Citibank 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COUNTRY AND FFIEC CROSS-BORDER RISK

MANAGEMENT PROCESS

Country Risk

Country risk is the risk that an event in a foreign country will impair the

value of Citigroup assets or will adversely affect the ability of obligors within

that country to honor their obligations to Citigroup. Country risk events may

include sovereign defaults, banking or currency crises, social instability, and

changes in governmental policies (for example, expropriation,

nationalization, confiscation of assets and other changes in legislation

relating to international ownership). Country risk includes local franchise

risk, credit risk, market risk, operational risk and cross-border risk.

The country risk management framework at Citigroup includes a number

of tools and management processes designed to facilitate the ongoing

analysis of individual countries and their risks. These include country risk

rating models, scenario planning and stress testing, internal watch lists, and

the Country Risk Committee process.

The Citigroup Country Risk Committee is the senior forum to evaluate the

Company’s total business footprint within a specific country franchise with

emphasis on responses to current potential country risk events. The

Committee is chaired by the Head of Global Country Risk Management and

includes as its members senior risk management officers, senior regional

business heads, and senior product heads. The Committee regularly reviews

all risk exposures within a country, makes recommendations as to actions,

and follows up to ensure appropriate accountability.

Cross-Border Risk

Cross-border risk is the risk that actions taken by a non-U.S. government

may prevent the conversion of local currency into non-local currency and/or

the transfer of funds outside the country, thereby impacting the ability of the

Company and its customers to transact business across borders.

Examples of cross-border risk include actions taken by foreign

governments such as exchange controls, debt moratoria, or restrictions on

the remittance of funds. These actions might restrict the transfer of funds or

the ability of the Company to obtain payment from customers on their

contractual obligations.

Management oversight of cross-border risk is performed through a formal

review process that includes annual setting of cross-border limits, ongoing

monitoring of cross-border exposures, as well as monitoring of economic

conditions globally and the establishment of internal cross-border risk

management policies.

Under Federal Financial Institutions Examination Council (FFIEC)

regulatory guidelines, total reported cross-border outstandings include cross-

border claims on third parties, as well as investments in and funding of local

franchises. Cross-border claims on third parties (trade and short-, medium-

and long-term claims) include cross-border loans, securities, deposits with

banks, investments in affiliates, and other monetary assets, as well as net

revaluation gains on foreign exchange and derivative products.

Cross-border outstandings are reported based on the country of the

obligor or guarantor. Outstandings backed by cash collateral are assigned to

the country in which the collateral is held. For securities received as

collateral, cross-border outstandings are reported in the domicile of the

issuer of the securities. Cross-border resale agreements are presented based

on the domicile of the counterparty in accordance with FFIEC guidelines.

Investments in and funding of local franchises represent the excess of

local country assets over local country liabilities. Local country assets are

claims on local residents recorded by branches and majority-owned

subsidiaries of Citigroup domiciled in the country, adjusted for externally

guaranteed claims and certain collateral. Local country liabilities are

obligations of non-U.S. branches and majority-owned subsidiaries of

Citigroup for which no cross-border guarantee has been issued by another

Citigroup office.

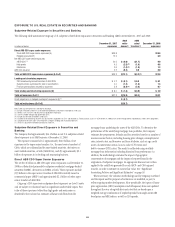

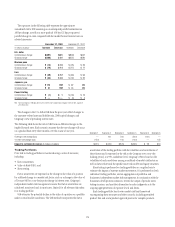

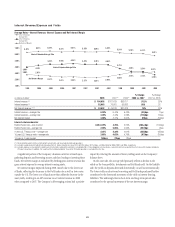

The table below shows all countries in which total FFIEC cross-border outstandings exceed 0.75% of total Citigroup assets:

December 31, 2008 December 31, 2007

Cross-border claims on third parties

In billions of dollars U.S. Banks Public Private Total

Trading and

short-term

claims (1)

Investments

in and

funding of

local

franchises

Total

cross-border

outstandings Commitments (2)

Total

cross-border

outstandings Commitments (2)

Germany $11.7 $2.4 $ 4.2 $18.3 $16.6 $11.6 $29.9 $40.7 $29.3 $46.4

India 0.7 — 7.1 7.8 4.9 20.2 28.0 1.6 39.0 1.7

United Kingdom 15.2 — 11.1 26.3 24.0 — 26.3 196.0 24.7 366.0

Cayman Islands 0.4 0.1 21.6 22.1 20.7 — 22.1 8.1 9.0 6.9

Korea 2.1 1.1 1.4 4.6 4.4 17.4 22.0 15.7 21.9 22.0

France 10.9 2.9 7.4 21.2 17.5 0.2 21.4 55.8 24.3 107.8

Netherlands 5.2 1.1 11.4 17.7 11.4 — 17.7 57.0 23.1 20.2

Canada 1.2 0.5 4.7 6.4 5.3 9.7 16.1 35.9 15.3 55.8

Italy 1.5 7.8 2.0 11.3 9.2 3.4 14.7 16.4 18.8 5.1

(1) Included in total cross-border claims on third parties.

(2) Commitments (not included in total cross-border outstandings) include legally binding cross-border letters of credit and other commitments and contingencies as defined by the FFIEC. Effective March 31, 2006, the

FFIEC revised the definition of commitments to include commitments to local residents to be funded with local currency local liabilities.

77