Citibank 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3. DISCONTINUED OPERATIONS

Sale of Citigroup’s German Retail Banking Operations

On December 5, 2008, Citigroup sold its German retail banking operations to

Credit Mutuel for Euro 5.2 billion, in cash plus the German retail bank’s

operating net earnings accrued in 2008 through the closing. The sale

resulted in an after-tax gain of approximately $3.9 billion including the

after-tax gain on the foreign currency hedge of $383 million recognized

during the fourth quarter of 2008.

The sale does not include the corporate and investment banking business

or the Germany-based European data center.

The German retail banking operations had total assets and total liabilities

as of November 30, 2008, of $15.6 billion and $11.8 billion, respectively.

Results for all of the German retail banking businesses sold, as well as the

net gain recognized in 2008 from this sale, are reported as Discontinued

operations for all periods presented.

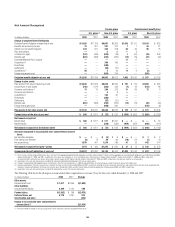

Summarized financial information for Discontinued operations,

including cash flows, related to the sale of the German retail banking

operations is as follows:

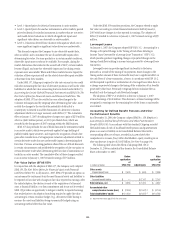

In millions of dollars 2008 2007 2006

Total revenues, net of interest expense $ 6,592 $ 2,212 $ 2,126

Income from discontinued operations $ 1,438 $ 652 $ 837

Gain on sale 3,695 ——

Provision for income taxes and minority interest,

net of taxes 426 214 266

Income from discontinued operations, net of

taxes $ 4,707 $ 438 $ 571

In millions of dollars 2008 2007 2006

Cash flows from operating activities $ (4,719) $ 2,227 $ 2,246

Cash flows from investing activities 18,547 (1,906) (3,316)

Cash flows from financing activities (14,226) (213) 1,147

Net cash provided by (used in) discontinued

operations $ (398) $ 108 $ 77

CitiCapital

On July 31, 2008, Citigroup sold substantially all of CitiCapital, the

equipment finance unit in North America. The total proceeds from the

transaction were approximately $12.5 billion and resulted in an after-tax

loss to Citigroup of $305 million. This loss is included in Income from

discontinued operations on the Company’s Consolidated Statement of

Income for the second quarter of 2008. The assets and liabilities for

CitiCapital totaled approximately $12.9 billion and $0.5 billion, respectively,

at June 30, 2008.

This transaction encompassed seven CitiCapital equipment finance business

lines, including Healthcare Finance, Private Label Equipment Finance,

Material Handling Finance, Franchise Finance, Construction Equipment

Finance, Bankers Leasing, and CitiCapital Canada. CitiCapital’s Tax Exempt

Finance business was not part of the transaction and was retained by Citigroup.

CitiCapital had approximately 1,400 employees and 160,000 customers

throughout North America.

Results for all of the CitiCapital businesses sold, as well as the net loss

recognized in 2008 from this sale, are reported as Discontinued operations

for all periods presented.

Summarized financial information for Discontinued operations,

including cash flows, related to the sale of CitiCapital is as follows:

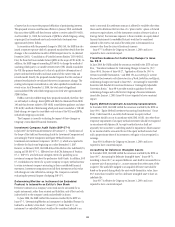

In millions of dollars 2008 2007 2006

Total revenues, net of interest expense $ 24 $ 991 $ 1,162

Income (loss) from discontinued operations $40 $ 273 $ 313

Loss on sale (506) ——

Provision (benefit) for income taxes and minority

interest, net of taxes (202) 83 86

Income (loss) from discontinued operations, net

of taxes $(264) $ 190 $ 227

In millions of dollars 2008 2007 2006

Cash flows from operating activities $(287) $(1,148) $ 2,596

Cash flows from investing activities 349 1,190 (2,664)

Cash flows from financing activities (61) (43) 3

Net cash provided by (used in) discontinued

operations $ 1 $ (1) $ (65)

Sale of the Asset Management Business

On December 1, 2005, the Company completed the sale of substantially all of

its Asset Management business to Legg Mason, Inc. (Legg Mason).

On January 31, 2006, the Company completed the sale of its Asset

Management business within Bank Handlowy (an indirect banking

subsidiary of Citigroup located in Poland) to Legg Mason. This transaction,

which was originally part of the overall Asset Management business sold to

Legg Mason on December 1, 2005, was postponed due to delays in obtaining

local regulatory approval. A gain from this sale of $18 million after-tax and

minority interest ($31 million pretax and minority interest) was recognized

in the first quarter of 2006 in Discontinued operations.

During March 2006, the Company sold 10.3 million shares of Legg Mason

stock through an underwritten public offering. The net sale proceeds of

$1.258 billion resulted in a pretax gain of $24 million in ICG.

In September 2006, the Company received from Legg Mason the final

closing adjustment payment related to this sale. This payment resulted in an

additional after-tax gain of $51 million ($83 million pretax), recorded in

Discontinued operations.

136