Citibank 2008 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

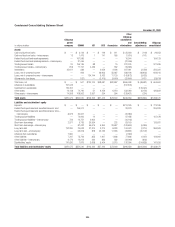

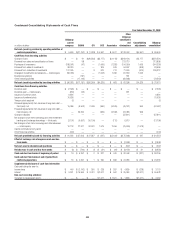

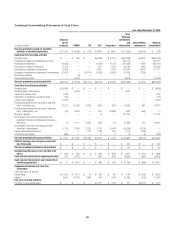

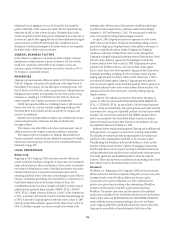

Condensed Consolidating Statements of Cash Flows

Year ended December 31, 2007

In millions of dollars

Citigroup

parent

company CGMHI CFI CCC Associates

Other

Citigroup

subsidiaries

and

eliminations

Consolidating

adjustments

Citigroup

consolidated

Net cash (used in) provided by operating

activities of continuing operations $ (7,572) $(26,696) $ (269) $ 3,973 $ 3,386 $ (40,386) $(3,973) $ (71,537)

Cash flows from investing activities

Change in loans $ — $ 174 $(23,943) $(7,601) $ (8,389) $(329,776) $ 7,601 $(361,934)

Proceeds from sales and securitizations of loans — — — — — 273,464 — 273,464

Purchases of investments (25,567) (302) — (690) (1,662) (246,895) 690 (274,426)

Proceeds from sales of investments 15,475 — — 276 755 195,523 (276) 211,753

Proceeds from maturities of investments 8,221 — — 430 961 112,164 (430) 121,346

Changes in investments and advances—

intercompany (31,692) — — 4,130 (1,391) 33,083 (4,130) —

Business acquisitions — — — — — (15,614) — (15,614)

Other investing activities — (986) — — — (15,980) — (16,966)

Net cash (used in) provided by investing

activities $(33,563) $ (1,114) $(23,943) $(3,455) $ (9,726) $ 5,969 $ 3,455 $ (62,377)

Cash flows from financing activities

Dividends paid $(10,778) $ — $ — $ — $ — $ — $ — $ (10,778)

Dividends paid—intercompany — (1,903) — (4,900) (1,500) 3,403 4,900 —

Issuance of common stock 1,060 — — — — — — 1,060

Redemption or retirement of preferred stock (1,000) — — — — — — (1,000)

Treasury stock acquired (663) — — — — — — (663)

Proceeds/(repayments) from issuance of long-term

debt—third-party, net 47,271 940 16,656 270 457 (12,345) (270) 52,979

Proceeds/(repayments) from issuance of long-term

debt—intercompany, net (399) 14,097 — 9,243 (4,511) (9,187) (9,243) —

Change in deposits — — — — — 93,422 — 93,422

Net change in short-term borrowings and other

investment banking and brokerage borrowings—

third-party 5,603 2,630 7,593 (1,200) (886) (4,515) 1,200 10,425

Net change in short-term borrowings and other

advances—intercompany 990 12,922 (410) (3,998) 12,717 (26,219) 3,998 —

Capital contributions from parent — — 375 — — (375) — —

Other financing activities (951) — — — — — — (951)

Net cash provided by (used in) financing

activities $ 41,133 $ 28,686 $ 24,214 $ (585) $ 6,277 $ 44,184 $ 585 $ 144,494

Effect of exchange rate changes on cash and

due from banks $ — $ — $ — $ — $ — $ 1,005 $ — $ 1,005

Net cash provided by discontinued operations $—$—$—$— $— $107 $— $107

Net (decrease)/increase in cash and due from

banks $ (2) $ 876 $ 2 $ (67) $ (63) $ 10,879 $ 67 $ 11,692

Cash and due from banks at beginning of

period 21 4,421 — 388 503 21,569 (388) 26,514

Cash and due from banks at end of period

from continuing operations $ 19 $ 5,297 $ 2 $ 321 $ 440 $ 32,448 $ (321) $ 38,206

Supplemental disclosure of cash flow

information

Cash paid during the year for:

Income taxes $ (1,225) $ 230 $ 18 $ 387 $ 54 $ 6,846 $ (387) $ 5,923

Interest 5,121 30,388 6,711 2,315 432 30,080 (2,315) 72,732

Non-cash investing activities:

Transfers to repossessed assets $ — $ — $ — $ 1,083 $ 1,226 $ 1,061 $(1,083) $ 2,287

223