Citibank 2008 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

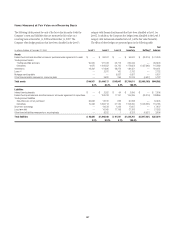

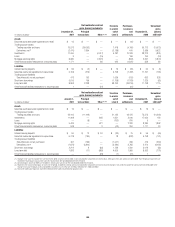

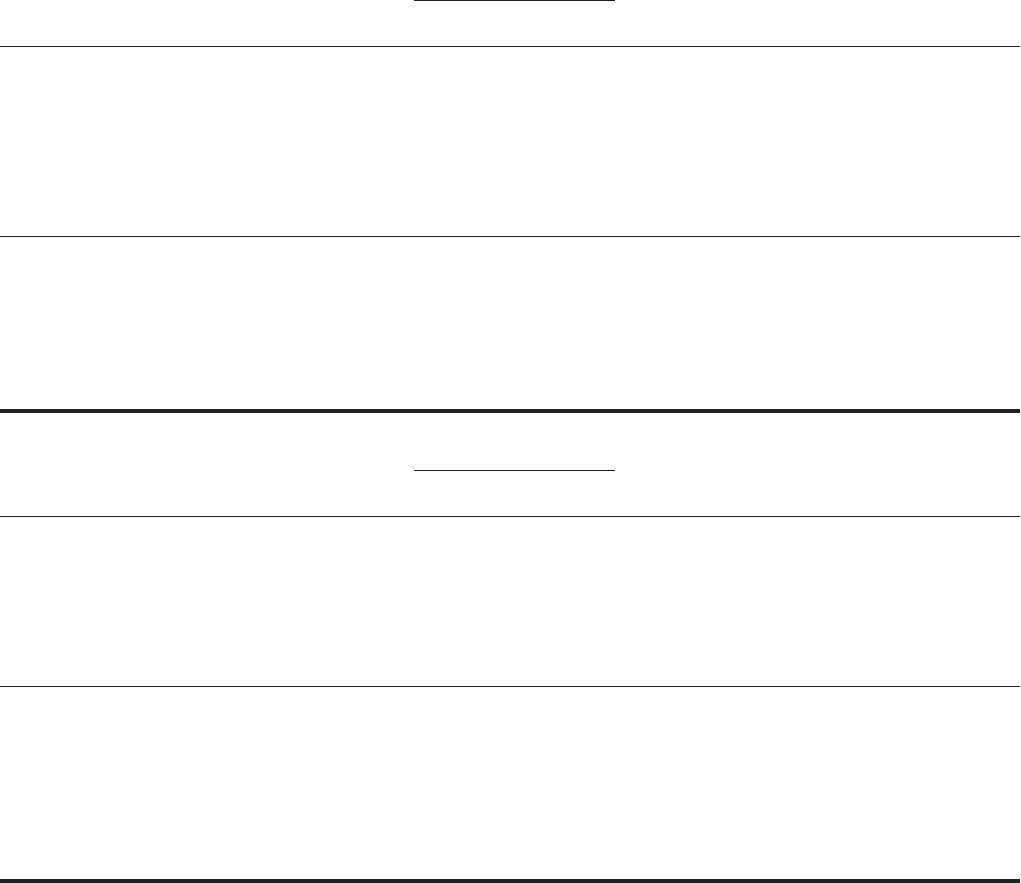

December 31,

2007

Net realized/unrealized

gains (losses) included in Transfers

in and/or

out of

Level 3

Purchases,

issuances

and

settlements

December 31,

2008

Unrealized

gains

(losses)

still held(3)

In millions of dollars

Principal

transactions Other (1) (2)

Assets

Securities purchased under agreements to resell $ 16 $ — $ — $ — $ (16) $ — $ —

Trading account assets

Trading securities and loans 75,573 (28,052) — 7,418 (4,166) 50,773 (19,572)

Derivatives, net (4) (2,470) 7,804 — (2,188) 440 3,586 9,622

Investments 17,060 — (4,917) 5,787 10,343 28,273 (801)

Loans 9 — (15) — 166 160 (19)

Mortgage servicing rights 8,380 — (1,870) — (853) 5,657 (1,870)

Other financial assets measured on a recurring basis 1,171 — 86 422 (1,320) 359 86

Liabilities

Interest-bearing deposits $ 56 $ (5) $ — $ 13 $ (20) $ 54 $ (3)

Securities sold under agreements to repurchase 6,158 (273) — 6,158 (1,422) 11,167 (136)

Trading account liabilities

Securities sold, not yet purchased 473 153 — 1,036 (703) 653 328

Short-term borrowings 5,016 106 — (1,798) (1,783) 1,329 (63)

Long-term debt 8,953 2,228 — 38,792 (34,319) 11,198 1,115

Other financial liabilities measured on a recurring basis 1 — (61) — (61) 1 —

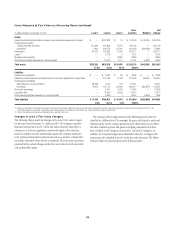

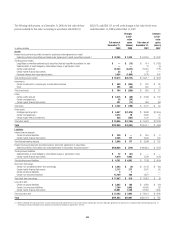

January 1,

2007

Net realized/unrealized

gains (losses) included in Transfers

in and/or

out of

Level 3

Purchases,

issuances

and

settlements

December 31,

2007

Unrealized

gains

(losses)

still held(3)

In millions of dollars

Principal

transactions Other (1) (2)

Assets

Securities purchased under agreements to resell $ 16 $ — $ — $ — $ — $ 16 $ —

Trading account assets

Trading securities and loans 22,415 (11,449) — 21,132 43,475 75,573 (10,262)

Investments 11,468 — 895 1,651 3,046 17,060 136

Loans — (8) — (793) 810 9 —

Mortgage servicing rights 5,439 — 621 — 2,320 8,380 1,892

Other financial assets measured on a recurring basis 948 — 2 (43) 264 1,171 20

Liabilities

Interest-bearing deposits $ 60 $ 12 $ 34 $ (33) $ 75 $ 56 $ (45)

Securities sold under agreements to repurchase 6,778 (194) — 78 (892) 6,158 (141)

Trading account liabilities

Securities sold, not yet purchased 467 (139) — (1,041) 908 473 (260)

Derivatives, net (4) (1,875) (3,840) — (3,280) 3,785 2,470 (9,462)

Short-term borrowings 2,214 9 (80) 1,139 1,592 5,016 (53)

Long-term debt 1,693 (11) (689) 4,600 1,960 8,953 (776)

Other financial liabilities measured on a recurring basis — — (23) (1) (21) 1 —

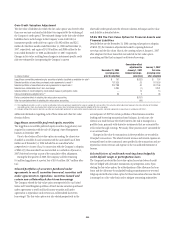

(1) Changes in fair value for available-for-sale investments (debt securities) are recorded in Accumulated other comprehensive income (loss), while gains from sales and losses due to other-than-temporary impairments are

recorded in Realized gains (losses) from sales of investments on the Consolidated Statement of Income.

(2) Unrealized gains (losses) on MSRs are recorded in Commissions and fees on the Consolidated Statement of Income.

(3) Represents the amount of total gains or losses for the period, included in earnings (and Accumulated other comprehensive income (loss) for changes in fair value of Available-for-sale investments) attributable to the

change in fair value relating to assets and liabilities classified as Level 3 that are still held at December 31, 2008 and 2007.

(4) Total Level 3 derivative exposures have been netted on these tables for presentation purposes only.

199