Citibank 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

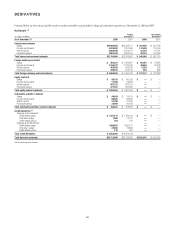

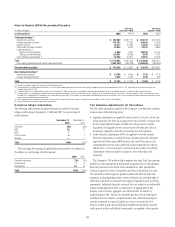

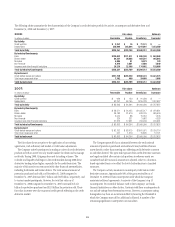

The following tables summarize the key characteristics of the Company’s credit derivative portfolio by activity, counterparty and derivative form as of

December 31, 2008 and December 31, 2007:

2008: Fair values Notionals

In millions of dollars Receivable Payable Beneficiary Guarantor

By Activity:

Credit portfolio $ 3,257 $ 15 $ 71,131 $ —

Dealer/client 225,094 203,694 1,519,081 1,443,280

Total by Activity $228,351 $203,709 $1,590,212 $1,443,280

By Industry/Counterparty:

Bank $128,042 $121,811 $ 996,248 $ 943,949

Broker-dealer 59,321 56,858 403,501 365,664

Monoline 6,886 91 9,973 139

Non-financial 4,874 2,561 5,608 7,540

Insurance and other financial institutions 29,228 22,388 174,882 125,988

Total by Industry/Counterparty $228,351 $203,709 $1,590,212 $1,443,280

By Instrument:

Credit default swaps and options $221,159 $203,220 $1,560,223 $1,441,375

Total return swaps and other 7,192 489 29,989 1,905

Total by Instrument $228,351 $203,709 $1,590,212 $1,443,280

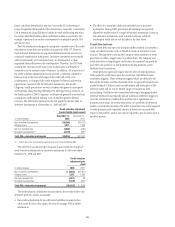

2007: Fair values Notionals

In millions of dollars Receivable Payable Beneficiary Guarantor

By Activity:

Credit portfolio $ 626 $ 129 $ 91,228 $ —

Dealer/client 82,767 84,165 1,815,728 1,767,837

Total by Activity $ 83,393 $ 84,294 $1,906,956 $1,767,837

By Industry/Counterparty:

Bank $ 28,571 $ 34,425 $1,035,217 $ 970,831

Broker-dealer 28,183 31,519 633,745 585,549

Monoline 5,044 88 15,064 1,243

Non-financial 220 331 3,682 4,253

Insurance and other financial institutions 21,375 17,931 219,248 205,961

Total by Industry/Counterparty $ 83,393 $ 84,294 $1,906,956 $1,767,837

By Instrument:

Credit default swaps and options $ 82,752 $ 83,015 $1,891,061 $1,755,716

Total return swaps and other 641 1,279 15,895 12,121

Total by Instrument $ 83,393 $ 84,294 $1,906,956 $1,767,837

The fair values shown are prior to the application of any netting

agreements, cash collateral, and market or credit value adjustments.

The Company actively participates in trading a variety of credit derivatives

products as both an active two-way market-maker for clients and to manage

credit risk. During 2008, Citigroup decreased its trading volumes. The

volatility and liquidity challenges in the credit markets during 2008 drove

derivatives trading values higher, especially for the credit derivatives. The

majority of this activity was transacted with other financial intermediaries,

including both banks and broker-dealers. The total notional amount of

protection purchased and sold as of December 31, 2008 compared to

December 31, 2007 decreased $317 billion and $325 billion, respectively, and

to various market participants. However, the total fair value as of

December 31, 2008 compared to December 31, 2007 increased by $145

billion for protection purchased and $119 billion for protection sold. These

fair value increases were due to general credit spreads widening in the credit

derivative market.

The Company generally has a mismatch between the total notional

amounts of protection purchased and sold and it may hold the reference

assets directly, rather than entering into offsetting credit derivative contracts

as and when desired. The open risk exposures from credit derivative contracts

are largely matched after certain cash positions in reference assets are

considered and after notional amounts are adjusted, either to a duration-

based equivalent basis or to reflect the level of subordination in tranched

structures.

The Company actively monitors its counterparty credit risk in credit

derivative contracts. Approximately 88% of the gross receivables as of

December 31, 2008 are from counterparties with which the Company

maintains collateral agreements. A majority of the Company’s top 15

counterparties (by receivable balance owed to the Company) are banks,

financial institutions or other dealers. Contracts with these counterparties do

not include ratings-based termination events. However, counterparty rating

downgrades may have an incremental effect by lowering the threshold at

which the Company may call for additional collateral. A number of the

remaining significant counterparties are monolines.

93