Citibank 2008 Annual Report Download - page 196

Download and view the complete annual report

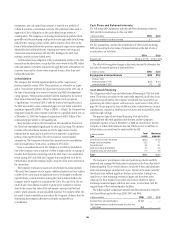

Please find page 196 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the swap’s value and the underlying yield of the debt. This type of hedge is

undertaken when SFAS 133 hedge requirements cannot be achieved or

management decides not to apply SFAS 133 hedge accounting. Another

alternative for the Company would be to elect to carry the note at fair value

under SFAS 159. Once the irrevocable election is made upon issuance of the

note, the full change in fair value of the note would be reported in earnings.

The related interest rate swap, with changes in fair value also reflected in

earnings, provides a natural offset to the note’s fair value change. To the

extent the two offsets would not be exactly equal, the difference would be

reflected in current earnings. This type of economic hedge is undertaken

when the Company prefers to follow this simpler method that achieves

similar financial statement results to an SFAS 133 fair-value hedge.

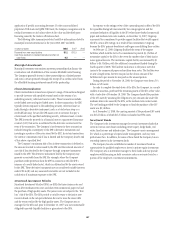

Fair value hedges

•Hedging of benchmark interest rate risk—Citigroup hedges exposure

to changes in the fair value of outstanding fixed-rate issued debt and

borrowings. The fixed cash flows from those financing transactions are

converted to benchmark variable-rate cash flows by entering into receive-

fixed, pay-variable interest rate swaps. These fair-value hedge

relationships use dollar-offset ratio analysis to determine whether the

hedging relationships are highly effective at inception and on an ongoing

basis.

Citigroup also hedges exposure to changes in the fair value of fixed-rate

assets, including available-for-sale debt securities and loans. The hedging

instruments used are receive-variable, pay-fixed interest rate swaps. Most of

these fair-value hedging relationships use dollar-offset ratio analysis to

determine whether the hedging relationships are highly effective at inception

and on an ongoing basis, while certain others use regression analysis.

•Hedging of foreign exchange risk—Citigroup hedges the change in fair

value attributable to foreign-exchange rate movements in

available-for-sale securities that are denominated in currencies other

than the functional currency of the entity holding the securities, which

may be within or outside the U.S. Typically, the hedging instrument

employed is a forward foreign-exchange contract. In this type of hedge,

the change in fair value of the hedged available-for-sale security

attributable to the portion of foreign exchange risk hedged is reported in

earnings and not Accumulated other comprehensive income—a

process that serves to offset substantially the change in fair value of the

forward contract that is also reflected in earnings. Citigroup typically

considers the premium associated with forward contracts (differential

between spot and contractual forward rates) as the cost of hedging; this is

excluded from the assessment of hedge effectiveness and reflected directly

in earnings. Dollar-offset method is typically used to assess hedge

effectiveness. Since that assessment is based on changes in fair value

attributable to changes in spot rates on both the available-for-sale

securities and the forward contracts for the portion of the relationship

hedged, the amount of hedge ineffectiveness is not significant.

Cash flow hedges

•Hedging of benchmark interest rate risk—Citigroup hedges variable

cash flows resulting from floating-rate liabilities and roll over

(re-issuance) of short-term liabilities. Variable cash flows from those

liabilities are converted to fixed-rate cash flows by entering into receive-

variable, pay-fixed interest-rate swaps and receive-variable, pay-fixed

forward-starting interest-rate swaps. For some hedges, the hedge

ineffectiveness is eliminated by matching all terms of the hedged item

and the hedging derivative at inception and on an ongoing basis.

Citigroup does not exclude any terms from consideration when applying

the matched terms method. To the extent all terms are not perfectly

matched, these cash-flow hedging relationships use either regression

analysis or dollar-offset ratio analysis to assess whether the hedging

relationships are highly effective at inception and on an ongoing basis.

Since efforts are made to match the terms of the derivatives to those of the

hedged forecasted cash flows as closely as possible, the amount of hedge

ineffectiveness is not significant even when the terms do not match

perfectly.

Citigroup also hedges variable cash flows resulting from investments in

floating-rate, available-for-sale debt securities. Variable cash flows from

those assets are converted to fixed-rate cash flows by entering into receive-

fixed, pay-variable interest-rate swaps. These cash-flow hedging relationships

use either regression analysis or dollar-offset ratio analysis to assess whether

the hedging relationships are highly effective at inception and on an

ongoing basis. Since efforts are made to align the terms of the derivatives to

those of the hedged forecasted cash flows as closely as possible, the amount

of hedge ineffectiveness is not significant.

•Hedging of foreign exchange risk—Citigroup locks in the functional

currency equivalent of cash flows of various balance sheet liability

exposures, including deposits, short-term borrowings and long-term debt

(and the forecasted issuances or rollover of such items) that are

denominated in a currency other than the functional currency of the

issuing entity. Depending on the risk-management objectives, these types

of hedges are designated as either cash-flow hedges of only foreign-

exchange risk or cash-flow hedges of both foreign-exchange and interest-

rate risk, and the hedging instruments used are foreign-exchange forward

contracts, cross-currency swaps and foreign-currency options. For some

hedges, Citigroup matches all terms of the hedged item and the hedging

derivative at inception and on an ongoing basis to eliminate hedge

ineffectiveness. Citigroup does not exclude any terms from consideration

when applying the matched terms method. To the extent all terms are not

perfectly matched, any ineffectiveness is measured using the

“hypothetical derivative method” from FASB Derivative Implementation

Group Issue G7. Efforts are made to match up the terms of the

hypothetical and actual derivatives used as closely as possible. As a result,

the amount of hedge ineffectiveness is not significant even when the

terms do not match perfectly.

Net investment hedges

Consistent with SFAS No. 52, Foreign Currency Translation (SFAS 52),

SFAS 133 allows hedging of the foreign-currency risk of a net investment in a

foreign operation. Citigroup uses foreign-currency forwards, options and

swaps and foreign-currency-denominated debt instruments to manage the

foreign-exchange risk associated with Citigroup’s equity investments in

several non-U.S. dollar functional currency foreign subsidiaries. In

accordance with SFAS 52, Citigroup records the change in the carrying

amount of these investments in the cumulative translation adjustment

account within Accumulated other comprehensive income (loss).

Simultaneously, the effective portion of the hedge of this exposure is also

190