Citibank 2008 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

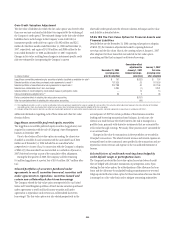

30. CONTINGENCIES

As described in the “Legal Proceedings” discussion on page 229, the

Company has been a defendant in numerous lawsuits and other legal

proceedings arising out of alleged misconduct in connection with:

(i) underwritings for, and research coverage of, WorldCom;

(ii) underwritings for Enron and other transactions and activities

related to Enron;

(iii) transactions and activities related to research coverage of

companies other than WorldCom; and

(iv) transactions and activities related to the IPO Securities

Litigation.

As of December 31, 2008, the Company’s litigation reserve for these

matters, net of amounts previously paid or not yet paid but committed to be

paid in connection with the Enron class action settlement and other

settlements arising out of these matters, was approximately $0.8 billion. The

Company believes that this reserve is adequate to meet all of its remaining

exposure for these matters.

As described in the “Legal Proceedings” discussion on page 229, the

Company is also a defendant in numerous lawsuits and other legal

proceedings arising out of alleged misconduct in connection with other

matters. In view of the large number of litigation matters, the uncertainties

of the timing and outcome of this type of litigation, the novel issues

presented, and the significant amounts involved, it is possible that the

ultimate costs of these matters may exceed or be below the Company’s

litigation reserves. The Company will continue to defend itself vigorously in

these cases, and seek to resolve them in the manner management believes is

in the best interests of the Company.

In addition, in the ordinary course of business, Citigroup and its

subsidiaries are defendants or co-defendants or parties in various litigation

and regulatory matters incidental to and typical of the businesses in which

they are engaged. In the opinion of the Company’s management, the

ultimate resolution of these legal and regulatory proceedings would not be

likely to have a material adverse effect on the consolidated financial

condition of the Company but, if involving monetary liability, may be

material to the Company’s operating results for any particular period.

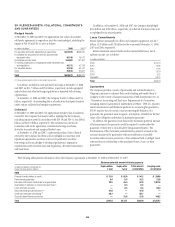

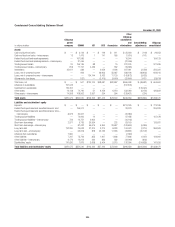

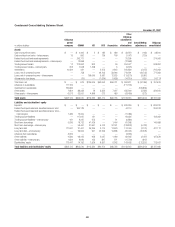

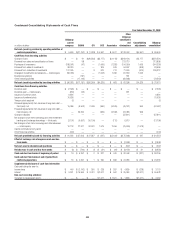

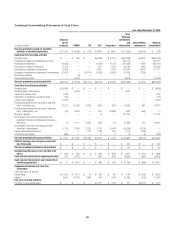

31. CITIBANK, N.A. STOCKHOLDER’S EQUITY

Statement of Changes in Stockholder’s Equity

In millions of dollars, except shares

Year ended December 31

2008 2007 2006

Preferred stock ($100 par value)

Balance, beginning of year $—$—$—

Redemption or retirement of preferred stock ———

Balance, end of year $ — $—$—

Common stock ($20 par value)

Balance, beginning of year — shares:

37,534,553 in 2008, 2007 and 2006 $ 751 $ 751 $ 751

Balance, end of year — shares:

37,534,553 in 2008, 2007 and 2006 $ 751 $ 751 $ 751

Surplus

Balance, beginning of year $ 69,135 $43,753 $37,978

Capital contribution from parent company 6,177 25,267 5,589

Employee benefit plans 183 85 176

Other (1) (728) 30 10

Balance, end of year $ 74,767 $69,135 $43,753

Retained earnings

Balance, beginning of year $ 31,915 $30,358 $24,062

Adjustment to opening balance, net of taxes (2) —(96) —

Adjusted balance, beginning of period $ 31,915 $30,262 $24,062

Net income (loss) (6,215) 2,304 9,338

Dividends paid (41) (651) (3,042)

Other (1) (3,924) ——

Balance, end of year $ 21,735 $31,915 $30,358

Accumulated other comprehensive

income (loss)

Balance, beginning of year $ (2,495) $ (1,709) $ (2,550)

Adjustment to opening balance, net of taxes (3) —(1) —

Adjusted balance, beginning of period $ (2,495) $ (1,710) $ (2,550)

Net change in unrealized gains (losses) on

investment securities available-for-sale, net

of taxes (6,746) (1,142) 234

Net change in foreign currency translation

adjustment, net of taxes (5,651) 2,143 1,926

Net change in cash flow hedges, net of taxes (1,162) (1,954) (430)

Pension liability adjustment, net of taxes 159 168 (3)

Adjustment to initially apply SFAS 158, net of

taxes —— (886)

Net change in Accumulated other

comprehensive income (loss) $(13,400) $ (785) $ 841

Balance, end of year $(15,895) $ (2,495) $ (1,709)

(Statement continues on next page)

214