Citibank 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

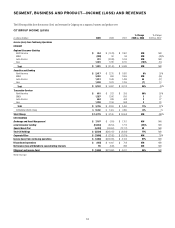

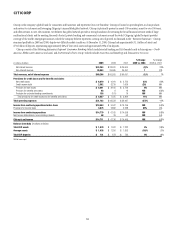

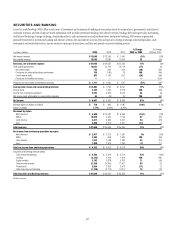

2008 vs. 2007

Revenues, net of interest expense decreased 21%, driven by lower

securitization revenue and higher credit losses in the securitization trusts,

which were partially offset by higher net interest margin in cards and higher

revenues in retail banking. Lower securitization revenue was mainly driven

by a write-down of $1.1 billion in the residual interest in securitized balances.

The residual interest was primarily affected by deterioration in the projected

credit loss assumption used to value the asset.

Net interest revenue was up 21%, mainly driven by lower funding costs.

Non-interest revenue decreased 39%, primarily due to lower

securitization revenue, higher credit losses in the securitization trusts, and

the absence of a $297 million gain on the sale of MasterCard shares in 2007.

This decline was partially offset by a $349 million gain on the sale of Visa

shares and a $170 million gain from a cards portfolio sale in 2008.

Operating expenses increased 31%, primarily driven by a $2.3 billion

goodwill impairment charge in 2008. Excluding the charge, expenses were

down 5% mainly reflecting the absence of a $292 million Visa litigation-

related charge in 2007 and a $159 million Visa litigation reserve release in

2008, partially offset by $217 million repositioning charges in 2008.

Provisions for loan losses and for benefits and claims increased $540

million driven by higher net credit losses, up $165 million, and a higher loan

loss reserve build, up $367 million, in both cards and retail banking. Higher

credit costs reflected a weakening of leading credit indicators, including

the continued acceleration in the rate at which delinquent cards customers

advanced to write-off, as well as trends in the macroeconomic environment,

including the housing market downturn and rising unemployment. The

cards managed net credit loss ratio increased 191 basis points to 5.72%, while

the retail banking net credit loss ratio increased 14 basis points to 3.54%.

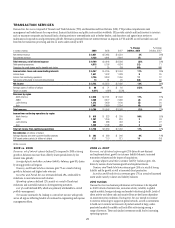

Managed Presentations

Managed-basis (Managed) presentations detail certain non-GAAP financial

measures. Managed presentations (applicable only to North American

branded and retail partner credit card operations in NA RCB and Citi

Holdings—Local Consumer Lending, respectively, as there are no

deconsolidated credit card securitizations in any other region) include

results from both the on-balance-sheet loans and off-balance-sheet loans,

and exclude the impact of credit card securitizations activity. Managed

presentations assume that securitized loans have not been sold and present

the results of the securitized loans in the same manner as Citigroup’s owned

loans. Citigroup believes that Managed presentations are useful to investors

because they are widely used by analysts and investors within the credit card

industry. Managed presentations are commonly used by other companies

within the financial services industry. See also the “2010 Outlook” for NA

RCB below.

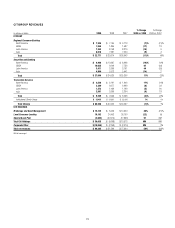

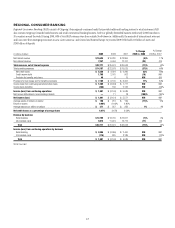

2009 2008 2007

Managed credit losses as

a percentage of average

managed loans 9.14% 5.62% 3.81%

Impact from credit card

securitizations 3.30% 2.02% 1.13%

Net credit losses as a

percentage of average loans 5.84% 3.60% 2.68%

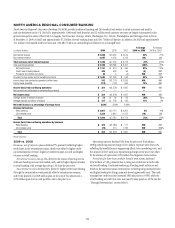

2010 Outlook

In 2010, NA RCB is expected to continue to operate in a challenging

economic and credit environment. Revenues will be affected by the continued

U.S. economic downturn that has impacted customer demand and credit

performance, as well as by legislative and regulatory changes. Both

retail banking and cards will continue to focus on tight expense control,

productivity improvements, and effective credit management. With high

levels of unemployment and bankruptcy filings in 2010, net credit losses,

delinquencies and defaults are expected to remain at elevated levels during

the year.

NA RCB results will also continue to be impacted by Citi’s continued

implementation of the CARD Act as well as the company’s loss mitigation

and forbearance programs, particularly in Citi’s card and U.S. mortgage

businesses. The majority of the provisions of the CARD Act will have taken

effect by February 2010. The CARD Act implementation began to impact

card revenues in the fourth quarter of 2009 as lower net interest rate revenue

due to such implementation was partially mitigated by pricing actions.

Management within NA RCB continues to review and revise the company’s

credit card business model to implement the required changes of the CARD

Act, and this will likely continue throughout 2010. While management of

NA RCB believes that it can mitigate a portion of the impact of the CARD

Act, Citi currently estimates that the net impact of the CARD Act on NA RCB

revenues for 2010 could be a reduction of approximately $400 to $600

million. See also “Results of Operations—Citi Holdings—Local Consumer

Lending” and “Managing Global Risk—Credit Risk” below.

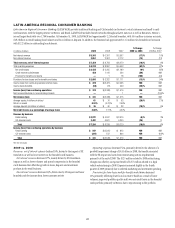

In addition, on January 1, 2010, Citi adopted SFAS No. 166, Accounting

for Transfers of Financial Assets, an Amendment of FASB Statement No.

140 (SFAS 166) and SFAS No. 167 Amendments to FASB Interpretation

No. 46(R) (SFAS 167). These new accounting standards will be applied

prospectively and will require consolidation of certain credit card

securitization trusts and the elimination of sale accounting for transfers of

credit card receivables to those trusts. Under previous accounting standards,

transfers of credit card receivables to the securitization trusts were accounted

for as sales. Consequently, beginning in 2010, the financial results of NA

RCB will vary from previously reported financial results prepared under the

amended accounting standards. See Note 1 to the Consolidated Financial

Statements for a discussion of “Future Application of Accounting Standards”

for further detail.