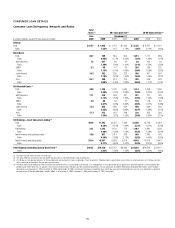

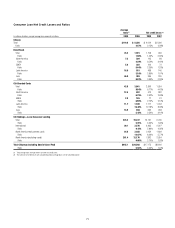

Citibank 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.78

North America Cards

Citi’s North America cards portfolio consists of our Citi-branded and

retail partner cards portfolios located in Citicorp—Regional Consumer

Banking and Citi Holdings—Local Consumer Lending, respectively. As

of December 31, 2009, the Citi-branded portfolio totaled approximately $83

billion while the retail partner cards portfolio was approximately $58 billion,

both reported on a managed basis.

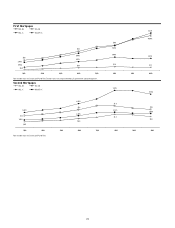

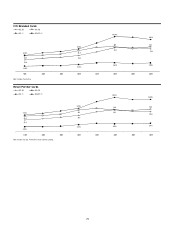

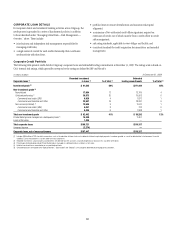

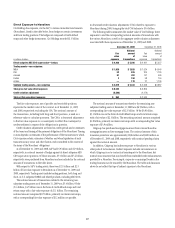

The following charts detail the quarterly trends in delinquencies and net

credit losses for Citigroup’s North America Citi-branded and retail partner

cards portfolios.

In each of the two portfolios, Citi has been actively eliminating riskier

accounts and sales to mitigate losses. First, we have removed high-risk

customers from the portfolio by either reducing available lines of credit or

closing accounts. On a net basis, end of period open accounts are down 11%

in both Citi-branded and retail partner cards versus prior-year levels. Second,

Citi has improved the tools used to identify and manage exposure in each of

the portfolios by targeting unique customer attributes.

In Citi’s experience to date, these portfolios have significantly different

characteristics:

Citi-branded cards tend to have a longer estimated account life, with •

higher credit lines and balances reflecting the greater utility of a multi-

purpose credit card.

Retail partner cards tend to have a shorter account life, with smaller credit •

lines and balances. The account portfolio, by nature, turns faster and the

loan balances reflect more recent vintages.

As a result, loss mitigation efforts, such as stricter underwriting standards

for new accounts, decreasing higher-risk credit lines, closing high-risk

accounts and re-pricing, tend to affect the retail partner cards portfolio faster

than the branded portfolio.

In addition to tightening credit standards, Citi also continues to pursue

other loss mitigation efforts, including improvements in collections

effectiveness and various forbearance programs. We believe forbearance

programs improve the longer-term quality of these accounts.

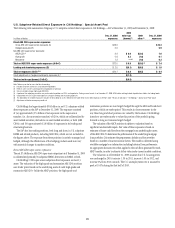

Citigroup offers both short-term and long-term modification programs to

its credit card customers, primarily in the U.S. The short-term U.S. programs

provide interest rate reductions for up to 12 months, while the long-term

programs provide interest rate reductions for up to five years. In both types

of U.S. programs, the annual percentage rate (APR) is typically reduced to

below 10%.

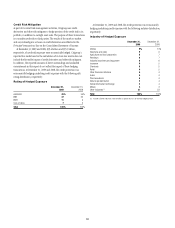

Citigroup monitors the performance of these U.S. credit card short-

term and long-term modification programs by tracking cumulative loss

rates by vintages (when customers enter a program) and comparing

that performance with that of similar accounts whose terms were not

modified. For example, for U.S. credit cards, in Citi’s experience to date, at

24 months after modifying an account, Citi typically reduces credit losses

by approximately one-third compared to similar accounts that were not

modified. Citi has observed that this improved performance of modified loans

relative to those not modified is generally greatest during the first 12 months

after modification. Following that period, losses have tended to increase but

typically stabilize at levels which are still below those for similar loans that

were not modified, resulting in an improved cumulative loss performance. To

date, Citi has tended to see that this benefit is sustained over time across our

U.S. credit card portfolios.

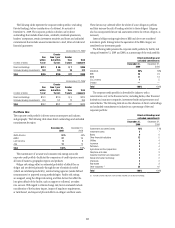

Recognizing the impact of various forbearance programs, we are

nevertheless seeing some early positive credit trends in both Citi-branded and

retail partner cards. While both portfolios experienced an expected seasonal

increase in 90+ day delinquencies in the fourth quarter of 2009, which we

currently expect could lead to a moderate increase in net credit losses in the

first quarter of 2010, earlier bucket delinquencies (30–89 days past due)

improved on a dollar basis.

Overall, however, Citi remains cautious and currently believes that net

credit losses in each of the cards portfolios will continue to remain at elevated

levels and will continue to be highly dependent on the external environment

and industry changes.