Citibank 2008 Annual Report Download - page 130

Download and view the complete annual report

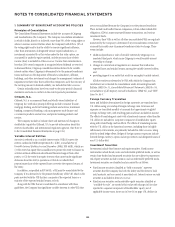

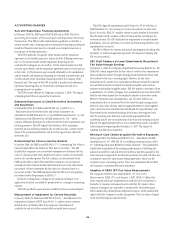

Please find page 130 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.fees and certain direct origination costs are generally deferred and

recognized as adjustments to income over the lives of the related loans.

As set out in Note 27 on page 202, the Company has elected fair value

accounting under SFAS 159 and SFAS 155 for certain loans. Such loans are

carried at fair value with changes in fair value reported in earnings. Interest

income on such loans is recorded in Interest revenue at the contractually

specified rate.

Loans for which the fair value option has not been elected under

SFAS 159 or SFAS 155 are classified upon origination or acquisition as either

held-for-investment or held-for-sale. This classification is based on

management’s intent and ability with regard to those loans.

Substantially all of the consumer loans sold or securitized by Citigroup

are U.S. prime mortgage loans or U.S. credit card receivables. The practice of

the U.S. prime mortgage business has been to sell all of its loans except for

nonconforming adjustable rate loans. U.S. prime mortgage conforming

loans are classified as held-for-sale at the time of origination. The related

cash flows are classified in the Consolidated Statement of Cash Flows in the

cash flows from operating activities category on the line Change in loans

held-for-sale.

U.S. credit card receivables are classified at origination as loans-held-for

sale to the extent that management does not have the intent to hold the

receivables for the foreseeable future or until maturity. The U.S. credit card

securitization forecast for the three months following the latest balance sheet

date is the basis for the amount of such loans classified as held-for-sale. Cash

flows related to U.S. credit card loans classified as held-for-sale at origination

or acquisition are reported in the cash flows from operating activities

category on the line Change in loans held-for-sale.

Loans that are held-for-investment are classified as Loans, net of

unearned income on the Consolidated Balance Sheet, and the related cash

flows are included within the cash flows from investing activities category in

the Consolidated Statement of Cash Flows on the line Changes in

loans. However, when the initial intent for holding a loan has changed from

held-for-investment to held-for-sale, the loan is reclassified to held-for-sale,

but the related cash flows continue to be reported in cash flows from

investing activities in the Consolidated Statement of Cash Flows on the line

Proceeds from sales and securitizations of loans.

Consumer Loans

Consumer loans represent loans and leases managed by the Global Cards

and Consumer Banking businesses and GWM. As a general rule, interest

accrual ceases for open-end revolving and closed-end installment and real

estate loans when payments are 90 days contractually past due. For credit

cards, however, the Company accrues interest until payments are 180 days

past due.

As a general rule, unsecured closed-end installment loans are charged off

at 120 days past due and unsecured open-end (revolving) loans are charged

off at 180 days contractually past due. Loans secured with non-real-estate

collateral are written down to the estimated value of the collateral, less costs

to sell, at 120 days past due. Real-estate secured loans (both open- and

closed-end) are written down to the estimated value of the property, less costs

to sell, at 180 days contractually past due.

In certain consumer businesses in the U.S., secured real estate loans are

written down to the estimated value of the property, less costs to sell, at the

earlier of the receipt of title or 12 months in foreclosure (a process that must

commence when payments are 120 days contractually past due). Closed-end

loans secured by non-real-estate collateral are written down to the estimated

value of the collateral, less costs to sell, at 180 days contractually past due.

Unsecured loans (both open- and closed-end) are charged off at 180 days

contractually past due and 180 days from the last payment, but in no event

can these loans exceed 360 days contractually past due.

Unsecured loans in bankruptcy are charged off within 30 days of

notification of filing by the bankruptcy court or within the contractual

write-off periods, whichever occurs earlier. In CitiFinancial, unsecured loans

in bankruptcy are charged off when they are 30 days contractually past due.

Corporate Loans

Corporate loans represent loans and leases managed by ICG. Corporate loans

are identified as impaired and placed on a cash (non-accrual) basis when it

is determined that the payment of interest or principal is doubtful or when

interest or principal is 90 days past due, except when the loan is well

collateralized and in the process of collection. Any interest accrued on

impaired corporate loans and leases is reversed at 90 days and charged

against current earnings, and interest is thereafter included in earnings only

to the extent actually received in cash. When there is doubt regarding the

ultimate collectibility of principal, all cash receipts are thereafter applied to

reduce the recorded investment in the loan. Impaired corporate loans and

leases are written down to the extent that principal is judged to be

uncollectible. Impaired collateral-dependent loans and leases, where

repayment is expected to be provided solely by the sale of the underlying

collateral and there are no other available and reliable sources of repayment,

are written down to the lower of cost or collateral value. Cash-basis loans are

returned to an accrual status when all contractual principal and interest

amounts are reasonably assured of repayment and there is a sustained period

of repayment performance in accordance with the contractual terms.

Lease Financing Transactions

Loans include the Company’s share of aggregate rentals on lease financing

transactions and residual values net of related unearned income. Lease

financing transactions represent direct financing leases and also include

leveraged leases. Unearned income is amortized under a method that results

in an approximate level rate of return when related to the unrecovered lease

investment. Gains and losses from sales of residual values of leased

equipment are included in Other revenue.

Loans Held-for-Sale

Corporate and consumer loans that have been identified for sale are

classified as loans held-for-sale included in Other assets. With the exception

of certain mortgage loans for which the fair-value option has been elected

under SFAS 159, these loans are accounted for at the lower of cost or market

value, with any write-downs or subsequent recoveries charged to Other

revenue.

Allowance for Loan Losses

Allowance for loan losses represents management’s estimate of probable

losses inherent in the portfolio. Attribution of the allowance is made for

analytical purposes only, and the entire allowance is available to absorb

probable credit losses inherent in the overall portfolio. Additions to the

allowance are made through the provision for credit losses. Credit losses are

deducted from the allowance, and subsequent recoveries are added.

Securities received in exchange for loan claims in debt restructurings are

initially recorded at fair value, with any gain or loss reflected as a recovery or

124