Citibank 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.88

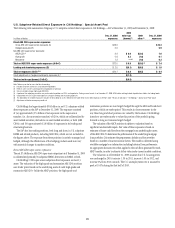

Highly Leveraged Financing Transactions

Highly leveraged financing commitments are agreements that provide

funding to a borrower with higher levels of debt (measured by the ratio of

debt capital to equity capital of the borrower) than is generally the case

for other companies. In recent years through mid-2008, highly leveraged

financing had been commonly employed in corporate acquisitions,

management buy-outs and similar transactions.

In these financings, debt service (that is, principal and interest payments)

absorbs a significant portion of the cash flows generated by the borrower’s

business. Consequently, the risk that the borrower may not be able to meet

its debt obligations is greater. Due to this risk, the interest rates and fees

charged for this type of financing are generally higher than for other types of

financing.

Prior to funding, highly leveraged financing commitments are assessed

for impairment and losses are recorded when they are probable and

reasonably estimable. For the portion of loan commitments that relates to

loans that will be held for investment, loss estimates are made based on the

borrower’s ability to repay the facility according to its contractual terms. For

the portion of loan commitments that relates to loans that will be held-for-

sale, loss estimates are made in reference to current conditions in the resale

market (both interest rate risk and credit risk are considered in the estimate).

Loan origination, commitment, underwriting and other fees are netted

against any recorded losses.

Citigroup generally manages the risk associated with highly leveraged

financings it has entered into by seeking to sell a majority of its exposures

to the market prior to or shortly after funding. In certain cases, all or a

portion of a highly leveraged financing to be retained is hedged with credit

derivatives or other hedging instruments. Thus, when a highly leveraged

financing is funded, Citigroup records the resulting loan as follows:

the portion that Citigroup will seek to sell is recorded as a loan held-for-•

sale in Other assets on the Consolidated Balance Sheet, and measured at

the lower of cost or market; and

the portion that will be retained is recorded as a loan held-for-investment •

in Loans and measured at amortized cost less a reserve for loan losses.

Due to the dislocation of the credit markets and the reduced market

interest in higher-risk/higher-yield instruments since the latter half of 2007,

liquidity in the market for highly leveraged financings has been limited. This

has resulted in Citi’s recording pretax write-downs on funded and unfunded

highly leveraged finance exposures of $521 million in 2009 and $4.9 billion

in 2008.

Citigroup’s exposures to highly leveraged financing commitments

totaled $5.0 billion at December 31, 2009 ($4.7 billion funded and

$0.3 billion in unfunded commitments), reflecting a decrease of $5 billion

from December 31, 2008.

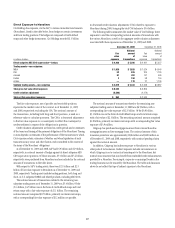

In 2008, Citigroup completed the transfer of approximately $12.0 billion

of loans to third parties, of which $8.5 billion relates to highly leveraged loan

commitments. In these transactions, the third parties purchased subordinate

interests backed by the transferred loans. These subordinate interests absorb

first loss on the transferred loans and provide the third parties with control of

the loans. Citigroup retained senior debt securities backed by the transferred

loans. These transactions were accounted for as sales of the transferred loans.

The loans were removed from the balance sheet and the retained securities

are classified as AFS securities on Citi’s Consolidated Balance Sheet.

In addition, Citigroup purchased protection on the senior debt securities

from the third-party subordinate interest holders via total return swaps

(TRS). The counterparty credit risk in the TRS is protected through

margin agreements that provide for both initial margin and additional

margin at specified triggers. Due to the initial cash margin received, the

existing margin requirements on the TRS, and the substantive subordinate

investments made by third parties, Citi believes that the transactions largely

mitigate Citi’s risk related to the transferred loans.

Citigroup’s sole remaining exposure to the transferred loans are the

senior debt securities, which have an amortized cost basis and fair value of

$7.0 billion at December 31, 2009. The change in the value of the retained

senior debt securities that are classified as AFS securities are recorded in AOCI

as they are deemed temporary. The offsetting change in the TRS are recorded

as cash flow hedges within AOCI. See Notes 16 and 22 to the Consolidated

Financial Statements for additional information.