Citibank 2008 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

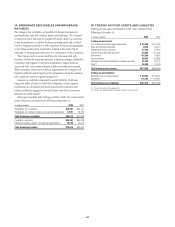

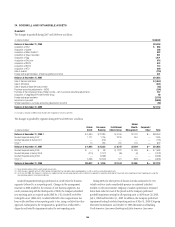

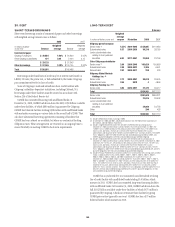

19. GOODWILL AND INTANGIBLE ASSETS

Goodwill

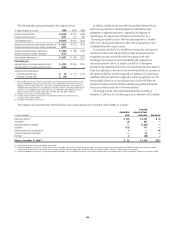

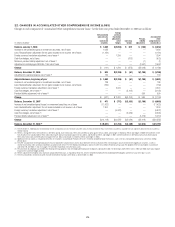

The changes in goodwill during 2007 and 2008 were as follows:

In millions of dollars Goodwill

Balance at December 31, 2006 $33,264

Acquisition of GFU $ 865

Acquisition of Quilter 268

Acquisition of Nikko Cordial (1) 892

Acquisition of Grupo Cuscatlán 921

Acquisition of Egg 1,471

Acquisition of Old Lane 516

Acquisition of BISYS 872

Acquisition of BOOC 712

Acquisition of ATD 569

Sale of Avantel (118)

Foreign exchange translation, smaller acquisitions and other 821

Balance at December 31, 2007 $41,053

Sale of German retail bank $ (1,047)

Sale of CitiCapital (221)

Sale of Citigroup Global Services Limited (85)

Purchase accounting adjustments—BISYS (184)

Purchase of the remaining shares of Nikko Cordial—net of purchase accounting adjustments 287

Acquisition of Legg Mason Private Portfolio Group 98

Foreign exchange translation (3,116)

Impairment of goodwill (9,568)

Smaller acquisitions, purchase accounting adjustments and other (85)

Balance at December 31, 2008 $27,132

(1) Includes a reduction of $965 million related to the recognition of certain tax benefits.

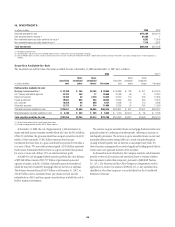

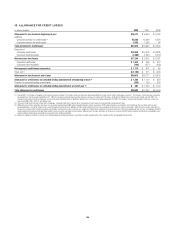

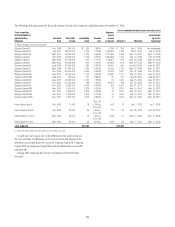

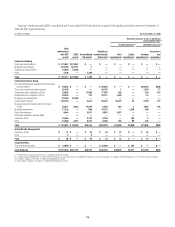

The changes in goodwill by segment during 2007 and 2008 were as follows:

In millions of dollars

Global

Cards

Consumer

Banking

Institutional

Clients Group

Global

Wealth

Management

Corporate/

Other Total

Balance at December 31, 2006 (1) $ 3,699 $ 22,280 $ 6,165 $1,120 $— $33,264

Goodwill acquired during 2007 1,171 1,755 3,315 844 — 7,085

Goodwill disposed of during 2007 — (118) — — — (118)

Other (2) 74 336 267 145 — 822

Balance at December 31, 2007 $ 4,944 $ 24,253 $ 9,747 $2,109 $— $41,053

Goodwill acquired during 2008 $ — $ 88 $ 1,331 $ 269 $— $ 1,688

Goodwill disposed of during 2008 (210) (1,127) (35) (6) — (1,378)

Goodwill impaired during 2008 — (9,568) — — — (9,568)

Other (2)(3) 6,098 (10,540) 301 (522) — (4,663)

Balance at December 31, 2008 $10,832 $ 3,106 $11,344 $1,850 $— $27,132

(1) Reclassified to conform to the current period’s presentation.

(2) Other changes in goodwill primarily reflect foreign exchange effects on non-dollar-denominated goodwill, as well as purchase accounting adjustments.

(3) As of June 30, 2008, the Company’s structure was reorganized and new operating segments were established. As goodwill is required to be tested for impairment at the reporting unit level, reporting units under the

new operating segments have been established.

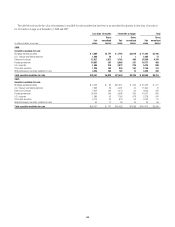

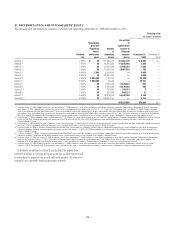

Goodwill impairment testing is performed at a level below the business

segments (referred to as a reporting unit). Changes in the management

structure in 2008 resulted in the creation of new business segments. As a

result, commencing with the third quarter of 2008, the Company identified

new reporting units as required under SFAS No. 142, Goodwill and Other

Intangible Assets (SFAS 142). Goodwill affected by the reorganization has

been reallocated from seven reporting units to ten, using a relative fair-value

approach. Subsequent to the reorganization, goodwill was reallocated to

disposals and tested for impairment under the new reporting units.

During 2008, the share prices of financial stocks continued to be very

volatile and were under considerable pressure in sustained turbulent

markets. In this environment, Citigroup’s market capitalization remained

below book value for most of the period and the Company performed

goodwill impairment testing for all reporting units as of February 28, 2008,

July 1, 2008 and December 31, 2008. In addition, the Company performed

impairment testing for selected reporting units as of May 31, 2008 (Citigroup

Alternative Investments) and October 31, 2008 (Securities and Banking,

North America Consumer Banking and Latin America Consumer

166