Citibank 2008 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

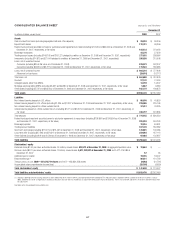

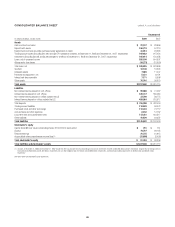

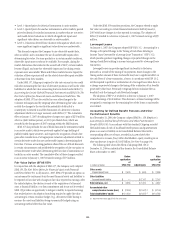

CONSOLIDATED BALANCE SHEET Citibank, N.A. and Subsidiaries

December 31

In millions of dollars, except shares 2008 2007

Assets

Cash and due from banks $ 22,107 $ 28,966

Deposits with banks 156,774 57,216

Federal funds sold and securities purchased under agreements to resell 41,613 23,563

Trading account assets (including $12,092 and $22,716 pledged to creditors at December 31, 2008 and December 31, 2007, respectively) 197,052 215,454

Investments (including $3,028 and $3,099 pledged to creditors at December 31, 2008 and December 31, 2007, respectively) 165,914 150,058

Loans, net of unearned income 555,198 644,597

Allowance for loan losses (18,273) (10,659)

Total loans, net $ 536,925 $ 633,938

Goodwill 10,148 19,294

Intangible assets 7,689 11,007

Premises and equipment, net 5,331 8,191

Interest and fees receivable 7,171 8,958

Other assets 76,316 95,070

Total assets $1,227,040 $1,251,715

Liabilities

Non-interest-bearing deposits in U.S. offices $ 59,808 $ 41,032

Interest-bearing deposits in U.S. offices 180,737 186,080

Non-interest-bearing deposits in offices outside the U.S. 33,769 38,775

Interest-bearing deposits in offices outside the U.S. 480,984 516,517

Total deposits $ 755,298 $ 782,404

Trading account liabilities 110,599 59,472

Purchased funds and other borrowings 116,333 74,112

Accrued taxes and other expenses 8,192 12,752

Long-term debt and subordinated notes 113,381 184,317

Other liabilities 41,879 39,352

Total liabilities $1,145,682 $1,152,409

Stockholder’s equity

Capital stock ($20 par value) outstanding shares: 37,534,553 in each period $ 751 $ 751

Surplus 74,767 69,135

Retained earnings 21,735 31,915

Accumulated other comprehensive income (loss) (1) (15,895) (2,495)

Total stockholder’s equity $ 81,358 $ 99,306

Total liabilities and stockholder’s equity $1,227,040 $1,251,715

(1) Amounts at December 31, 2008 and December 31, 2007 include the after-tax amounts for net unrealized gains (losses) on investment securities of ($8.008) billion and ($1.262) billion, respectively, for foreign currency

translation of ($3.964) billion and $1.687 billion, respectively, for cash flow hedges of ($3,247) billion and ($2.085) billion, respectively, and for pension liability adjustments of ($676) million and ($835) million,

respectively.

See Notes to the Consolidated Financial Statements.

121