Citibank 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

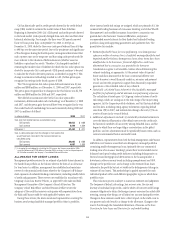

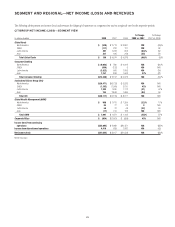

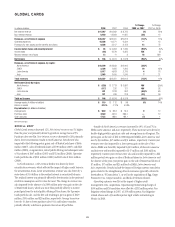

GLOBAL CARDS

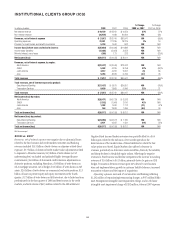

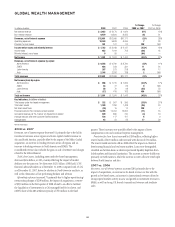

In millions of dollars 2008 2007 2006

% Change

2008 vs. 2007

% Change

2007 vs. 2006

Net interest revenue $11,267 $10,682 $ 8,725 5% 22%

Non-interest revenue 8,940 12,369 11,087 (28) 12

Revenues, net of interest expense $20,207 $23,051 $19,812 (12)% 16%

Operating expenses 10,556 10,571 9,324 —13

Provisions for loan losses and for benefits and claims 9,556 5,517 3,152 73 75

Income before taxes and minority interest $ 95 $ 6,963 $ 7,336 (99)% (5)%

Income taxes (84) 2,278 2,355 NM (3)

Minority interest, net of taxes 13 11 3 18 NM

Net income $ 166 $ 4,674 $ 4,978 (96)% (6)%

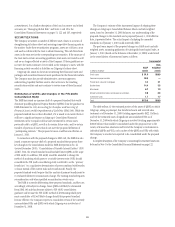

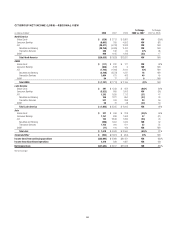

Revenues, net of interest expense, by region:

North America $10,299 $13,893 $13,905 (26)% —

EMEA 2,326 1,955 1,205 19 62%

Latin America 5,017 4,803 2,726 476

Asia 2,565 2,400 1,976 721

Total revenues $20,207 $23,051 $19,812 (12)% 16%

Net income (loss) by region:

North America $ (529) $ 2,713 $ 3,887 NM (30)%

EMEA (117) 232 121 NM 92

Latin America 491 1,233 652 (60)% 89

Asia 321 496 318 (35) 56

Total net income $ 166 $ 4,674 $ 4,978 (96)% (6)%

Average assets (in billions of dollars) $ 119 $ 112 $ 98 6% 14%

Return on assets 0.14% 4.17% 5.08%

Key indicators (in billions of dollars)

Average loans $ 90.0 $ 82.3 $ 73.6 912

Purchase sales 436.0 434.9 389.0 —12

Open accounts 175.5 188.6 186.1 (7) 1

NM Not meaningful.

2008 vs. 2007

Global Cards revenue decreased 12%. Net interest revenue was 5% higher

than the prior year primarily driven by growth in average loans of 9%.

Purchase sales were flat. Non-interest revenue decreased by 28% primarily

due to lower securitization results in North America. Results were also

impacted by the following pretax gains: sale of MasterCard shares of $466

million (2007), sales of Redecard shares of $729 million (2007) and $663

million (2008), reorganization, initial public offering and subsequent sales

of Visa shares of $447 million (2007) and $523 million (2008), Upromise

Cards portfolio sale of $201 million (2008) and DCI sale of $111 million

(2008).

In North America, a 26% revenue decline was driven by lower

securitization revenues, which reflected the impact of higher credit losses in

the securitization trusts. Lower securitization revenue was also driven by a

write-down of $1.6 billion in the residual interest in securitized balances.

The residual interest was primarily affected by deterioration in the projected

credit loss assumption used to value the asset. The change in revenue was

also impacted by the absence of a $393 million prior-year gain on the sale

of MasterCard shares, which was more than partially offset by a current

period gain from the initial public offering of Visa shares, the Upromise

Cards portfolio sale, and the DCI sale resulting in pre-tax gains of $349

million, $201 million and $29 million, respectively. Average loans were

lower by 1% due to lower purchase sales (4%) and balance transfers,

partially offset by a decline in payment rates across all portfolios.

Outside of North America, revenues increased by 19%, 4% and 7% in

EMEA,Latin America and Asia, respectively. These increases were driven by

double-digit growth in purchase sales and average loans in all regions. The

pretax gain on the sale of DCI in 2008 impacted EMEA,Latin America and

Asia by $34 million, $17 million and $31 million, respectively. Current-year

revenues were also impacted by a lower pretax gain on the sale of Visa

shares: EMEA was favorably impacted by $18 million, while Latin America

and Asia were unfavorably impacted by $147 million and $103 million,

respectively. Current-year revenues were also unfavorably impacted by a $66

million pretax lower gain on sales of Redecard shares in Latin America and

the absence of the prior-year pretax gain on the sale of MasterCard shares of

$7 million, $37 million and $21 million for EMEA,Latin America and

Asia, respectively. Results include the impact of foreign currency translation

gains related to the strengthening of local currencies (generally referred to

hereinafter as “FX translation”), as well as the acquisitions of Egg, Grupo

Financiero Uno, Grupo Cuscatlán, and Bank of Overseas Chinese.

Operating expenses were flat as the impact of higher credit

management costs, acquisitions, repositioning/restructuring charges of

$184 million and FX translation were offset by a $292 million pretax Visa

litigation-related charge in 2007, a $159 million pretax Visa litigation-

related release and a $36 million pretax legal vehicle restructuring in

Mexico in 2008.

29