Citibank 2008 Annual Report Download - page 135

Download and view the complete annual report

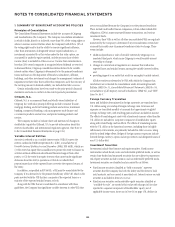

Please find page 135 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ACCOUNTING CHANGES

Sale with Repurchase Financing Agreements

In February 2008, the FASB issued FASB Staff Position (FSP) FAS 140-3,

Accounting for Transfers of Financial Assets and Repurchase Financing

Transactions. This FSP provides implementation guidance on whether a

security transfer with a contemporaneous repurchase financing involving the

transferred financial asset must be evaluated as one linked transaction or

two separate de-linked transactions.

The FSP requires the recognition of the transfer and the repurchase

agreement as one linked transaction, unless all of the following criteria are

met: (1) the initial transfer and the repurchase financing are not

contractually contingent on one another; (2) the initial transferor has full

recourse upon default, and the repurchase agreement’s price is fixed and not

at fair value; (3) the financial asset is readily obtainable in the marketplace

and the transfer and repurchase financing are executed at market rates; and

(4) the maturity of the repurchase financing is before the maturity of the

financial asset. The scope of this FSP is limited to transfers and subsequent

repurchase financings that are entered into contemporaneously or in

contemplation of one another.

The FSP becomes effective for Citigroup on January 1, 2009. The impact

of adopting this FSP is not expected to be material.

Enhanced Disclosures of Credit Derivative Instruments

and Guarantees

In September 2008, the FASB issued FSP FAS 133-1 and FIN 45-4,

“Disclosures about Credit Derivatives and Certain Guarantees: An

Amendment of FASB Statement No. 133 and FASB Interpretation No. 45, and

Clarification of the Effective Date of FASB Statement No. 161,” which

requires additional disclosures for sellers of credit derivative instruments and

certain guarantees. This FSP requires the disclosure of the maximum

potential amount of future payments, the related fair value, and the current

status of the payment/performance risk for certain guarantees and credit

derivatives sold.

Determining Fair Value in Inactive Markets

In October 2008, the FASB issued FSP FAS 157-3, “Determining Fair Value of

Financial Assets When the Market for That Asset is Not Active.” The FSP

clarifies that companies can use internal assumptions to determine the fair

value of a financial asset when markets are inactive, and do not necessarily

have to rely on broker quotes. The FSP confirms a joint statement by the

FASB and the SEC in which they stated that companies can use internal

assumptions when relevant market information does not exist and provides

an example of how to determine the fair value for a financial asset in a

non-active market. The FASB emphasized that the FSP is not new guidance,

but rather clarifies the principles in SFAS 157.

Revisions resulting from a change in the valuation technique or its

application should be accounted for prospectively as a change in accounting

estimate.

The FSP was effective upon issuance and did not have a material impact.

Measurement of Impairment for Certain Securities

In January 2009, the FASB issued FSP EITF 99-20-1, “Amendments to the

Impairment Guidance of EITF Issue 99-20,” to achieve more consistent

determination of whether other-than-temporary impairments of

available-for-sale or held-to-maturity debt securities have occurred.

This FSP aligns the impairment model of Issue No. 99-20 with that of

FASB Statement 115, Accounting for Certain Investments in Debt and

Equity Securities. SFAS 115 requires entities to assess whether it is probable

that the holder will be unable to collect all amounts due according to the

contractual terms. The FSP eliminates the requirement to consider market

participants’ views of cash flows of a security in determining whether or not

impairment has occurred.

The FSP is effective for interim and annual reporting periods ending after

December 15, 2008 and applied prospectively. The impact of adopting this

FSP was not material.

SEC Staff Guidance on Loan Commitments Recorded at

Fair Value through Earnings

On January 1, 2008, the Company adopted Staff Accounting Bulletin No. 109

(SAB 109), which requires that the fair value of a written loan commitment

that is marked-to-market through earnings should include the future cash

flows related to the loan’s servicing rights. However, the fair value

measurement of a written loan commitment still must exclude the expected

net cash flows related to internally-developed intangible assets (such as

customer relationship intangible assets). SAB 109 applies to two types of loan

commitments: (1) written mortgage loan commitments for loans that will be

held-for-sale when funded that are marked to market as derivatives under

SFAS 133 (derivative loan commitments); and (2) other written loan

commitments that are accounted for at fair value through earnings under

SFAS 159’s fair-value election. SAB 109 supersedes SAB 105, which applied

only to derivative loan commitments and allowed the expected future cash

flows related to the associated servicing of the loan to be recognized only

after the servicing asset had been contractually separated from the

underlying loan by sale or securitization of the loan with servicing retained.

SAB 109 was applied prospectively to loan commitments issued or modified

in fiscal quarters beginning after December 15, 2007. The impact of

adopting this SAB was not material.

Netting of Cash Collateral against Derivative Exposures

During April 2007, the FASB issued FSP FIN 39-1, “Amendment of FASB

Interpretation No. 39” (FSP FIN 39-1) modifying certain provisions of FIN

39, “Offsetting of Amounts Related to Certain Contracts.” This amendment

clarified the acceptability of the existing market practice of offsetting the

amounts recorded for cash collateral receivables or payables against the fair

value amounts recognized for net derivative positions executed with the same

counterparty under the same master netting agreement, which was the

Company’s prior accounting practice. Thus, this amendment did not affect

the Company’s consolidated financial statements.

Adoption of SFAS 157—Fair Value Measurements

The Company elected to early-adopt SFAS No. 157, Fair Value

Measurements (SFAS 157), as of January 1, 2007. SFAS 157 defines fair

value, expands disclosure requirements around fair value and specifies a

hierarchy of valuation techniques based on whether the inputs to those

valuation techniques are observable or unobservable. Observable inputs

reflect market data obtained from independent sources, while unobservable

inputs reflect the Company’s market assumptions. These two types of inputs

create the following fair value hierarchy:

129