Citibank 2008 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

commitments. For a further description of the loan loss reserve and related

accounts, see “Managing Global Risk” and Notes 1 and 18 to the

Consolidated Financial Statements on pages 51, 122 and 165, respectively.

SECURITIZATIONS

The Company securitizes a number of different asset classes as a means of

strengthening its balance sheet and accessing competitive financing rates in

the market. Under these securitization programs, assets are sold into a trust

and used as collateral by the trust to obtain financing. The cash flows from

assets in the trust service the corresponding trust securities. If the structure of

the trust meets certain accounting guidelines, trust assets are treated as sold

and are no longer reflected as assets of the Company. If these guidelines are

not met, the assets continue to be recorded as the Company’s assets, with the

financing activity recorded as liabilities on Citigroup’s balance sheet.

Citigroup also assists its clients in securitizing their financial assets and

packages and securitizes financial assets purchased in the financial markets.

The Company may also provide administrative, asset management,

underwriting, liquidity facilities and/or other services to the resulting

securitization entities and may continue to service some of these financial

assets.

Elimination of QSPEs and Changes in the FIN 46(R)

Consolidation Model

The FASB has issued an exposure draft of a proposed standard that would

eliminate Qualifying Special Purpose Entities (QSPEs) from the guidance in

FASB Statement No. 140, Accounting for Transfers and Servicing of

Financial Assets and Extinguishments of Liabilities (SFAS 140). While the

proposed standard has not been finalized, if it is issued in its current form it

will have a significant impact on Citigroup’s Consolidated Financial

Statements as the Company will lose sales treatment for certain assets

previously sold to a QSPE, as well as for certain future sales, and for certain

transfers of portions of assets that do not meet the proposed definition of

“participating interests.” This proposed revision could become effective on

January 1, 2010.

In connection with the proposed changes to SFAS 140, the FASB has also

issued a separate exposure draft of a proposed standard that proposes three

key changes to the consolidation model in FASB Interpretation No. 46

(revised December 2003), “Consolidation of Variable Interest Entities” (FIN

46(R)). First, the revised standard would include former QSPEs in the scope

of FIN 46(R). In addition, FIN 46(R) would be amended to change the

method of analyzing which party to a variable interest entity (VIE) should

consolidate the VIE (such consolidating entity is referred to as the “primary

beneficiary”) to a qualitative determination of power combined with benefits

or losses instead of the current risks and rewards model. Finally, the

proposed standard would require that the analysis of primary beneficiaries be

re-evaluated whenever circumstances change. The existing standard requires

reconsideration only when specified reconsideration events occur.

The FASB is currently deliberating these proposed standards, and they are,

accordingly, still subject to change. Since QSPEs will likely be eliminated

from SFAS 140 and thus become subject to FIN 46(R) consolidation

guidance and because the FIN 46(R) method of determining which party

must consolidate a VIE will likely change should this proposed standard

become effective, the Company expects to consolidate certain of the currently

unconsolidated VIEs and QSPEs with which Citigroup was involved as of

December 31, 2008.

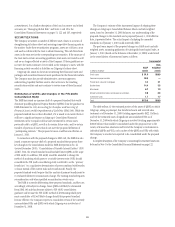

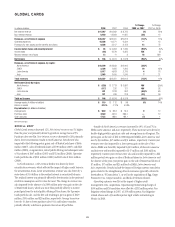

The Company’s estimate of the incremental impact of adopting these

changes on Citigroup’s Consolidated Balance Sheets and risk-weighted

assets, based on December 31, 2008 balances, our understanding of the

proposed changes to the standards and a proposed January 1, 2010 effective

date, is presented below. The actual impact of adopting the amended

standards as of January 1, 2010 could materially differ.

The pro forma impact of the proposed changes on GAAP assets and risk-

weighted assets, assuming application of existing risk-based capital rules, at

January 1, 2010 (based on the balances at December 31, 2008) would result

in the consolidation of incremental assets as follows:

Incremental

GAAP

Risk-

weighted

In billions of dollars assets assets

Credit cards $ 91.9 $88.9

Commercial paper conduits 59.6 —

Private label consumer mortgages 4.4 2.1

Student loans 14.4 3.5

Muni bonds 6.2 1.9

Mutual fund deferred sales commission securitization 0.8 0.8

Investment funds 1.7 1.7

Total $179.0 $98.9

The table reflects (i) the estimated portion of the assets of QSPEs to which

Citigroup, acting as principal, has transferred assets and received sales

treatment as of December 31, 2008 (totaling approximately $822.1 billion),

and (ii) the estimated assets of significant unconsolidated VIEs as of

December 31, 2008 with which Citigroup is involved (totaling approximately

$288.0 billion) that would be consolidated under the proposal. Due to the

variety of transaction structures and level of the Company’s involvement in

individual QSPEs and VIEs, only a subset of the QSPEs and VIEs with which

the Company is involved are expected to be consolidated under the proposed

change.

A complete description of the Company’s accounting for securitized assets can

be found in Note 1 to the Consolidated Financial Statements on page 122.

20