Citibank 2008 Annual Report Download - page 184

Download and view the complete annual report

Please find page 184 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

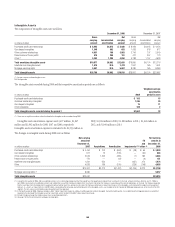

This table does not include:

• certain venture capital investments made by some of the Company’s

private equity subsidiaries, as the Company accounts for these

investments in accordance with the Investment Company Audit Guide;

• certain limited partnerships where the Company is the general partner

and the limited partners have the right to replace the general partner or

liquidate the funds;

• certain investment funds for which the Company provides investment

management services and personal estate trusts for which the Company

provides administrative, trustee and/or investment management services;

• VIEs structured by third parties where the Company holds securities in

inventory. These investments are made on arm’s-length terms; and

• transferred assets to a VIE where the transfer did not qualify as a sale and

where the Company did not have any other involvement that is deemed to

be a variable interest with the VIE. These transfers are accounted for as

secured borrowings by the Company.

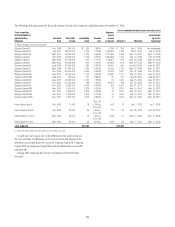

The asset balances for consolidated VIEs represent the carrying amounts

of the assets consolidated by the Company. The carrying amount may

represent the amortized cost or the current fair value of the assets depending

on the legal form of the asset (e.g., security or loan) and the Company’s

standard accounting policies for the asset type and line of business.

The asset balances for unconsolidated VIEs where the Company has

significant involvement represent the most current information available to

the Company. In most cases, the asset balances represent an amortized cost

basis without regard to impairments in fair value, unless fair value

information is readily available to the Company. For VIEs that obtain asset

exposures synthetically through derivative instruments (for example,

synthetic CDOs), the Company includes the full original notional amount of

the derivative as an asset.

The maximum funded exposure represents the balance sheet carrying

amount of the Company’s investment in the VIE. It reflects the initial

amount of cash invested in the VIE plus any accrued interest and is adjusted

for any impairments in value recognized in earnings and any cash principal

payments received. The maximum exposure of unfunded positions

represents the remaining undrawn committed amount, including liquidity

and credit facilities provided by the Company, or the notional amount of a

derivative instrument considered to be a variable interest, adjusted for any

declines in fair value recognized in earnings. In certain transactions, the

Company has entered into derivative instruments or other arrangements that

are not considered variable interests in the VIE under FIN 46(R) (e.g.,

interest rate swaps, cross-currency swaps, or where the Company is the

purchaser of credit protection under a credit default swap or total return

swap where the Company pays the total return on certain assets to the SPE).

Receivables under such arrangements are not included in the maximum

exposure amounts.

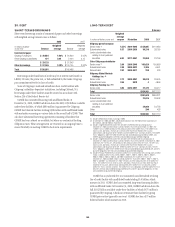

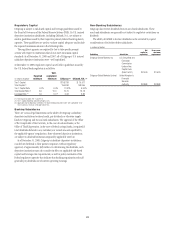

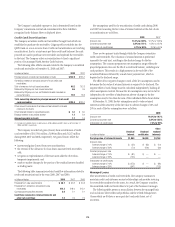

Consolidated VIEs—Balance Sheet Classification

The following table presents the carrying amounts and classification of

consolidated assets that are collateral for consolidated VIE obligations:

In billions of dollars

December 31,

2008

December 31,

2007

Cash $ 1.9 $ 12.3

Trading account assets 22.2 87.3

Investments 17.5 15.0

Loans 2.6 2.2

Other assets 2.7 4.8

Total assets of consolidated VIEs $46.9 $121.6

The following table presents the carrying amounts and classification of the

third-party liabilities of the consolidated VIEs:

In billions of dollars

December 31,

2008

Trading account liabilities $ 0.8

Short-term borrowings 17.0

Long-term debt 6.8

Other liabilities 3.0

Total liabilities of consolidated VIEs $27.6

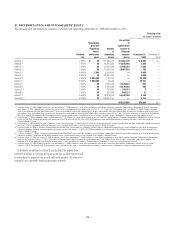

The consolidated VIEs included in the table above represent hundreds of

separate entities with which the Company is involved. In general, the third-

party investors in the obligations of consolidated VIEs have recourse only to

the assets of the VIEs and do not have recourse to the Company, except where

the Company has provided a guarantee to the investors or is the counterparty

to certain derivative transactions involving the VIE. In addition, the assets

are generally restricted only to pay such liabilities. Thus, the Company’s

maximum exposure to loss related to consolidated VIEs is significantly less

than the carrying value of the consolidated VIE assets due to outstanding

third-party financing. Intercompany liabilities are excluded from the table.

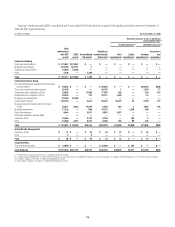

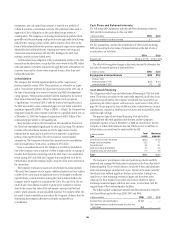

Significant Interest in VIEs—Balance Sheet Classification

The following table presents the carrying amounts and classification of

significant interests in VIEs:

In billions of dollars

December 31,

2008

Trading account assets $ 6.3

Investments 8.4

Loans 15.9

Other assets 3.1

Total assets $33.7

In billions of dollars

December 31,

2008

Trading account liabilities $0.2

Long-term debt 0.4

Other liabilities 0.6

Total liabilities $1.2

178