Citibank 2008 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

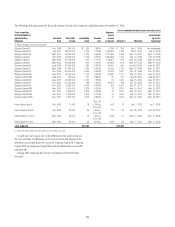

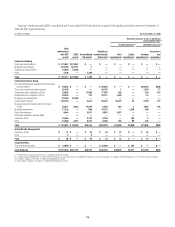

In millions of dollars, except loans in billions 2008 2007

Loan amounts, at year end

On balance sheet $ 87.5 $ 93.5

Securitized amounts(1) 105.9 108.1

Loans held-for-sale —1.0

Total managed loans $193.4 $202.6

Delinquencies, at year end

On balance sheet $2,490 $1,929

Securitized amounts 2,655 1,864

Loans held-for-sale —14

Total managed delinquencies $5,145 $3,807

Credit losses, net of recoveries,

for the year ended December 31, 2008 2007 2006

On balance sheet $ 5,918 $3,877 $3,208

Securitized amounts 7,407 4,728 3,986

Loans held-for-sale ——5

Total managed $13,325 $8,605 $7,199

(1) Includes $1.2 billion in interest and fee receivables.

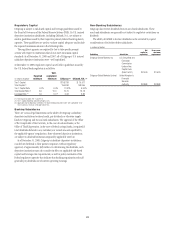

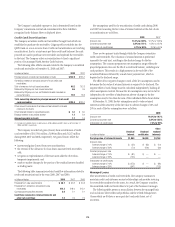

Funding, Liquidity Facilities and Subordinate Interests

Citigroup securitizes credit card receivables through three securitization

trusts. The trusts are funded through a mix of sources, including

commercial paper and medium- and long-term notes. Term notes can be

issued at a fixed or floating rate. The Omni Trust has issued approximately

$3.3 billion of commercial paper through the Commercial Paper Funding

Facility (CPFF).

Citigroup is a provider of liquidity facilities to the commercial paper

programs of the two primary securitization trusts with which it transacts.

Both facilities are made available on market terms to each trust. With respect

to the Palisades commercial paper program in the Omni Master Trust (the

“Omni Trust”), Citibank (South Dakota), N. A., a wholly owned subsidiary of

Citigroup, is the sole provider of a full-liquidity facility. The liquidity facility

requires Citibank (South Dakota), N.A. to purchase Palisades’s commercial

paper at maturity if the commercial paper does not roll over as long as there

are available credit enhancements outstanding, typically in the form of

subordinated notes. The Palisades liquidity commitment amounted to $8.5

billion at December 31, 2008 and $7.5 billion at December 31, 2007,

respectively. During 2008, Citibank (South Dakota), N.A. also became the

sole provider of a full-liquidity facility to the Dakota commercial paper

program of the Citibank Master Credit Card Trust (the “Master Trust”). This

facility requires Citibank (South Dakota), N.A. to purchase Dakota

commercial paper at maturity if the commercial paper does not roll over as

long as there are available credit enhancements outstanding, typically in the

form of subordinated notes. The Dakota liquidity commitment amounted to

$11 billion at December 31, 2008.

In addition, during 2008 Citibank (South Dakota), N.A. entered into an

agreement to provide liquidity to a third-party non-consolidated multi-seller

commercial paper conduit (the Conduit), which is not a VIE. Citibank

(South Dakota), N.A. provides this facility on market terms. The Conduit

holds a $3.6 billion bond issued by the Omni Trust. Citibank (South

Dakota), N.A. will be required to act in its capacity as liquidity provider as

long as there are available credit enhancements outstanding and if: (1) the

Conduit is unable to roll over its maturing commercial paper; or (2)

Citibank (South Dakota), N.A. loses its A-1/P-1 credit rating. At December 31,

2008, the liquidity commitment for this transaction was $4.0 billion.

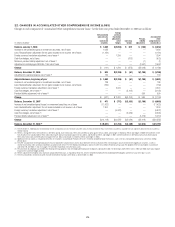

In October 2008, Citibank (South Dakota), N.A. acquired subordinated

bonds issued by the Omni Trust having an aggregate notional principal of

$265 million. The issuance of these bonds by the Omni Trust to Citibank

(South Dakota), N.A. was effected in order to avert a downgrade of all of

Omni Trust’s outstanding AAA and A securities by Standard & Poor’s. The

subordinated notes pay interest installments and principal upon maturity in

December 2009. As a result of this action, the Company is currently holding

ongoing discussions with Board staff from the Federal Reserve regarding the

application of the associated risk-based capital requirements. The action will

increase risk-weighted assets for purposes of calculating the Company’s risk-

based capital ratios. However, the timing and extent of the increase is not yet

certain, pending completion of discussions with the Federal Reserve.

In December 2008, the excess spread for the Master Trust fell below the

trigger level of 4.50%. Beginning in January 2009, this event requires the

excess cash in the Master Trust to be diverted to a spread account set aside for

the benefit of the investors in the Trust, instead of reverting back to Citigroup

immediately. The excess spread is a measure of the profitability of the credit

card accounts in the Master Trust expressed as a percent of the principal

balance outstanding. If the three-month average excess spread stays between

4.00% and 4.50% of the outstanding principal balance, the required funding

of the spread account is $680 million. The funds in the spread account can

only be paid to investors if the Master Trust goes into liquidation. If the

three-month average excess spread moves back above the 4.50% trigger level,

the funds in the spread account will be released to Citigroup.

In February 2009, Standard & Poor’s placed its BBB rating on the Master

Trust Class C notes on “ratings watch negative.” This status applies for 90

days, at which time Standard & Poor’s will re-evaluate the credit rating of

the bonds unless Citigroup takes action in the interim. In response, the

Company has decided to issue a Class D note as well as subordinate a portion

of principal cash flows due to the Company in the form of non-certificated

seller’s interest. Citigroup expects to issue the Class D note in the second

quarter of 2009 and to effect the subordination of seller’s interest cash flows

in March 2009. Should these actions be deemed satisfactory, the Class C

bonds will be removed from “ratings watch negative” and the BBB rating

will be affirmed by S&P. If these actions are executed, Citigroup’s risk-

weighted assets will be increased, but the timing and extent of such increase

would not yet be certain pending resolution of discussions with the Federal

Reserve.

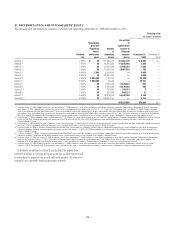

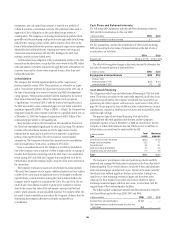

Mortgage Securitizations

The Company provides a wide range of mortgage loan products to a diverse

customer base. In connection with the securitization of these loans, the

Company’s U.S. Consumer mortgage business retains the servicing rights,

which entitle the Company to a future stream of cash flows based on the

outstanding principal balances of the loans and the contractual servicing

fee. Failure to service the loans in accordance with contractual requirements

may lead to a termination of the servicing rights and the loss of future

servicing fees. In non-recourse servicing, the principal credit risk to the

Company is the cost of temporary advances of funds. In recourse servicing,

the servicer agrees to share credit risk with the owner of the mortgage loans,

such as FNMA or FHLMC, or with a private investor, insurer or guarantor.

Losses on recourse servicing occur primarily when foreclosure sale proceeds

of the property underlying a defaulted mortgage loan are less than the

180