Citibank 2008 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

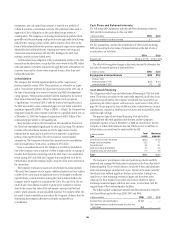

outstanding principal balance and accrued interest of the loan and the cost

of holding and disposing of the underlying property. The Company’s

mortgage loan securitizations are primarily non-recourse, thereby effectively

transferring the risk of future credit losses to the purchasers of the securities

issued by the trust. Securities and Banking retains servicing for a limited

number of its mortgage securitizations.

The Company’s Consumer business provides a wide range of mortgage

loan products to its customers. Once originated, the Company often

securitizes these loans through the use of QSPEs. These QSPEs are funded

through the issuance of Trust Certificates backed solely by the transferred

assets. These certificates have the same average life as the transferred assets.

In addition to providing a source of liquidity and less expensive funding,

securitizing these assets also reduces the Company’s credit exposure to the

borrowers. These mortgage loan securitizations are primarily non-recourse,

thereby effectively transferring the risk of future credit losses to the

purchasers of the securities issued by the trust. However, the Company

generally retains the servicing rights and in certain instances retains

investment securities, interest-only strips and residual interests in future cash

flows from the trusts.

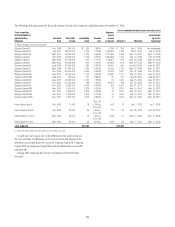

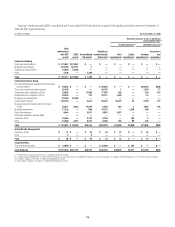

The following tables summarize selected cash flow information related to

mortgage securitizations for the years 2008, 2007 and 2006:

2008

In billions of dollars

U.S. Consumer

mortgages

Securities and

Banking

mortgages

Proceeds from new securitizations $89.2 $6.3

Contractual servicing fees received 2.1 —

Cash flows received on retained interests and

other net cash flows 0.7 0.2

2007

In billions of dollars

U.S. Consumer

mortgages

Securities and

Banking

mortgages

Proceeds from new securitizations $107.2 $40.1

Contractual servicing fees received 1.7 —

Cash flows received on retained interests and

other net cash flows 0.3 0.3

2006

In billions of dollars

U.S. Consumer

mortgages

Securities and

Banking

mortgages

Proceeds from new securitizations $67.5 $31.9

Contractual servicing fees received 1.0 —

Cash flows received on retained interests and

other net cash flows — 0.2

The Company recognized gains (losses) on securitizations of U.S.

Consumer mortgages of $73 million, $(27) million, and $82 million for

2008, 2007 and 2006, respectively. Gains (losses) recognized on the

securitization of Securities and Banking activities during 2008, 2007 and

2006 were $(16) million, $145 million and $302 million, respectively.

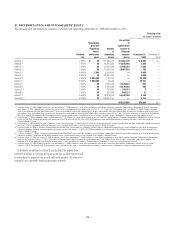

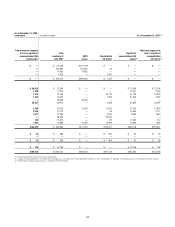

Key assumptions used for the securitization of mortgages during 2008

and 2007 in measuring the fair value of retained interests at the date of sale

or securitization are as follows:

2008

U.S. Consumer

mortgages

Securities and

Banking mortgages

Discount rate 4.5% to 18.2% 5.1% to 39.4%

Constant prepayment rate 3.6% to 32.9% 2.0% to 18.2%

Anticipated net credit losses — 40.0% to 85.0%

2007

U.S. Consumer

mortgages

Securities and

Banking mortgages

Discount rate 9.6% to 17.5% 2.5% to 30.1%

Constant prepayment rate 4.9% to 24.2% 6.1% to 52.5%

Anticipated net credit losses — 10.0% to 100.0%

In 2008, U.S. Consumer mortgage rates exhibited considerable variability

due to economic conditions and market volatility. This resulted in a

significant variation in assumed prepayment rates and discount rates.

The range in the key assumptions for retained interests in Securities and

Banking is due to the different characteristics of the interests retained by the

Company. The interests retained by Securities and Banking range from

highly rated and/or senior in the capital structure to unrated and/or residual

interests.

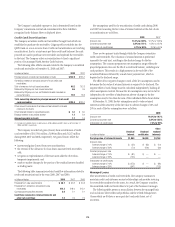

The effect of two negative changes in each of the key assumptions used to

determine the fair value of retained interests is required to be disclosed. The

negative effect of each change must be calculated independently, holding all

other assumptions constant. Because the key assumptions may not in fact be

independent, the net effect of simultaneous adverse changes in the key

assumptions may be less than the sum of the individual effects shown below.

At December 31, 2008, the key assumptions used to value retained

interests and the sensitivity of the fair value to adverse changes of 10% and

20% in each of the key assumptions were as follows:

2008

U.S.

Consumer

mortgages

Securities

and Banking

mortgages

Discount rate 7.8% 5.1% to 39.4%

Constant prepayment rate 30.6% 2.0% to 18.2%

Anticipated net credit losses 0.1% 40.0% to 85%

In millions of dollars

U.S.

Consumer

mortgages

Securities and

Banking

mortgages

Carrying value of retained interests $ 7,571 $ 956

Discount rates

Adverse change of 10% $ (149) $ (45)

Adverse change of 20% (290) (90)

Constant prepayment rate

Adverse change of 10% $ (480) $ (9)

Adverse change of 20% (910) (18)

Anticipated net credit losses

Adverse change of 10% $ (26) $ (62)

Adverse change of 20% (49) (113)

181