Citibank 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

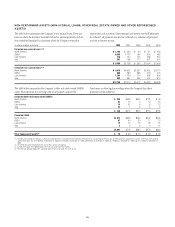

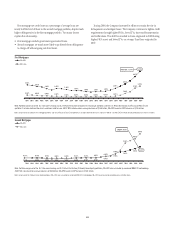

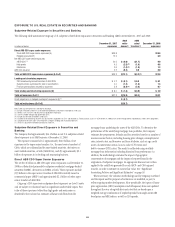

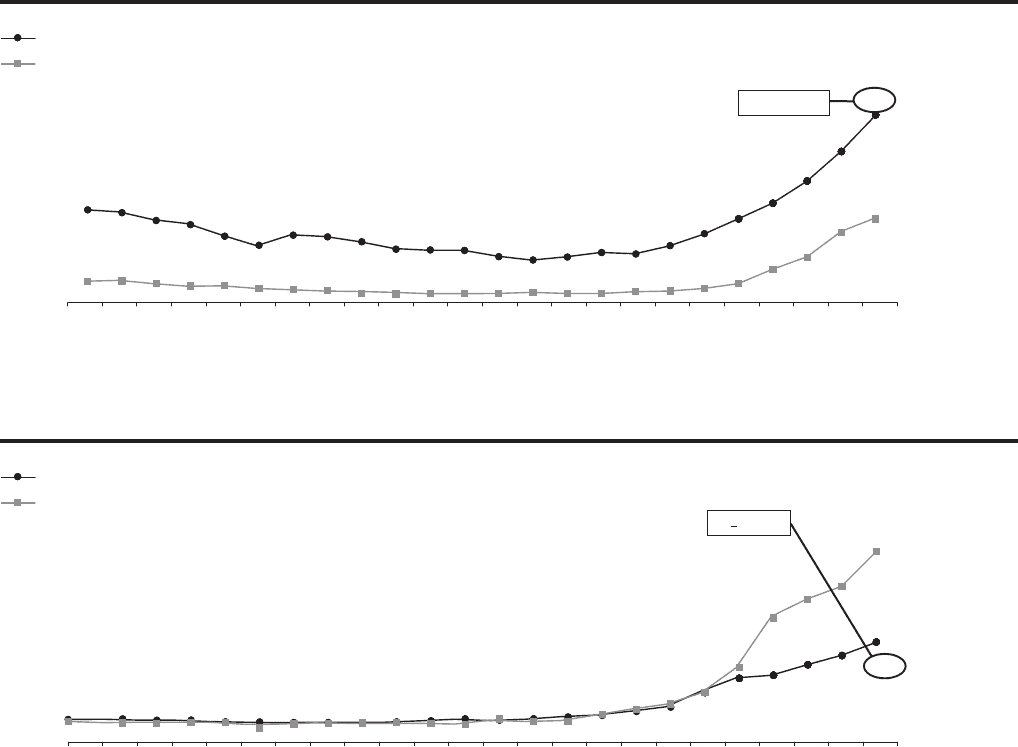

First mortgage net credit losses as a percentage of average loans are

nearly half the level of those in the second mortgage portfolio, despite much

higher delinquencies in the first mortgage portfolio. Two major factors

explain this relationship:

• First mortgages include government-guaranteed loans.

• Second mortgages are much more likely to go directly from delinquency

to charge-off without going into foreclosure.

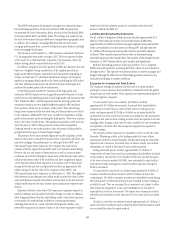

During 2008, the Company increased its efforts to contain the rise in

delinquencies and mitigate losses. The Company continues to tighten credit

requirements through higher FICOs, lower LTVs, increased documentation

and verifications. This shift has resulted in loans originated in 2008 having

higher FICO scores and lower LTVs, on average, than those originated in

2007.

2.82%

4.61%

3.02%

5.71%

0.63% 0.56% 0.49% 0.37% 0.32% 0.25%

2.16%

1.00%

2.57%

2.07%

1.47%

2.04%

2.51%

1.40% 1.38%

1.58%

1.84%

2.05%

0.31% 0.41%

90+DPD

NCL ratio

First Mortgages

Note: Portfolio comprised of the U.S. Consumer Lending and U.S. Retail Distribution (Citibank) first mortgage portfolios and the U.S. Retail Distribution (CitiFinancial) Real Estate

portfolio. It includes deferred fees/costs and loans held for sale. 4Q’07 NCL ratio based on average balances of $156 billion, 90+DPD based on EOP balances of $155 billion.

FICO<620: 11.77%

0.26%

0.26%

1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05 3Q05 4Q05 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 3Q082Q081Q084Q07 4Q08

Note: comprised of the Citibank first mortgage portfolios and the CitiFinancial Real Estate portfolio. It includes deferred fees/costs and loans held for sale. 90+DPD based on end of period balances of $137.5 billion.

Second Mortgages

Note: Portfolio comprised of the U.S. Consumer Lending and U.S. Retail Distribution (Citibank) Home Equity portfolios; 90+DPD rate calculated by combined MBA/OTS methodology.

4Q’07 NCL ratio based on average balances of $64 billion, 90+DPD based on EOP balances of $63 billion.

90+DPD

NCL ratio

5.05%

0.17%

2.03%

1.45%

2.41%

0.11% 0.09% 0.09% 0.04% 0.06% 0.06%

4.03%

3.16%

0.99%

0.41%

0.11%

0.15%

0.14% 0.14%

0.13%

0.09%

0.08%

0.47% 0.94%

0.25%

0.15%

1Q03 2Q03 3Q03 4Q03 1Q04 2Q04 3Q04 4Q04 1Q05 2Q05 3Q05 4Q05 1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 3Q082Q081Q084Q07 4Q08

LTV>90: 4.69%

Note: comprised of the Citibank Home Equity portfolios; 90+DPD rate calculated by combined MBA/OTS methodology. 90+DPD based on end of period balances of $59.6 billion.

62