Citibank 2009 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

230

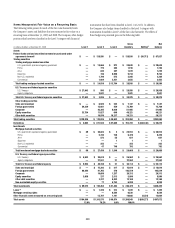

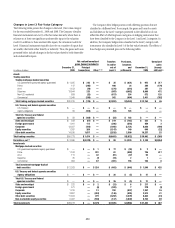

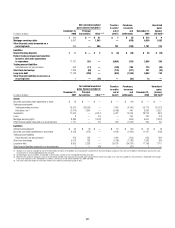

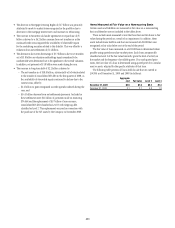

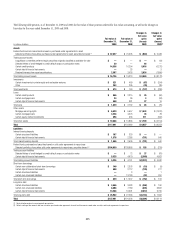

Changes in Level 3 Fair Value Category

The following tables present the changes in the Level 3 fair value category

for the years ended December 31, 2009 and 2008. The Company classifies

financial instruments in Level 3 of the fair value hierarchy when there is

reliance on at least one significant unobservable input to the valuation

model. In addition to these unobservable inputs, the valuation models for

Level 3 financial instruments typically also rely on a number of inputs that

are readily observable either directly or indirectly. Thus, the gains and losses

presented below include changes in the fair value related to both observable

and unobservable inputs.

The Company often hedges positions with offsetting positions that are

classified in a different level. For example, the gains and losses for assets

and liabilities in the Level 3 category presented in the tables below do not

reflect the effect of offsetting losses and gains on hedging instruments that

have been classified by the Company in the Level 1 and Level 2 categories. In

addition, the Company hedges items classified in the Level 3 category with

instruments also classified in Level 3 of the fair value hierarchy. The effects of

these hedges are presented gross in the following tables.

December 31,

2008

Net realized/unrealized

gains (losses) included in Transfers

in and/or

out of

Level 3

Purchases,

issuances

and

settlements

December 31,

2009

Unrealized

gains

(losses)

still held (3)

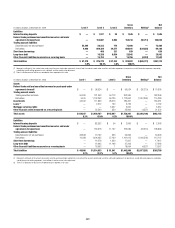

In millions of dollars

Principal

transactions Other (1) (2)

Assets

Trading securities

Trading mortgage-backed securities

U.S. government-sponsored agency guaranteed $ 1,325 $ 243 $ — $ 35 $ (631) $ 972 $ 317

Prime 147 (295) — 498 34 384 (179)

Alt-A 1,153 (78) — (374) (314) 387 73

Subprime 13,844 233 — (997) (4,082) 8,998 472

Non-U.S. residential 858 (23) — (617) 354 572 125

Commercial 2,949 (256) — 362 (604) 2,451 (762)

Total trading mortgage-backed securities $20,276 $ (176) $ — $(1,093) $(5,243) $ 13,764 $ 46

U.S. Treasury and federal agencies securities

U.S. Treasury $ — $ — $ — $ — $ — $ — $ —

Agency obligations 59 (108) — (54) 103 — —

Total U.S. Treasury and federal

agencies securities $ 59 $ (108) $ — $ (54) $ 103 $ — $ —

State and municipal $ 233 $ (67) $ — $ 219 $ (163) $ 222 $ 4

Foreign government 1,261 112 — (396) (518) 459 3

Corporate 13,027 (184) — (1,492) (2,731) 8,620 (449)

Equity securities 1,387 260 — (1,147) 140 640 (22)

Other debt securities 14,530 1,637 — (2,520) 2,590 16,237 53

Total trading securities $50,773 $ 1,474 $ — $(6,483) $(5,822) $ 39,942 $ (365)

Derivatives, net (4) $ 3,586 $(4,878) $ — $ 80 $ 4,320 $ 3,108 $(4,854)

Investments

Mortgage-backed securities

U.S. government-sponsored agency guaranteed $ — $ — $ 1 $ 77 $ (76) $ 2 $ —

Prime 1,163 — 201 61 (689) 736 417

Alt-A 111 — 42 (61) (37) 55 —

Subprime 25 — (7) (19) 2 1 —

Commercial 964 — 87 (461) 156 746 8

Total investment mortgage-backed

debt securities $ 2,263 $ — $ 324 $ (403) $ (644) $ 1,540 $ 425

U.S. Treasury and federal agencies securities

Agency obligations $ — $ — $ — $ 26 $ (5) $ 21 $ —

Total U.S. Treasury and federal

agencies securities $ — $ — $ — $ 26 $ (5) $ 21 $ —

State and municipal $ 222 $ — $ 2 $ (13) $ 6 $ 217 $ —

Foreign government 571 — (6) (302) 7 270 (3)

Corporate 1,019 — 13 762 (537) 1,257 16

Equity securities 3,807 — (453) (146) (695) 2,513 41

Other debt securities 11,324 — 279 (1,292) (1,479) 8,832 (81)

Non-marketable equity securities 9,067 — (538) (137) (1,639) 6,753 69

Total investments $28,273 $ — $(379) $(1,505) $(4,986) $ 21,403 $ 467