Citibank 2008 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

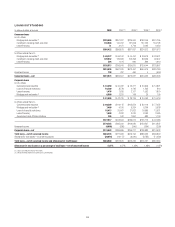

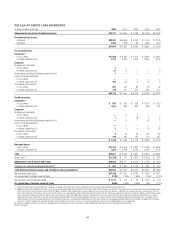

DETAILS OF CREDIT LOSS EXPERIENCE

In millions of dollars at year end 2008 2007 2006 2005 2004

Allowance for loan losses at beginning of year $16,117 $ 8,940 $ 9,782 $11,269 $12,643

Provision for loan losses

Consumer $28,282 $15,599 $ 6,224 $ 7,149 $ 7,205

Corporate 5,392 1,233 96 (295) (972)

$33,674 $16,832 $ 6,320 $ 6,854 $ 6,233

Gross credit losses

Consumer (1)

In U.S. offices $11,676 $ 5,766 $ 4,413 $ 5,829 $ 6,937

In offices outside the U.S. 7,172 5,150 3,915 2,964 3,304

Corporate

Mortgage and real estate

In U.S. offices 4————

In offices outside the U.S. 37 31—6

Governments and official institutions outside the U.S. 3————

Loans to financial institutions

In U.S. offices —————

In offices outside the U.S. 463 69 6 10 3

Commercial and industrial

In U.S. offices 637 635 85 78 52

In offices outside the U.S. 778 241 220 287 571

$20,770 $11,864 $ 8,640 $ 9,168 $10,873

Credit recoveries

Consumer (1)

In U.S. offices $ 585 $ 695 $ 650 $ 1,007 $ 1,079

In offices outside the U.S. 1,015 966 897 693 691

Corporate

Mortgage and real estate

In U.S. offices —31——

In offices outside the U.S. 1—18 5 3

Governments and official institutions outside the U.S. —4 7 55 1

Loans to financial institutions

In U.S. offices ———— 6

In offices outside the U.S. 21 4 15 35

Commercial and industrial

In U.S. offices 649 20 104 100

In offices outside the U.S. 140 220 182 473 357

$ 1,749 $ 1,938 $ 1,779 $ 2,352 $ 2,272

Net credit losses

In U.S. offices $11,726 $ 5,654 $ 3,827 $ 4,796 $ 5,804

In offices outside the U.S. 7,295 4,272 3,034 2,020 2,797

Total $19,021 $ 9,926 $ 6,861 $ 6,816 $ 8,601

Other—net (2) $ (1,154) $ 271 $ (301) $ (1,525) $ 994

Allowance for loan losses at end of year $29,616 $16,117 $ 8,940 $ 9,782 $11,269

Allowance for unfunded lending commitments (3) $ 887 $ 1,250 $ 1,100 $ 850 $ 600

Total allowance for loans, leases and unfunded lending commitments $30,503 $17,367 $10,040 $10,632 $11,869

Net consumer credit losses $17,248 $ 9,255 $ 6,781 $ 7,093 $ 8,471

As a percentage of average consumer loans 3.13% 1.79% 1.52% 1.76% 2.13%

Net corporate credit losses/(recoveries) $ 1,773 $ 671 $ 80 $ (277) $ 130

As a percentage of average corporate loans 0.96% 0.36% 0.05% NM 0.11%

(1) Consumer credit losses primarily relate to U.S. mortgages, revolving credit and installment loans. Recoveries primarily relate to revolving credit and installment loans.

(2) 2008 primarily includes reductions to the loan loss reserve of approximately $800 million related to FX translation, $102 million related to securitizations, $244 million for the sale of the German retail banking operation,

$156 million for the sale of CitiCapital, partially offset by additions of $106 million related to the Cuscatlán and Bank of the Overseas Chinese acquisitions. 2007 primarily includes reductions to the loan loss reserve of

$475 million related to securitizations and transfers to loans held-for-sale, and reductions of $83 million related to the transfer of the U.K. CitiFinancial portfolio to held-for-sale, offset by additions of $610 million related

to the acquisitions of Egg, Nikko Cordial, Grupo Cuscatlán and Grupo Financiero Uno. 2006 primarily includes reductions to the loan-loss reserve of $429 million related to securitizations and portfolio sales and the

addition of $84 million related to the acquisition of the CrediCard portfolio. 2005 primarily includes reductions to the loan-loss reserve of $584 million related to securitizations and portfolio sales, a reduction of $110

million related to purchase accounting adjustments from the KorAm acquisition, and a reduction of $90 million from the sale of CitiCapital’s transportation portfolio. 2004 primarily includes the addition of $715 million

of loan-loss reserves related to the acquisition of KorAm and the addition of $148 million of loan-loss reserves related to the acquisition of Washington Mutual Finance Corporation.

(3) Represents additional credit-loss reserves for unfunded corporate lending commitments and letters of credit recorded with Other liabilities on the Consolidated Balance Sheet.

NM Not meaningful.

54