Citibank 2008 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

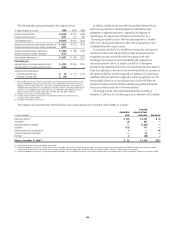

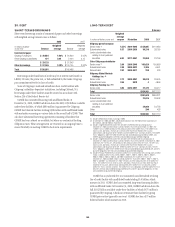

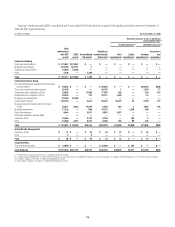

Regulatory Capital

Citigroup is subject to risk-based capital and leverage guidelines issued by

the Board of Governors of the Federal Reserve System (FRB). Its U.S. insured

depository institution subsidiaries, including Citibank, N.A., are subject to

similar guidelines issued by their respective primary federal bank regulatory

agencies. These guidelines are used to evaluate capital adequacy and include

the required minimums shown in the following table.

The regulatory agencies are required by law to take specific prompt

actions with respect to institutions that do not meet minimum capital

standards. As of December 31, 2008 and 2007, all of Citigroup’s U.S. insured

subsidiary depository institutions were “well capitalized.”

At December 31, 2008, regulatory capital as set forth in guidelines issued by

the U.S. federal bank regulators is as follows:

In millions of dollars

Required

minimum

Well-

capitalized

minimum Citigroup (3) Citibank, N.A. (3)

Tier 1 Capital $118,758 $ 70,977

Total Capital (1) 156,398 108,355

Tier 1 Capital Ratio 4.0% 6.0% 11.92% 9.94%

Total Capital Ratio (1) 8.0 10.0 15.70 15.18

Leverage Ratio (2) 3.0 5.0 (3) 6.08 5.82

(1) Total Capital includes Tier 1 and Tier 2.

(2) Tier 1 Capital divided by adjusted average assets.

(3) Applicable only to depository institutions. For bank holding companies to be “well capitalized,” they

must maintain a minimum Leverage Ratio of 3%.

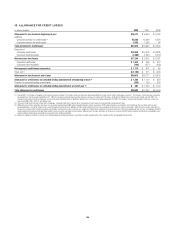

Banking Subsidiaries

There are various legal limitations on the ability of Citigroup’s subsidiary

depository institutions to extend credit, pay dividends or otherwise supply

funds to Citigroup and its non-bank subsidiaries. The approval of the Office

of the Comptroller of the Currency, in the case of national banks, or the

Office of Thrift Supervision, in the case of federal savings banks, is required if

total dividends declared in any calendar year exceed amounts specified by

the applicable agency’s regulations. State-chartered depository institutions

are subject to dividend limitations imposed by applicable state law.

As of December 31, 2008, Citigroup’s subsidiary depository institutions

can declare dividends to their parent companies, without regulatory

approval, of approximately $69 million. In determining the dividends, each

depository institution must also consider its effect on applicable risk-based

capital and leverage ratio requirements, as well as policy statements of the

federal regulatory agencies that indicate that banking organizations should

generally pay dividends out of current operating earnings.

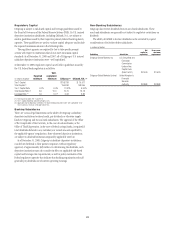

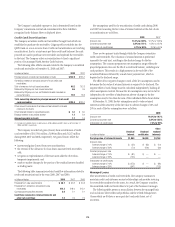

Non-Banking Subsidiaries

Citigroup also receives dividends from its non-bank subsidiaries. These

non-bank subsidiaries are generally not subject to regulatory restrictions on

dividends.

The ability of CGMHI to declare dividends can be restricted by capital

considerations of its broker-dealer subsidiaries.

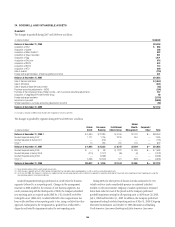

In millions of dollars

Subsidiary Jurisdiction

Net

capital or

equivalent

Excess over

minimum

requirement

Citigroup Global Markets Inc. U.S. Securities and

Exchange

Commission

Uniform Net

Capital Rule

(Rule 15c3-1) $2,490 $1,639

Citigroup Global Markets Limited United Kingdom’s

Financial

Services

Authority $3,888 $3,888

173