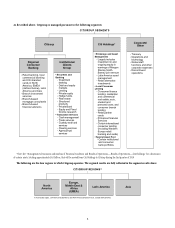

The outcome of this examination was that we realigned the Company’s many and diverse

businesses into two primary operating segments: Citicorp and Citi Holdings. This action

clarified for our employees and all other stakeholders our strategic priorities for the future of

Citigroup in the United States and around the world.

Into Citicorp, we placed the businesses that are core to our strategy and that offer shareholders

the greatest earnings potential within appropriate risk parameters. These businesses are:

• Global Transaction Services

- Treasury and Trade Solutions

- Securities and Fund Services

• SecuritiesandBanking

- Global Banking

- Global Markets

- Citi Private Bank

- Citi Capital Advisors

• RegionalConsumerBanking

- Four Regional Consumer Banks in North America, EMEA (Europe, Middle East, and

Africa), Latin America and Asia that each include retail banking, local commercial banking

and Citi-branded cards

These businesses position us squarely against the world’s high-growth markets and products.

Our core mission is to be the global bank for institutions and individuals, and to serve our

clients with distinction. We bring them unique value through our global reach and innovative

solutions.

In Citi Holdings, we assembled assets and businesses that are not central to our strategy.

Some have significant value in their own right. Some have iconic brand names. Many are

economically sensitive. Citi Holdings encompasses:

• BrokerageandAssetManagement,whichincludestheMorganStanleySmithBarneyjoint

venture

• LocalConsumerLending

- North America, which includes residential and commercial real estate loans; auto, student

and personal loans; and retail partner cards

- International, which includes Western Europe consumer banking and other consumer

finance franchises around the world

• SpecialAssetPool,whichincludesnon-coreassets,manyofwhichareilliquidincurrent

markets

We are managing the Citi Holdings businesses with an eye toward tightly controlling their

risks and divesting them as quickly as market conditions and other factors enable us to

maximize their value. Since the end of 2007, we have completed more than 35 divestitures.

Our riskiest assets, which are pooled in Citi Holdings, already have been substantially

reduced, as I have noted, and they will continue to shrink. Overall, Citi Holdings assets have

declined by $351 billion, or almost 40%, over the past two years. Financial resources gained

from our ongoing divestitures are being reallocated to Citicorp.

Our restructuring of the Company for strategic clarity, I should add, has been an important

means of achieving further operating effectiveness and efficiency because we have expedited

sound decision-making on asset and liability management, capital allocation and other priorities.

World-Class Talent

Of course, all of our accomplishments would mean very little for the future of Citi without

the right people and management in place to execute our plans. Talent is the bedrock of

our strategy. In the slightly more than two years since I became CEO, we have extensively

revamped the leadership of Citi and its businesses, not only at the very top but also

throughout our organization.