Citibank 2008 Annual Report Download - page 206

Download and view the complete annual report

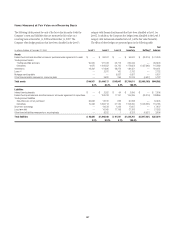

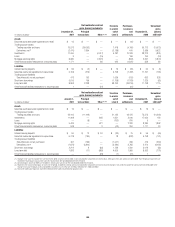

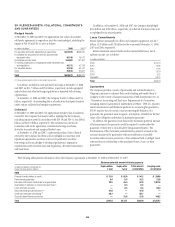

Please find page 206 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The following is a discussion of the changes to the Level 3 balances for

each of the roll-forward tables presented above.

The significant changes from December 31, 2007 to December 31, 2008 in

Level 3 assets and liabilities are due to:

- A net decrease in trading securities and loans of $24.8 billion that

was driven by:

(i) Net realized and unrealized losses of $28.1 billion

recorded in Principal transactions, which composed

mostly of write-downs recognized on various trading

securities including ABCP of $9 billion;

(ii) Net transfers in of $7.4 billion, which consisted of

approximately $26 billion of net transfers in from Level 2

to Level 3 as the availability of observable pricing inputs

continued to decline due to the current credit crisis, offset

by transfers out of Level 3 of approximately $19 billion

primarily related to Level 3 trading inventory being

reclassified to held-to-maturity investments during the

fourth quarter of 2008; and

(iii) Net settlements of trading securities of $4.2 billion in

Level 3.

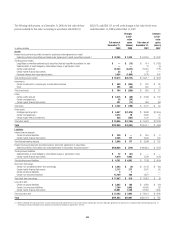

- The shift in the Level 3 net unrealized gains/(losses) from trading

derivatives driven by:

(i) A net gain of $7.8 billion relating to complex derivative

contracts, such as those linked to credit, equity and

commodity exposures. These gains include both realized

and unrealized gains during 2008 and are partially offset

by losses recognized in instruments that have been

classified in Levels 1 and 2;

(ii) $2.2 billion in net transfers in and/or out of Level 3,

representing a net transfer in of derivative liabilities

during the year.

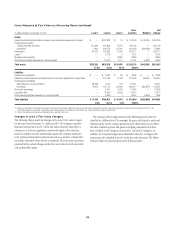

- The increase in Level 3 Investments of $11.2 billion primarily

resulted from:

(i) The addition of $10.3 billion from net purchases,

issuances and settlements, which included $8.7 billion in

senior debt securities retained by the Company from its

sale of a corporate loan portfolio that included highly

leveraged loans during the second quarter of 2008, plus

$3 billion of ARS securities purchased from GWM clients,

in accordance with the Auction Rate Securities settlement

agreement ;

(ii) The net transfer in of investment securities from Level 2 to

Level 3 of $5.8 billion, as the availability of observable

pricing inputs continued to decline due to the current

credit crisis; and

(iii) Net losses recognized of $4.9 billion which was recorded

in Accumulated other comprehensive income (loss)

primarily related to Alt-A MBS classified as

available-for-sale investments.

- The decrease in Mortgage Servicing Rights of $2.7 billion was

primarily attributed to mark-to-market losses recognized in the

portfolio due to decreases in the mortgage interest rates and

increases in refinancing.

- The increase in the Level 3 balance for Securities sold under

agreements to repurchase of $5 billion is driven by a $6.2 billion

increase from net transfers in as the continued credit crisis

impacted the availability of observable inputs for the underlying

securities related to this liability. This was offset by a reduction

from net settlements of $1.4 billion.

- The decrease in Level 3 short-term borrowings of $3.7 billion is due

to net transfers out of $1.8 billion as valuation methodology inputs

considered to be unobservable were determined not to be significant

to the overall valuation. In addition, net payments of $1.8 billion

were made during 2008 against the Level 3 short-term debt

obligations.

- The increase in Level 3 Long-term debt of $2.2 billion is driven by:

(i) The net transfers in of $38.8 billion, substantially all of

which related to the transfer of consolidated SIV debt in

the first quarter of 2008, as the availability of observable

inputs continued to decline due to the current crisis; offset

by

(ii) $2.2 billion in gains recognized as credit spreads widened

during the year;

(iii) $34.3 billion decrease from net settlements/payments.

Included in these settlements were $21 billion of

payments made on maturing SIV debt and the

replacement of $17 billion of non-recourse, consolidated

SIV debt classified as Level 3 with Citigroup debt classified

as Level 2. This replacement occurred in connection with

the purchase of the SIV assets by the Company in

November 2008.

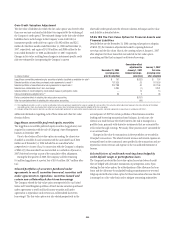

The significant changes from January 1, 2007 to December 31, 2007 in

Level 3 assets and liabilities are due to:

- The increase in trading securities and loans of $53.2 billion that

was driven primarily by:

(i) The net additions/purchases of $43.5 billion, which

included asset-backed commercial paper purchases where

the Company had liquidity puts and assets bought with

Nikko Cordial acquisitions

(ii) The net transfers in of $21.1 billion for items previously

classified as Level 2 as prices and other valuation inputs

became unobservable with the market dislocation crises

that began in the second half of 2007; and

(iii) Mark-to-market losses of $11.4 billion primarily

attributable to writedowns on super senior tranches,

junior tranches, ABCP and other related inventory.

- The increase in Level 3 Investments of $5.6 billion, primarily

resulting from the acquisition of Nikko Cordial.

- The increase in Mortgage servicing rights of $2.9 billion which was

primarily due to the first quarter 2007 acquisition of ABN AMRO

Mortgage Group.

- The decrease in net derivative trading account assets of $4.4 billion

was due to mark-to-market losses and net purchases/originations

of $3.8 billion, offset by net transfers in of Level 3 trading derivative

liabilities of $3.3 billion.

200