Citibank 2008 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Municipal Securities Tender Option Bond (TOB) Trusts

The Company sponsors TOB trusts that hold fixed- and floating-rate,

tax-exempt securities issued by state or local municipalities. The trusts are

typically single-issuer trusts whose assets are purchased from the Company

and from the secondary market. The trusts issue long-term senior floating

rate notes (“Floaters”) and junior residual securities (“Residuals”). The

Floaters have a long-term rating based on the long-term rating of the

underlying municipal bond and a short-term rating based on that of the

liquidity provider to the trust. The Residuals are generally rated based on the

long-term rating of the underlying municipal bond and entitle the holder to

the residual cash flows from the issuing trust.

The Company sponsors three kinds of TOB trusts: customer TOB trusts,

proprietary TOB trusts and QSPE TOB trusts.

•Customer TOB trusts are trusts through which customers finance

investments in municipal securities and are not consolidated by the

Company. Proprietary and QSPE TOB trusts, on the other hand, provide

the Company with the ability to finance its own investments in municipal

securities.

•Proprietary TOB trusts are generally consolidated, in which case the

financing (the Floaters) is recognized on the Company’s balance sheet as

a liability. However, certain proprietary TOB trusts are not consolidated by

the Company, where the Residuals are held by hedge funds that are

consolidated and managed by the Company. The assets and the

associated liabilities of these TOB trusts are not consolidated by the hedge

funds (and, thus, are not consolidated by the Company) under the

application of the AICPA Investment Company Audit Guide, which

precludes consolidation of owned investments. The Company consolidates

the hedge funds, because the Company holds controlling financial

interests in the hedge funds. Certain of the Company’s equity investments

in the hedge funds are hedged with derivatives transactions executed by

the Company with third parties referencing the returns of the hedge fund.

•QSPE TOB trusts provide the Company with the same exposure as

proprietary TOB trusts and are not consolidated by the Company.

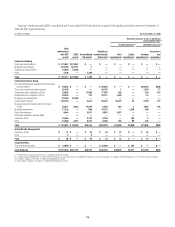

Credit rating distribution is based on the external rating of the municipal

bonds within the TOB trusts, including any credit enhancement provided by

monoline insurance companies or the Company in the primary or secondary

markets, as discussed below. The total assets for proprietary TOB Trusts

(consolidated and non-consolidated) includes $0.9 billion of assets where

the Residuals are held by a hedge fund that is consolidated and managed by

the Company.

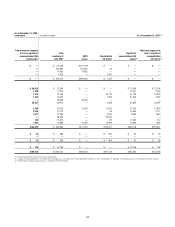

The TOB trusts fund the purchase of their assets by issuing Floaters along

with Residuals, which are frequently less than 1% of a trust’s total funding.

The tenor of the Floaters matches the maturity of the TOB trust and is equal

to or shorter than the tenor of the municipal bond held by the trust, and the

Floaters bear interest rates that are typically reset weekly to a new market rate

(based on the SIFMA index). Floater holders have an option to tender the

Floaters they hold back to the trust periodically. Customer TOB trusts issue

the Floaters and Residuals to third parties. Proprietary and QSPE TOB trusts

issue the Floaters to third parties and the Residuals are held by the Company.

Approximately $3.9 billion of the municipal bonds owned by TOB trusts

have an additional credit guarantee provided by the Company. In all other

cases, the assets are either unenhanced or are insured with a monoline

insurance provider in the primary market or in the secondary market. While

the trusts have not encountered any adverse credit events as defined in the

underlying trust agreements, certain monoline insurance companies have

experienced downgrades. In these cases, the Company has proactively

managed the TOB programs by applying additional secondary market

insurance on the assets or proceeding with orderly unwinds of the trusts.

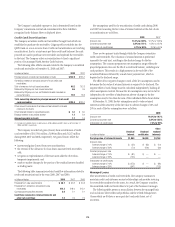

The Company, in its capacity as remarketing agent, facilitates the sale of

the Floaters to third parties at inception of the trust and facilitates the reset of

the Floater coupon and tenders of Floaters. If Floaters are tendered and the

Company (in its role as remarketing agent) is unable to find a new investor

within a specified period of time, it can declare a failed remarketing (in

which case the trust is unwound) or may choose to buy the Floaters into its

own inventory and may continue to try to sell it to a third-party investor.

While the level of the Company’s inventory of Floaters fluctuates, the

Company held approximately $1.9 billion of Floater inventory related to the

Customer, Proprietary and QSPE TOB programs as of December 31, 2008.

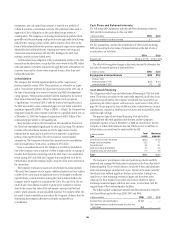

If a trust is unwound early due to an event other than a credit event on

the underlying municipal bond, the underlying municipal bond is sold in

the secondary market. If there is an accompanying shortfall in the trust’s

cash flows to fund the redemption of the Floaters after the sale of the

underlying municipal bond, the trust draws on a liquidity agreement in an

amount equal to the shortfall. Liquidity agreements are generally provided to

the trust directly by the Company. For customer TOBs where the Residual is

less than 25% of the trust’s capital structure, the Company has a

reimbursement agreement with the Residual holder under which the

Residual holder reimburses the Company for any payment made under the

liquidity arrangement. Through this reimbursement agreement, the

Residual holder remains economically exposed to fluctuations in value of

the municipal bond. These reimbursement agreements are actively

margined based on changes in value of the underlying municipal bond to

mitigate the Company’s counterparty credit risk. In cases where a third party

provides liquidity to a proprietary or QSPE TOB trust, a similar

reimbursement arrangement is made whereby the Company (or a

consolidated subsidiary of the Company) as Residual holder absorbs any

losses incurred by the liquidity provider. As of December 31, 2008, liquidity

agreements provided with respect to customer TOB trusts totaled $7.1 billion,

offset by reimbursement agreements in place with a notional amount of $5.5

billion. The remaining exposure relates to TOB transactions where the

Residual owned by the customer is at least 25% of the bond value at the

inception of the transaction. In addition, the Company has provided liquidity

arrangements with a notional amount of $6.5 billion to QSPE TOB trusts

and other non-consolidated proprietary TOB trusts described above.

The Company considers the customer and proprietary TOB trusts

(excluding QSPE TOB trusts) to be variable interest entities within the scope

of FIN 46(R). Because third-party investors hold the Residual and Floater

interests in the customer TOB trusts, the Company’s involvement and

variable interests include only its role as remarketing agent and liquidity

provider. On the basis of the variability absorbed by the customer through

the reimbursement arrangement or significant residual investment, the

Company does not consolidate the Customer TOB trusts. The Company’s

variable interests in the Proprietary TOB trusts include the Residual as well

as the remarking and liquidity agreements with the trusts. On the basis of the

variability absorbed through these contracts (primarily the Residual), the

Company generally consolidates the Proprietary TOB trusts. Finally, certain

proprietary TOB trusts and QSPE TOB trusts are not consolidated by

186