Citibank 2008 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

billion at December 31, 2008 and December 31, 2007, respectively. Securities

and other marketable assets held as collateral amounted to $27 billion and

$54 billion, the majority of which collateral is held to reimburse losses

realized under securities lending indemnifications. The decrease from the

prior year is in line with the decrease in the notional amount of these

indemnifications, which are collateralized. Additionally, letters of credit in

favor of the Company held as collateral amounted to $503 million and $370

million at December 31, 2008 and December 31, 2007, respectively. Other

property may also be available to the Company to cover losses under certain

guarantees and indemnifications; however, the value of such property has

not been determined.

Performance Risk

Citigroup evaluates the performance risk of its guarantees based on the

assigned referenced counterparty internal or external ratings. Where external

ratings are used, investment-grade ratings are considered to be Baa/BBB and

above, while anything below is considered non-investment grade. The

Citigroup internal ratings are in line with the related external rating system.

On certain underlying referenced credits or entities, ratings are not available.

Such referenced credits are included in the “Not-rated” category. The

maximum potential amount of the future payments related to guarantees

and credit derivatives sold is determined to be the notional amount of these

contracts, which is the par amount of the assets guaranteed.

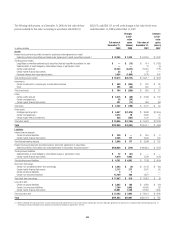

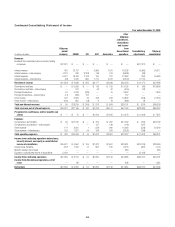

Presented in the table below is the maximum potential amount of future

payments classified based upon internal and external credit ratings as of

December 31, 2008. As previously mentioned, the determination of the

maximum potential future payments is based on the notional amount of the

guarantees without consideration of possible recoveries under recourse

provisions or from collateral held or pledged. Such amounts bear no

relationship to the anticipated losses, if any, on these guarantees.

Maximum potential amount of future payments

In billions of dollars

Investment

grade

Non-investment

grade

Not

rated Total

Financial standby letters of

credit $49.2 $28.6 $ 16.4 $ 94.2

Performance guarantees 5.7 5.0 5.6 16.3

Derivative instruments

deemed to be

guarantees — — 67.9 67.9

Guarantees of collection of

contractual cash flows — — 0.3 0.3

Loans sold with recourse — — 0.3 0.3

Securities lending

indemnifications — — 47.6 47.6

Credit card merchant

processing — — 56.7 56.7

Custody indemnifications

and other 18.5 3.1 — 21.6

Total $73.4 $36.7 $194.8 $304.9

Credit Derivatives

A credit derivative is a bilateral contract between a buyer and a seller under

which the seller sells protection against the credit risk of a particular entity

(“reference entity” or “reference credit”). Credit derivatives generally require

that the seller of credit protection make payments to the buyer upon the

occurrence of predefined credit events (commonly referred to as “settlement

triggers”). These settlement triggers are defined by the form of the derivative

and the reference credit and are generally limited to the market standard of

failure to pay on indebtedness and bankruptcy of the reference credit and, in

a more limited range of transactions, debt restructuring. Credit derivative

transactions referring to emerging market reference credits will also typically

include additional settlement triggers to cover the acceleration of

indebtedness and the risk of repudiation or a payment moratorium. In

certain transactions, protection may be provided on a portfolio of referenced

credits or asset-backed securities. The seller of such protection may not be

required to make payment until a specified amount of losses has occurred

with respect to the portfolio and/or may only be required to pay for losses up

to a specified amount.

The Company makes markets in and trades a range of credit derivatives,

both on behalf of clients as well as for its own account. Through these

contracts, the Company either purchases or writes protection on either a

single name or a portfolio of reference credits. The Company uses credit

derivatives to help mitigate credit risk in its corporate loan portfolio and

other cash positions, to take proprietary trading positions, and to facilitate

client transactions.

The range of credit derivatives sold includes credit default swaps, total

return swaps and credit options.

A credit default swap is a contract in which, for a fee, a protection seller

(guarantor) agrees to reimburse a protection buyer (beneficiary) for any

losses that occur due to a credit event on a reference entity. If there is no

credit default event or settlement trigger, as defined by the specific derivative

contract, then the guarantor makes no payments to the beneficiary and

receives only the contractually specified fee. However, if a credit event occurs

and in accordance with the specific derivative contract sold, the guarantor

will be required to make a payment to the beneficiary.

A total return swap transfers the total economic performance of a

reference asset, which includes all associated cash flows, as well as capital

appreciation or depreciation. The protection buyer (beneficiary) receives a

floating rate of interest and any depreciation on the reference asset from the

protection seller (guarantor), and in return the protection seller receives the

cash flows associated with the reference asset, plus any appreciation. Thus,

the beneficiary will be obligated to make a payment any time the floating

interest rate payment according to the total return swap agreement and any

depreciation of the reference asset exceed the cash flows associated with the

underlying asset. A total return swap may terminate upon a default of the

reference asset subject to the provisions in the related total return swap

agreement between the protection seller (guarantor) and the protection

buyer (beneficiary).

211