Citibank 2008 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

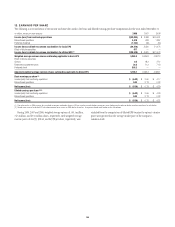

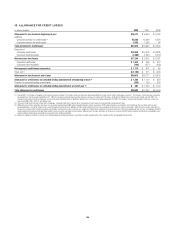

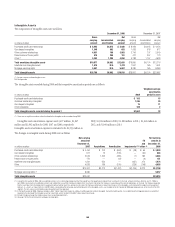

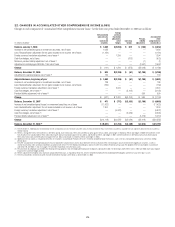

18. ALLOWANCE FOR CREDIT LOSSES

In millions of dollars 2008 2007 2006

Allowance for loan losses at beginning of year $16,117 $ 8,940 $ 9,782

Additions

Consumer provision for credit losses (1) 28,282 15,599 6,224

Corporate provision for credit losses 5,392 1,233 96

Total provision for credit losses $33,674 $16,832 $ 6,320

Deductions (2)

Consumer credit losses $18,848 $10,916 $ 8,328

Consumer credit recoveries (1,600) (1,661) (1,547)

Net consumer loan losses $17,248 $ 9,255 $ 6,781

Corporate credit losses $ 1,922 $ 948 $ 312

Corporate credit recoveries (149) (277) (232)

Net corporate credit losses (recoveries) $ 1,773 $ 671 $ 80

Other, net (3) $ (1,154) $ 271 $ (301)

Allowance for loan losses at end of year $29,616 $16,117 $ 8,940

Allowance for credit losses on unfunded lending commitments at beginning of year (4) $ 1,250 $ 1,100 $ 850

Provision for unfunded lending commitments (363) 150 250

Allowance for credit losses on unfunded lending commitments at end of year (4) $ 887 $ 1,250 $ 1,100

Total allowance for credit losses $30,503 $17,367 $10,040

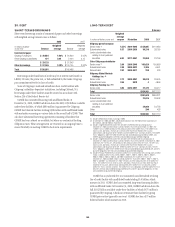

(1) During 2007, the Company changed its estimate of loan losses inherent in the Global Cards and Consumer Banking portfolios that were not yet visible in delinquency statistics. The changes in estimate were accounted

for prospectively. For the quarter ended March 31, 2007, the change in estimate decreased the Company’s pretax net income by $170 million, or $0.02 per diluted share. For the quarter ended June 30, 2007, the

change in estimate decreased the Company’s pretax net income by $240 million, or $0.03 per diluted share. For the quarter ended September 30, 2007, the change in estimate decreased the Company’s pretax net

income by $900 million, or $0.11 per diluted share.

(2) Consumer credit losses primarily relate to U.S. mortgages, revolving credit and installment loans. Recoveries primarily relate to revolving credit and installment loans.

(3) 2008 primarily includes reductions to the loan loss reserve of approximately $800 million related to foreign currency translation, $102 million related to securitizations, $244 million for the sale of the German retail

banking operations, and $156 million for the sale of CitiCapital partially offset by additions of $106 million related to the Cuscatlán and Bank of the Overseas Chinese acquisitions. 2007 primarily includes reductions to

the loan loss reserve of $475 million related to securitizations and transfers to loans held-for-sale, reductions of $83 million related to the transfer of the U.K. CitiFinancial portfolio to held-for-sale, and additions of $610

million related to the acquisition of Egg, Nikko Cordial, Grupo Cuscatlán and Grupo Financiero Uno. 2006 primarily includes reductions to the loan loss reserve of $429 million related to securitizations and portfolio sales

and the addition of $84 million related to the acquisition of the CrediCard portfolio.

(4) Represents additional credit loss reserves for unfunded corporate lending commitments and letters of credit recorded within Other liabilities on the Consolidated Balance Sheet.

165