Citibank 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.v

• TheUnitedStates,andalmostallothersignificanteconomies,musthavehealthyexport

marketsmorethanever.Nodevelopedoremergingnationcanrelyoninternaldemandfor

stronggrowthnearlyasmuchasinthepast.

• Tocompete,companiesarebecomingmoreandmoremultinationalintheiroperationsand

marketing.Thisrequiresfirst-rateinternationalbankingcapabilities.

• Allofusasindividualsareinaveryrealsensebecomingcitizensoftheworld—inour

travel,education,communication,investmentandspending.Social,politicalandeconomic

forcesarebeingcompressedintoasmallerandsmallerglobeinwaysthatareatonce

bothpowerfullycreativeanddangerouslyfragile.Weallareprofoundlyaffectedbythe

complexityandintensityofthisphenomenon.

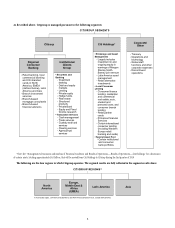

Citi, among all banking institutions, is uniquely qualified to meet the challenges of globalization

for clients. Our Global Transaction Services (GTS) business, for example, provides

unparalleled resources in trade finance, cash management, securities and fund services,

and other specialties. Its global payment flows are as high as $9 trillion per day. Within GTS,

Citi continues to invest in technology for its global network and develop innovative solutions,

including pre-paid, commercial cards and new online banking technology beyond traditional

transaction management and reporting. GTS is also building out its Investor Services suite of

solutions for the large, under-penetrated market for middle and back office outsourcing among

a full range of investors.

Our Securities and Banking businesses serve clients with the combination of global reach,

local experience, product scope and expertise that defines Citi. Our comprehensive trading

and distribution platform operates via local trading desks in 75 countries, complemented

by superior market-making capabilities and best-in-class origination. Our investment

bank advised on many of the largest deals in 2009, ranking #3 in global completed M&A

volume. Our focus on our clients’ needs earned us Best Global Corporate and Institutional

Bank honors from GlobalFinance magazine and our commitment to providing clients with

intellectual capital and independent, insightful research earned us a top-four ranking in each

major geography in InstitutionalInvestor’s highly regarded research poll.

Our Citi Capital Advisors business was restructured and streamlined into three asset classes

and substantially all funds have outperformed their respective benchmarks. Our personalized

wealth management platform, Citi Private Bank, advised more than one third of the world’s

billionaires through 60 offices located in 31 countries.

Our aspiration is to deliver on the promise that “a client of Citi anywhere is a client of Citi

everywhere.” Through our advantageous geographic positioning and our capabilities in virtual

technology, we are not far from that goal.

Constant Innovation

To be client-centric and globally competitive requires obsessive attention to innovation. Even

at the height of the financial crisis, we knew we could not afford to abandon this priority, and

we did not. Now, with strong fundamentals in place, we are able to expand our investment in

this vital dimension of our businesses.

There are many initiatives that showcase Citi’s lead role in banking innovation. For example,

in Japan, our new “Ubiquity” bank branches offer a fascinating model of the high-tech

innovations that clients everywhere are starting to expect from state-of-the-art banking

services. Worldwide, we intend to deploy an integrated banking and cards platform that gives

us a 360-degree view of our clients’ needs and relationships with us. In addition, we are

successfully developing mobile consumer banking in most markets. And the high-tech GTS

platform, which spans the globe, points to one of the most important goals of innovation for us:

to be the “digital bank of the future.”