Citibank 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Write-Down of Intangible Asset Related to Old Lane

As a result of Old Lane Partners, L.P. and Old Lane Partners GP, LLC

notifying their investors that they would have the opportunity to redeem their

investments in the hedge fund, without restriction effective July 31, 2008, ICG

recorded a pretax write-down of $202 million on intangible assets related to

this multi-strategy hedge fund during the first quarter of 2008. By April 2008,

substantially all unaffiliated investors had notified Old Lane of their

intention to redeem their investments. See Note 19 on page 166 for

additional information.

Write-Down of Intangible Asset Related to Nikko Asset

Management

During the fourth quarter of 2008, Citigroup performed an impairment

analysis of Japan’s Nikko Asset Management fund contracts which represent

the rights to manage and collect fees on investor assets and are accounted for

as indefinite-lived intangible assets. As a result, an impairment loss of $937

million pretax ($607 million after-tax) was recorded in ICG.

Nikko Cordial

Citigroup began consolidating Nikko Cordial’s financial results and the

related minority interest on May 9, 2007, when Nikko Cordial became a

61%-owned subsidiary. Later in 2007, Citigroup increased its ownership stake

in Nikko Cordial to approximately 68%. Nikko Cordial results are included in

Citigroup’s Securities and Banking and Global Wealth Management

businesses.

On January 29, 2008, Citigroup completed the acquisition of the

remaining Nikko Cordial shares that it did not already own by issuing

175 million Citigroup common shares (approximately $4.4 billion based on

the exchange terms) in exchange for those remaining Nikko Cordial shares.

The share exchange was completed following the listing of Citigroup’s

common shares on the Tokyo Stock Exchange on November 5, 2007.

Transaction with Banco de Chile

In 2007, Citigroup and Quiñenco entered into a definitive agreement to

establish a strategic partnership that combines Citigroup operations in Chile

with Banco de Chile’s local banking franchise to create a banking and

financial services institution with approximately 20% market share of the

Chilean banking industry. The transaction closed on January 1, 2008.

Under the agreement, Citigroup sold its Chilean operations and other

assets in exchange for an approximate 32.96% stake in LQIF, a wholly owned

subsidiary of Quiñenco that controls Banco de Chile. This investment is

accounted for under the equity method of accounting. As part of the overall

transaction, Citigroup also acquired the U.S. branches of Banco de Chile for

approximately $130 million. The new partnership calls for active

participation by Citigroup in the management of Banco de Chile including

board representation at both LQIF and Banco de Chile. In addition, as part of

the definitive agreement, Citigroup and Quiñenco agreed on certain

transactions that could increase Citigroup’s stake in LQIF to approximately

50%. Specifically, Quiñenco has a put that would require Citigroup to buy an

additional approximately 8.5% stake in LQIF. Citigroup has a call on, or the

option to buy, this increased ownership percentage as well. Further,

Citigroup has an option to buy an additional approximately 8.5% in LQIF,

resulting in a potential 50% ownership stake in LQIF. Each of these potential

additional acquisitions will be exercisable in 2010.

SUBSEQUENT EVENT

Joint Venture with Morgan Stanley

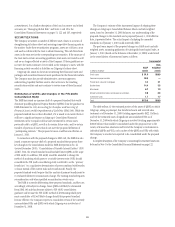

On January 13, 2009, Citigroup reached a definitive agreement to sell its

Smith Barney business, which includes Smith Barney in the U.S., Smith

Barney in Australia and Quilter in the U.K., to a joint venture to be formed

with Morgan Stanley in exchange for a 49% stake in the joint venture and an

upfront cash payment of $2.7 billion from Morgan Stanley. The joint

venture, to be called Morgan Stanley Smith Barney, will combine the sold

businesses with Morgan Stanley’s Global Wealth Management Group. It will

not include Citi Private Bank, Nikko Cordial Securities or Citigroup’s bank

branch-based financial advisors.

The joint venture’s combined businesses have more than 20,000 financial

advisors, 1,000 offices, $1.7 trillion in client assets at December 31, 2008,

$14.9 billion in 2008 pro forma combined revenues, and $2.8 billion in 2008

pro forma combined pretax profit.

Upon closing, and following the cash payment of $2.7 billion from

Morgan Stanley to Citigroup, Morgan Stanley will own 51% and Citi will own

49% of the joint venture. Morgan Stanley and Citi will have various purchase

and sale rights for the joint venture, but Citi is expected to retain the full

amount of its stake at least through year three and to continue to own a

significant stake in the joint venture at least through year five.

The transaction, which is subject to and contingent upon regulatory

approvals and other customary closing conditions, is expected to close in the

third quarter of 2009. At closing, and based on current estimates of the fair

value of the joint venture, the Company estimates that it will recognize a

pretax gain of approximately $9.5 billion (approximately $5.8 billion after

tax) and will generate approximately $6.5 billion of tangible common

equity.

14