Citibank 2008 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

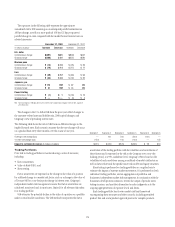

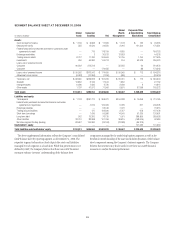

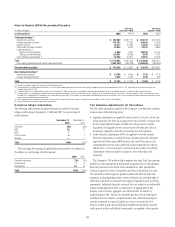

SEGMENT BALANCE SHEET AT DECEMBER 31, 2008

In millions of dollars

Global

Cards

Consumer

Banking ICG

Global

Wealth

Management

Corporate/Other

& Consolidating

Eliminations

Total Citigroup

Consolidated

Assets:

Cash and due from banks $ 1,136 $ 8,683 $ 17,599 $ 1,103 $ 732 $ 29,253

Deposits with banks 535 12,030 34,250 2,016 121,500 170,331

Federal funds sold and securities borrowed or purchased under

agreements to resell — 719 178,759 4,655 — 184,133

Brokerage receivables — 2 30,613 13,663 — 44,278

Trading account assets 8,737 11,780 344,609 10,755 1,754 377,635

Investments 450 46,984 144,413 244 63,929 256,020

Loans, net of unearned income

Consumer 90,562 373,542 — 55,545 24 519,673

Corporate — — 174,455 — 88 174,543

Loans, net of unearned income $ 90,562 $373,542 $ 174,455 $ 55,545 $ 112 $ 694,216

Allowance for loan losses (6,932) (14,950) (7,250) (484) — (29,616)

Total loans, net $ 83,630 $358,592 $ 167,205 $ 55,061 $ 112 $ 664,600

Goodwill 10,832 3,106 11,344 1,850 — 27,132

Intangible assets 6,696 7,085 2,730 3,299 6 19,816

Other assets 1,797 47,572 71,506 6,801 37,596 165,272

Total assets $113,813 $496,553 $1,003,028 $ 99,447 $ 225,629 $1,938,470

Liabilities and equity:

Total deposits $ 1,133 $281,774 $ 368,421 $104,398 $ 18,459 $ 774,185

Federal funds purchased and securities loaned or sold under

agreements to repurchase — 4,515 195,406 5,025 347 205,293

Brokerage payables — — 63,446 7,470 — 70,916

Trading account liabilities — 127 162,636 3,737 978 167,478

Short-term borrowings — 1,435 59,386 14,540 51,330 126,691

Long-term debt 242 15,320 76,130 1,051 266,850 359,593

Other liabilities 28,751 83,998 101,766 36,815 (158,646) 92,684

Net inter-segment funding (lending) 83,687 109,384 (24,163) (73,589) (95,319) —

Stockholders’ equity — — — — 141,630 141,630

Total liabilities and stockholders’ equity $113,813 $496,553 $1,003,028 $ 99,447 $ 225,629 $1,938,470

The above supplemental information reflects the Company’s consolidated

GAAP balance sheet by reporting segment as of December 31, 2008. The

respective segment information closely depicts the assets and liabilities

managed by each segment as of such date. While this presentation is not

defined by GAAP, the Company believes that these non-GAAP financial

measures enhance investors’ understanding of the balance sheet

components managed by the underlying business segments as well as the

beneficial interrelationship of the asset and liability dynamics of the balance

sheet components among the Company’s business segments. The Company

believes that investors may find it useful to see these non-GAAP financial

measures to analyze financial performance.

81