Citibank 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

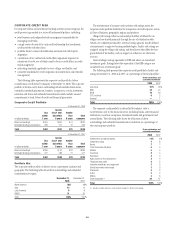

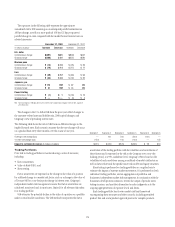

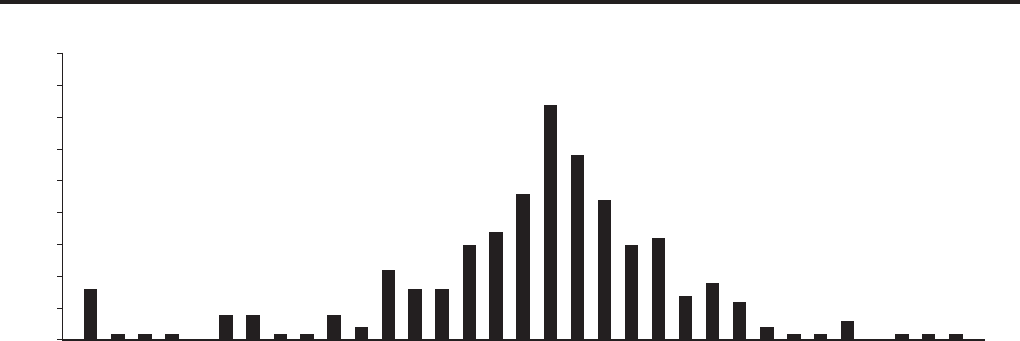

Total revenues of the trading business consist of:

• customer revenue, which includes spreads from customer flow and

positions taken to facilitate customer orders;

• proprietary trading activities in both cash and derivative transactions; and

• net interest revenue.

All trading positions are marked to market, with the result reflected in

earnings. In 2008, negative trading-related revenue (net losses) was recorded

for 109 of 260 trading days. Of the 109 days on which negative revenue (net

losses) was recorded, 21 were greater than $400 million. The following

histogram of total daily revenue or loss captures trading volatility and shows

the number of days in which the Company’s trading-related revenues fell

within particular ranges.

($600) to ($550)

Histogram of Daily Trading-Related Revenue*

-

Twelve Months Ended December 31, 2008

-

5

10

15

20

40

35

30

25

45

Revenue (dollars in millions)

Number of Trading Days

*Includes subprime-related losses on credit positions which were marked intermittently during each month. Most of the loss events in the $800-$4,500 million category are due to

cumulative write-downs on these positions.

($4500) to ($800)

($50) to 0

($100) to ($50)

($150) to ($100)

($200) to ($150)

($250) to ($200)

($300) to ($250)

($350) to ($300)

($400) to ($350)

($450) to ($400)

($500) to ($450)

($550) to ($500)

($650) to ($600)

($700) to ($650)

($750) to ($700)

($800) to ($750)

0 to 50

50 to 100

100 to 150

150 to 200

200 to 250

250 to 300

300 to 350

350 to 400

400 to 450

450 to 500

500 to 550

550 to 600

600 to 650

650 to 700

700 to 750

750 to 800

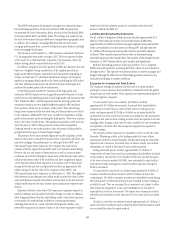

Citigroup periodically performs extensive back-testing of many hypothetical

test portfolios as one check of the accuracy of its VAR. Back-testing is the

process in which the daily VAR of a portfolio is compared to the actual daily

change in the market value of its transactions. Back-testing is conducted to

confirm that the daily market value losses in excess of a 99% confidence level

occur, on average, only 1% of the time. The VAR calculation for the

hypothetical test portfolios, with different degrees of risk concentration,

meets this statistical criteria.

The level of price risk exposure at any given point in time depends on the

market environment and expectations of future price and market

movements, and will vary from period to period.

For Citigroup’s major trading centers, the aggregate pretax VAR in the

trading portfolios was $319 million at December 31, 2008 and $191 million

at December 31, 2007. Daily exposures averaged $292 million in 2008 and

ranged from $220 million to $393 million.

The Subprime Group (SPG) exposures became fully integrated into VAR

during the first quarter of 2008. As a result, December 31, 2008 VAR and

2008 average VAR increased by approximately $29 million and $111 million,

respectively.

74