Citibank 2008 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

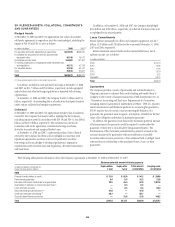

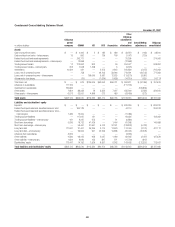

Statement of Changes in Stockholder’s Equity

(Continued)

In millions of dollars, except shares

Year ended December 31

2008 2007 2006

Total common stockholder’s equity $ 81,358 $99,306 $73,153

Total stockholder’s equity $ 81,358 $99,306 $73,153

Comprehensive income (loss)

Net income (loss) $ (6,215) $ 2,304 $ 9,338

Net change in Accumulated other comprehensive

income (loss) (13,400) (785) 841

Comprehensive income (loss) $(19,615) $ 1,519 $10,179

(1) Primarily represents the transfer of Citibank, N.A.’s investment in Citi Financial Japan, KK to the

Citigroup’s affiliate, Nikko Citi Holdings.

(2) The adjustment to opening balance for Retained earnings represents the total of the after-tax gain

(loss) amounts for the adoption of the following accounting pronouncements:

• SFAS 157 for $9 million,

• SFAS 159 for $15 million,

• FSP 13-2 for $(142) million, and

• FIN 48 for $22 million.

See Notes 1, 26 and 27 on pages 122, 192 and 202, respectively.

(3) The after-tax adjustment to the opening balance of Accumulated other comprehensive income (loss)

represents the reclassification of the unrealized gains (losses) related to several miscellaneous items

previously reported in accordance with SFAS 115. The related unrealized gains and losses were

reclassified to Retained earnings upon the adoption of the fair value option in accordance with

SFAS 159. See Notes 1 and 27 on pages 122 and 202 for further discussions.

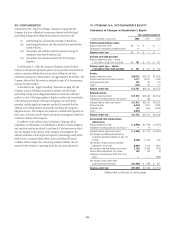

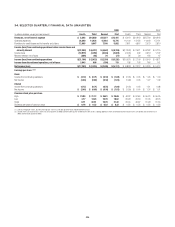

32. SUBSEQUENT EVENTS

Exchange Offer and U.S. Government Exchange

On February 27, 2009, Citigroup announced an exchange offer of its

common stock for up to $27.5 billion of its existing preferred securities and

trust preferred securities at a conversion price of $3.25 per share. The U.S.

government will match this exchange up to a maximum of $25 billion of its

preferred stock at the same conversion price. These transactions will

significantly dilute the existing common stockholders of the Company. As

announced, the transactions will increase the Company’s tangible common

equity (TCE). The transactions will require no additional U.S. government

investment in Citigroup and will not change the Company’s overall strategy

or operations. In addition, the transactions will not change the Company’s

Tier 1 Capital Ratio of 11.9% as of December 31, 2008. In connection with

the transactions, Citigroup will suspend dividends on its preferred securities

(other than its trust preferred securities) and, as a result, on its common

stock. Full implementation of the proposed exchange offer is subject to

approval of Citigroup’s shareholders, which cannot be guaranteed.

Reset of Conversion Terms of the $12.5 Billion

Convertible Preferred Stock

On January 23, 2009, pursuant to Citibank’s prior agreement with the

purchasers of the $12.5 billion convertible preferred stock issued in a private

offering during 2008, the conversion price was reset from $31.62 per share to

$26.35 per share. The reset will result in Citigroup issuing approximately

79 million additional common shares if converted. There will be no impact

to net income, total stockholders’ equity or capital ratios due to the reset.

However, the reset will result in a reclassification from retained earnings to

additional paid in capital of $1.2 billion to reflect the benefit of the reset to

the preferred stockholders.

215