Citibank 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Citibank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MANAGING GLOBAL RISK

RISK MANAGEMENT

The Company believes that effective risk management is of primary

importance to its success. Accordingly, the Company has a comprehensive

risk management process to monitor, evaluate and manage the principal

risks it assumes in conducting its activities. These risks include credit,

market liquidity and operational, including legal and reputational

exposures.

Citigroup’s risk management framework is designed to balance corporate

oversight with well-defined independent risk management functions.

Enhancements were made to the risk management framework

throughout 2008 based on guiding principles established by the Chief Risk

Officer:

• a common Risk Capital model to evaluate risks;

• a defined risk appetite, aligned with business strategy;

• accountability through a common framework to manage risks;

• risk decisions based on transparent, accurate and rigorous analytics;

• expertise, stature, authority and independence of Risk Managers; and

• empowering Risk Managers to make decisions and escalate issues.

Significant focus has been placed on fostering a risk culture based on a

policy of “Taking Intelligent Risk with Shared Responsibility, without

forsaking Individual Accountability.”

• “Taking intelligent risk” means that Citi must carefully identify, measure

and aggregate risks, and must fully understand downside risks.

• “Shared responsibility” means that individuals own and influence

business outcomes, including risk controls.

• “Individual accountability” means individuals held ourselves

accountable to actively manage risk.

The Chief Risk Officer, working closely with the Citi CEO, established

management committees, Citi’s Audit and Risk Management Committee and

Citi’s Board of Directors, is responsible for:

• establishing core standards for the management, measurement and

reporting of risk;

• identifying, assessing, communicating and monitoring risks on a

company-wide basis;

• engaging with senior management and the Board of Directors on a

frequent basis on material matters with respect to risk-taking activities in

the businesses and related risk management processes; and

• ensuring that the risk function has adequate independence, authority,

expertise, staffing, technology and resources.

Changes were made to the risk management organization in 2008 to

facilitate the management of risk across three dimensions: businesses,

regions and critical products.

Each of the major business groups has a Business Chief Risk Officer who

is the focal point for risk decisions (such as setting risk limits or approving

transactions) in the business.

There are also Regional Chief Risk Officers, accountable for the risks in

their geographic area, and who are the primary risk contact for the regional

business heads and local regulators.

In addition, the position of Product Chief Risk Officers was created for

those areas of critical importance to Citigroup such as real estate, structured

credit products and fundamental credit. The Product Risk Officers are

accountable for the risks within their specialty and they focus on problem

areas across businesses and regions. The Product Risk Officers serve as a

resource to the Chief Risk Officer, as well as to the Business and Regional

Chief Risk Officers, to better enable the Business and Regional Chief Risk

Officers to focus on the day-to-day management of risks and responsiveness

to business flow.

In addition to changing the risk management organization to facilitate

the management of risk across these three dimensions, the risk organization

also includes the newly-created Business Management team to ensure that

the risk organization has the appropriate infrastructure, processes and

management reporting. This team includes:

• the risk capital group, which continues to enhance the risk capital model

and ensure that it is consistent across all our business activities;

• the risk architecture group, which ensures we have integrated systems and

common metrics, and thereby allows us to aggregate and stress test

exposures across the institution;

• the infrastructure risk group, which focuses on improving our operational

processes across businesses and regions; and

• the office of the Chief Administrative Officer, which focuses on

re-engineering risk communications and relationships, including our

critical regulatory relationships.

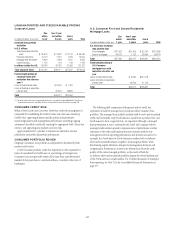

RISK AGGREGATION AND STRESS TESTING

While the major risk areas are described individually on the following pages,

these risks often need to be reviewed and managed in conjunction with one

another and across the various businesses.

The Chief Risk Officer, as noted above, monitors and controls major risk

exposures and concentrations across the organization. This means

aggregating risks, within and across businesses, as well as subjecting those

risks to alternative stress scenarios in order to assess the potential economic

impact they may have on the Company.

During 2008, comprehensive stress tests were implemented across Citi for

mark-to-market, available-for-sale, and accrual portfolios. These firm-wide

stress reports measure the potential impact to the Company and its

component businesses of very large changes in various types of key risk

factors (e.g., interest rates, credit spreads), as well as the potential impact of

a number of historical and hypothetical forward-looking systemic stress

scenarios.

Supplementing the stress testing described above, Risk Management,

working with input from the businesses and Finance, provides enhanced

periodic updates to senior management and the Board of Directors on

significant potential exposures across Citigroup arising from risk

concentrations (e.g., residential real estate), financial market participants

51