Citibank 2009 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.58

Liquidity is essential to Citigroup’s businesses, and

Citigroup relies on external sources to finance a

significant portion of its operations.

Adequate liquidity is essential to Citigroup’s businesses. Citigroup’s liquidity

could be materially, adversely affected by factors Citigroup cannot control,

such as general disruption of the financial markets or negative views about

the financial services industry in general. In addition, Citigroup’s ability to

raise funding could be impaired if lenders develop a negative perception of

Citigroup’s short-term or long-term financial prospects, or a perception that

it is experiencing greater liquidity risk.

Regulatory measures instituted in late 2008 and 2009, such as the FDIC’s

temporary guarantee of the newly issued senior debt as well as deposits in

non-interest-bearing deposit transaction accounts, and the commercial

paper funding facility of the Federal Reserve Board were designed to stabilize

the financial markets and the liquidity position of financial institutions

such as Citigroup. While much of Citigroup’s long-term and short-term

unsecured funding during 2009 was issued pursuant to these government-

sponsored funding programs, Citigroup began to access funding outside

of these programs, particularly during the fourth quarter of 2009, due, in

part, to the fact that many of these facilities were terminating. Citi’s reliance

on government-sponsored short-term funding facilities was substantially

reduced as of the end of 2009. The impact that the termination of any of

these facilities could have on Citigroup’s ability to access funding in the

future is uncertain. It is also unclear whether Citigroup will be able to

regain access to the public long-term unsecured debt markets on historically

customary terms.

Citigroup’s cost of obtaining long-term unsecured funding is directly

related to its credit spreads in both the cash bond and derivatives markets.

Increases in Citigroup’s credit qualifying spreads can significantly increase

the cost of this funding. Credit spreads are influenced by market and rating

agency perceptions of Citigroup’s creditworthiness and may be influenced

by movements in the costs to purchasers of credit default swaps referenced to

Citigroup’s long-term debt.

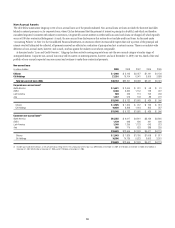

In addition, a significant portion of Citigroup’s business activities are

based on gathering deposits and borrowing money and then lending or

investing those funds, including through market-making activities in

tradable securities. Citigroup’s profitability is in part a function of the spread

between interest rates earned on such loans and investments, as well as other

interest-earning assets, and the interest rates paid on deposits and other

interest-bearing liabilities. During 2009, the need to maintain adequate

liquidity caused Citigroup to invest available funds in lower-yielding assets,

such as those issued by the U.S. government. As a result, during 2009,

the yields across both the interest-earning assets and the interest-bearing

liabilities dropped significantly from 2008. The lower asset yields more

than offset the lower cost of funds, resulting in lower net interest margins

compared to 2008. There can be no assurance that Citigroup’s net interest

margins will not continue to remain low.

Any reduction in Citigroup’s and its subsidiaries’ credit

ratings could increase the cost of its funding from, and

restrict its access to, the capital markets and have a

material adverse effect on its results of operations and

financial condition.

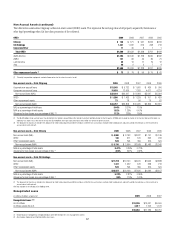

Each of Citigroup’s and Citibank, N.A.’s long-term/senior debt is currently rated

investment grade by Fitch Ratings, Moody’s Investors Service and Standard &

Poor’s. The rating agencies regularly evaluate Citigroup and its subsidiaries,

and their ratings of Citigroup’s and its subsidiaries’ long-term and short-term

debt are based on a number of factors, including financial strength, as well as

factors not entirely within the control of Citigroup and its subsidiaries, such as

conditions affecting the financial services industry generally.

In light of the difficulties in the financial services industry and the

financial markets generally, or as a result of events affecting Citigroup more

specifically, Citigroup and its subsidiaries may not be able to maintain their

current respective ratings. A reduction in Citigroup’s or its subsidiaries’

credit ratings could adversely affect Citigroup’s liquidity, widen its credit

spreads or otherwise increase its borrowing costs, limit its access to the capital

markets or trigger obligations under certain bilateral provisions in some

of Citigroup’s trading and collateralized financing contracts. In addition,

under these provisions, counterparties could be permitted to terminate

certain contracts with Citigroup or require it to post additional collateral.

Termination of Citigroup’s trading and collateralized financing contracts

could cause Citigroup to sustain losses and impair its liquidity by requiring

Citigroup to find other sources of financing or to make significant cash

payments or securities transfers. For additional information on the potential

impact of a reduction in Citigroup’s or its subsidiaries’ credit ratings, see

“Capital Resources and Liquidity.”

Certain of the credit rating agencies have stated that the credit ratings of

Citi and other financial institutions have benefited from the implicit support

that the U.S. government and regulators have provided to the financial

industry through the financial crisis. The expectation that this support will be

reduced over time, unless offset by improvement in standalone credit profiles,

could have a negative impact on the credit ratings of financial institutions,

including Citi.

Market disruptions may increase the risk of customer or

counterparty delinquency or default.

Market and economic disruptions, as well as the policies of the Federal

Reserve Board or other government agencies or entities, can adversely affect

Citigroup’s customers, obligors on securities or other instruments or other

counterparties, potentially increasing the risk that they may fail to repay

their securities or loans or otherwise default on their contractual obligations

to Citigroup, some of which maybe significant. These customers, obligors

or counterparties could include individuals or corporate or governmental

entities. Moreover, Citigroup may incur significant credit risk exposure

from holding securities or other obligations or entering into swap or other

derivative contracts under which obligors or other counterparties have

long-term obligations to make payments to Citigroup. Market conditions

over the last several years, including credit deterioration, decreased liquidity

and pricing transparency along with increased market volatility, have

negatively impacted Citigroup‘s credit risk exposure. Although Citigroup

regularly reviews its credit exposures, default risk may arise from events or

circumstances that are difficult to detect or foresee.