Citibank 2008 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

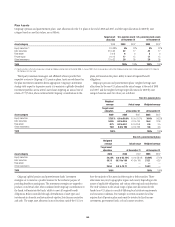

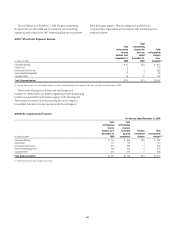

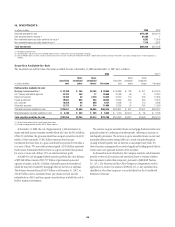

Plan Assets

Citigroup’s pension and postretirement plans’ asset allocations for the U.S. plans at the end of 2008 and 2007, and the target allocations for 2009 by asset

category based on asset fair values, are as follows:

Target asset

allocation

U.S. pension assets

at December 31

U.S. postretirement assets

at December 31

Asset category 2009 2008 2007 2008 2007

Equity securities (1) 3 to 38% 6% 27% 6% 27%

Debt securities 25 to 62 42 17 42 17

Real estate 3to8 6666

Private equity 0to15 17 15 17 15

Other investments 12 to 32 29 35 29 35

Total 100% 100% 100% 100%

(1) Equity securities in the U.S. pension plans include no Citigroup common stock at the end of 2008. In January 2007, the U.S. pension plans sold all the Citigroup common stock it held (approximately $137.2 million) to

the Company at its fair value.

Third-party investment managers and affiliated advisors provide their

respective services to Citigroup’s U.S. pension plans. Assets are rebalanced as

the plan investment committee deems appropriate. Citigroup’s investment

strategy with respect to its pension assets is to maintain a globally diversified

investment portfolio across several asset classes targeting an annual rate of

return of 7.75% that, when combined with Citigroup’s contributions to the

plans, will maintain the plans’ ability to meet all required benefit

obligations.

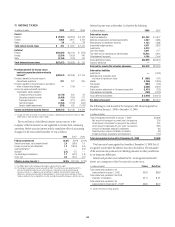

Citigroup’s pension and postretirement plans’ weighted average asset

allocations for the non-U.S. plans and the actual ranges at the end of 2008

and 2007, and the weighted average target allocations for 2009 by asset

category based on asset fair values, are as follows:

Non-U.S. pension plans

Weighted

average Actual range Weighted average

Target asset

allocation at December 31 at December 31

Asset category 2009 2008 2007 2008 2007

Equity securities 37.61% 0.0 to 56.8% 0.0 to 75.1% 34.4% 56.2%

Debt securities 53.95 0.0 to 85.5 0.0 to 100 55.4 37.8

Real estate 0.75 0.0 to 40.1 0.0 to 35.9 0.6 0.5

Other investments 7.69 0.0 to 100 0.0 to 100 9.6 5.5

Total 100% 100% 100%

Non-U.S. postretirement plans

Weighted

average Actual range Weighted average

Target asset

allocation at December 31 at December 31

Asset category 2009 2008 2007 2008 2007

Equity securities 39.34% 0.0 to 53.18% 0.0 to 58.4% 52.26% 57.4%

Debt securities 36.13 36.11 to 100 41.6 to 100 37.21 42.6

Real estate —————

Other investments 24.53 0.0 to 10.71 —10.53 —

Total 100% 100% 100%

Citigroup’s global pension and postretirement funds’ investment

strategies are to invest in a prudent manner for the exclusive purpose of

providing benefits to participants. The investment strategies are targeted to

produce a total return that, when combined with Citigroup’s contributions to

the funds, will maintain the funds’ ability to meet all required benefit

obligations. Risk is controlled through diversification of asset types and

investments in domestic and international equities, fixed income securities

and cash. The target asset allocation in most locations outside the U.S. is to

have the majority of the assets in either equity or debt securities. These

allocations may vary by geographic region and country depending on the

nature of applicable obligations and various other regional considerations.

The wide variation in the actual range of plan asset allocations for the

funded non-U.S. plans is a result of differing local statutory requirements

and economic conditions. For example, in certain countries local law

requires that all pension plan assets must be invested in fixed income

investments, government funds, or local country securities.

148