Citibank 2008 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.FUNDING

Overview

Because Citigroup is a bank holding company, substantially all of its net

earnings are generated within its operating subsidiaries. These subsidiaries

make funds available to Citigroup, primarily in the form of dividends.

Certain subsidiaries’ dividend-paying abilities may be limited by covenant

restrictions in credit agreements, regulatory requirements and/or rating-

agency requirements that also impact their capitalization levels.

Global financial markets faced unprecedented disruption in the latter part

of 2008. Citigroup and other U.S. financial services firms are currently

benefiting from numerous government programs that are improving

markets and supporting their current liquidity positions. These programs

provide Citigroup with significant current funding capacity and significant

liquidity support. These include:

• In October 2008, the FDIC established the Temporary Liquidity Guarantee

Program (TLGP). The TLGP provides a guarantee of certain newly issued

senior unsecured long-term debt of banks, thrifts and certain holding

companies, and by providing full coverage of non-interest-bearing deposit

transaction accounts, regardless of dollar amount. The TLGP guarantees

coverage of qualifying senior unsecured debt issued with a maturity prior

to July 1, 2012. A significant portion of Citigroup’s existing commercial

paper is guaranteed under this program. In addition, in December 2008,

Citigroup issued approximately $5.75 billion of senior unsecured debt

under this program. In January and February 2009, Citigroup and its

affiliates issued an additional $14.9 billion in senior unsecured debt

under the program. It has been proposed that the TLGP be extended from

its current expiration date of June 30, 2009 to October 30, 2009.

• In March 2008, the Federal Reserve Board authorized the Federal Reserve

Bank of New York to establish the Primary Dealer Credit Facility to

provide overnight financing to primary dealers in exchange for a broad

range of collateral. Citigroup utilizes this program to supplement its

secured financing capabilities. On December 31, 2008, Citigroup had

funded $13.8 billion on a secured basis under this program.

• In October 2008, the Federal Reserve Board established the Commercial

Paper Funding Facility (CPFF) to provide a liquidity backstop to U.S.

issuers of commercial paper. Under the CPFF, the Federal Reserve Bank of

New York finances purchases of unsecured highly rated three-month U.S.

dollar-denominated commercial paper of eligible issuers through

primary dealers. On December 31, 2008, Citigroup had $9.0 billion

Commercial Paper and $3.3 billion Credit Card Asset-Backed Commercial

Paper outstanding under the program.

• In March 2008, the Federal Reserve Board expanded its securities lending

program to promote liquidity in the financing markets for Treasury

securities and other collateral and thus foster the functioning of financial

markets more generally. Under the Term Securities Lending Facility

(TSLF), the Federal Reserve lends up to $200 billion of Treasury securities

to primary dealers secured for a term of 28 days by a pledge of other

securities, including federal agency debt, federal agency residential-

mortgage-backed securities (MBS) and non-agency AAA/Aaa-rated

private-label residential MBS. The securities are made available through a

weekly auction process. Citigroup uses the TSLF to facilitate secured

funding transactions for its inventory as well as that of its customers.

It has been proposed that the CPFF, PDCF and the TSLF be extended from

their current expiration dates of June 30, 2009 to October 30, 2009.

• In November 2008, the Federal Reserve Board announced the creation of

the Term Asset-Backed Securities Loan Facility (TALF), a facility designed

to support the issuance of asset-backed securities (ABS) collateralized by

student loans, auto loans, credit card loans and loans guaranteed by the

Small Business Administration (SBA). An expansion of this program,

announced in February 2009, could broaden the eligible collateral to

encompass other types of newly issued AAA-rated asset-backed securities,

such as commercial mortgage-backed securities, private-label residential

mortgage-backed securities and other asset-backed securities. Details of

this program, including its commencement date, have not yet been

announced. The TALF is currently scheduled to expire on December 31,

2009.

• The U.S. Department of Education (DOE) has been working to ensure

uninterrupted and timely access to Federal student loans by taking steps

to maintain stability in student lending. The Ensuring Continued Access

to Student Loans Act of 2008 (ECASLA) enacted by Congress in May 2008

allows the DOE to purchase qualifying Stafford and PLUS Loans

originated during the 2003-2009 academic years. Legislation passed in

October 2008 provides for a one year extension of authority for the DOE to

purchase certain guaranteed student loans as defined under ECASLA

through the 2009-2010 academic year. On July 3, 2008, the Company

filed a required Notice of Intent to Participate with the Department under

a program limited to qualifying loans originated during the 2008-2009

academic year. The Company received its initial funding through the

Participation Program on December 5, 2008. In addition, on November 8,

2008, the DOE announced that it would provide liquidity support to one

or more conforming Asset-Based Commercial Paper (ABCP) conduit(s).

While details of this conduit are forthcoming, it is intended that all fully-

disbursed non-consolidation Federal Family Education Loan Program

(FFELP) loans awarded between October 1, 2003 and July 1, 2009 will be

eligible for inclusion. On November 20, 2008 the DOE announced that it

will take the additional step of using existing authority to purchase

certain 2007-2008 academic year FFELP loans.

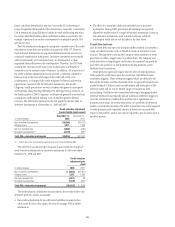

In addition to the above programs, during the second half of 2007 and

the full year of 2008, the Company took a series of actions to reduce potential

funding risks related to short-term market dislocations. The amount of

commercial paper outstanding was reduced and the weighted-average

maturity was extended, the parent company liquidity portfolio (a portfolio of

cash and highly liquid securities) and broker-dealer “cash box”

(unencumbered cash deposits) were increased substantially and the amount

of unsecured overnight bank borrowings was reduced. For each of the past

eight months in the period ending December 31, 2008, the Company was, on

average, a net lender of funds in the interbank market or had excess cash

placed in its account at the Federal Reserve Bank of New York. As of

December 31, 2008, the parent company liquidity portfolio and broker-dealer

“cash box” totaled $66.8 billion as compared with $24.2 billion at

December 31, 2007.

These actions to reduce funding risks, the reduction of the balance sheet

and the substantial support provided by U.S. government programs have

allowed the combined parent and broker-dealer entities to maintain

sufficient liquidity to meet all maturing unsecured debt obligations due

within a one-year time horizon, without accessing the unsecured markets.

98